Climate Finance

At the UN Climate Change Conference (COP26) in November 2021, world leaders came together and set a global agenda on a path to net zero emissions. Pledges were made to further cut carbon dioxide emissions, reduce the use of coal, lower methane emissions, and stop deforestation. Importantly, an actionable framework was put around the promises made in the Paris Agreement.

There are volumes of literature explaining why the world needs to focus on lowering greenhouse gas emissions. Countless experts list the devastating effects rising global temperatures will have on weather, crops, biodiversity, migration, and health. And a continuous stream of politicians and public figures tell us how important it is to support a green agenda. But unfortunately, there has been little focus on what is likely the most important subject — how do we pay for global action on climate change?

In the report that follows, we aim to answer two questions: (1) What investment is needed in different regions and countries for climate mitigation and adaptation? and (2) How can we mobilize this investment efficiently to enable the world to reach its climate goals while still growing in population and developing the economy?

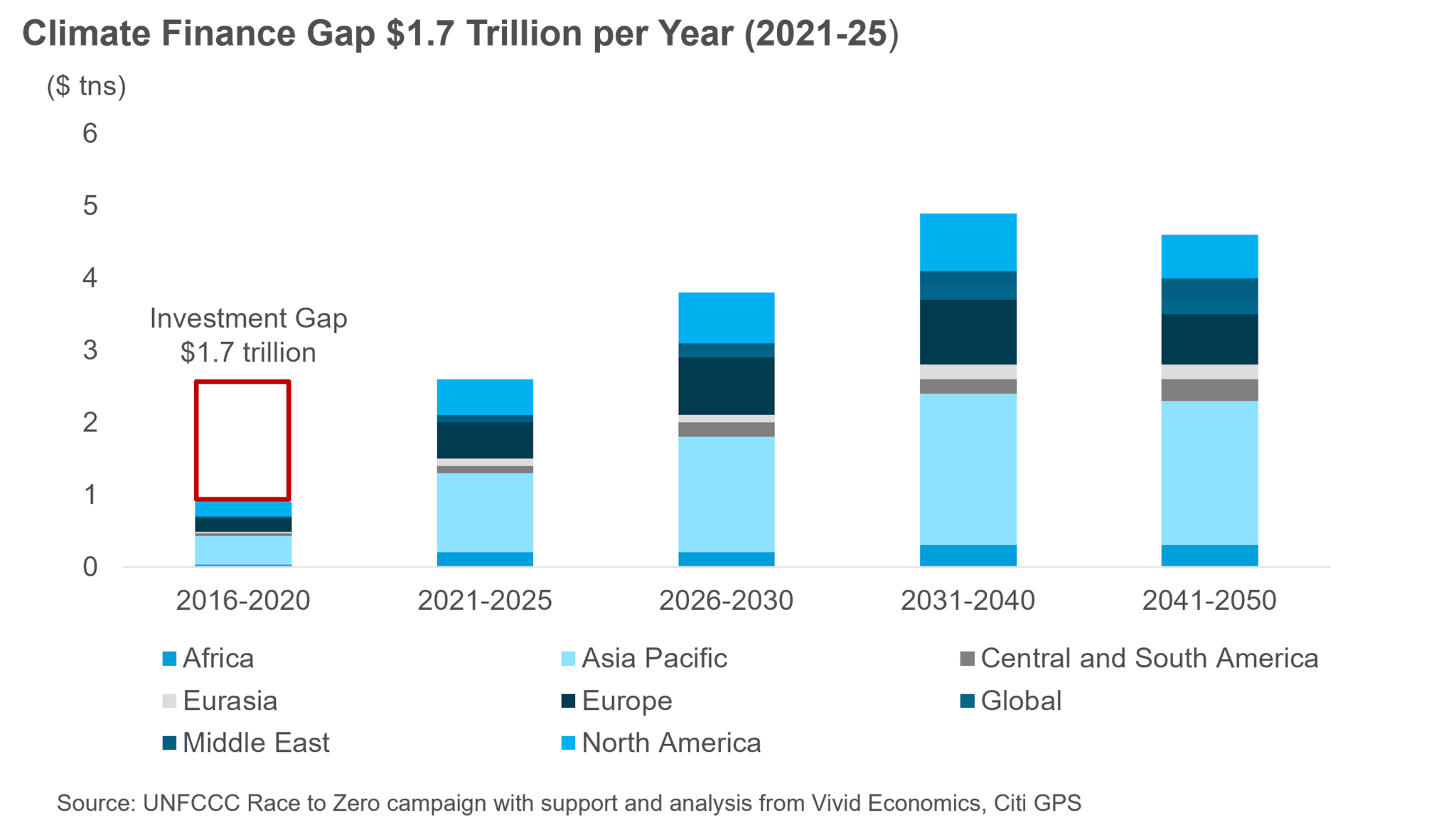

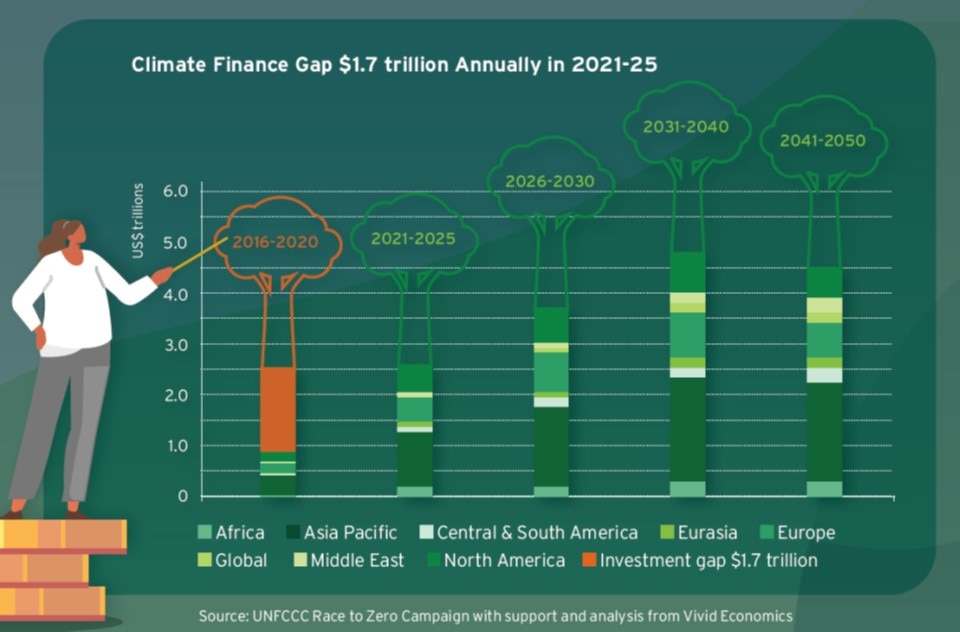

Overall, it is estimated that $125 trillion will be needed for the world to reach net zero by 2050. From 2021-25, that equates to $2.6 trillion per year, rising to $3.8 trillion from 2026 through 2030. Although climate finance has increased over the past decade, it is still significantly below the levels required for us to be on the path to net zero. Average annual climate finance flows in 2016-20 were estimated at between $600 billion and $900 billion meaning there is a $1.7 trillion gap between what the world has been delivering each year towards climate financing and what is required through 2025. Alarmingly, no single country or region is currently on track to meet its individual climate financing targets.

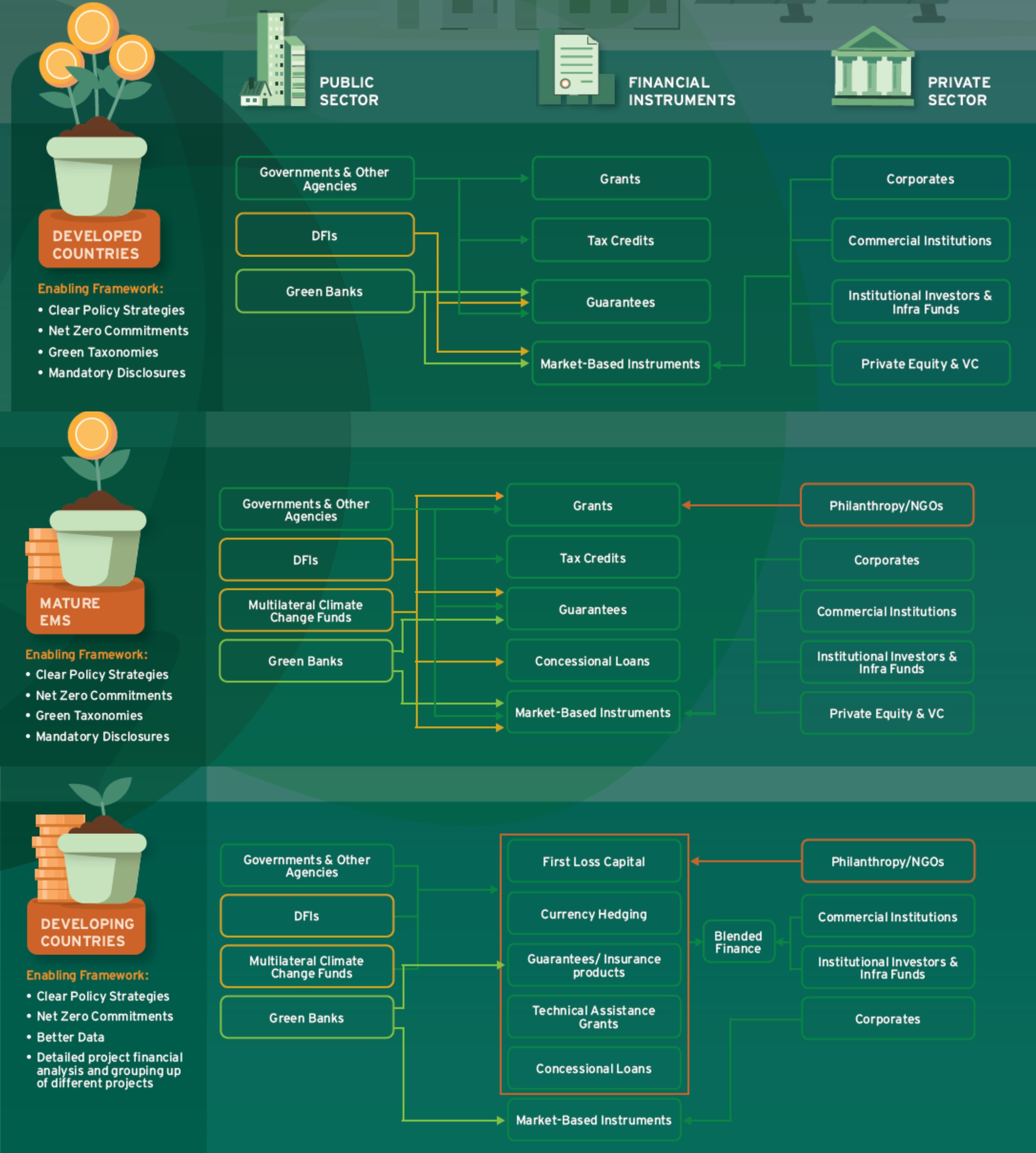

Mobilizing climate financing is a challenge as there is no one global solution. The public sector, including governments and development finance institutions, has played an extremely important role in mobilizing finance and the private sector has contributed 49% of investment funds. Unlocking private sector capital for climate finance is crucial as private actors could provide 70% of the $2.6 trillion needed in investment every year (on average in 2021-25) to put the world on a path to net zero by 2050.[1]

Financial instruments, such as blended finance, in conjunction with development finance institutions can increase private sector investment in developing economies. And green banks, which develop clean project pipelines, are using innovative financing to accelerate the transition to clean energy.

Collaboration — between developed and developing economies as well as the public and private sectors — is key to making this a just transition.

[1] UNFCCC Race to Zero campaign with support and analysis from Vivid Economics, “Financing Road Maps,” accessed November 2, 2022.Authors: Elizabeth Curmi,Jason Channell,Ying Qin,Amy Thompson,

Climate Finance Gap

Substantial Investment Scale Is Needed Across All Regions

Making It Happen