The Impact of ESG on EM Credit

In a recent report, the Head of EM Economics, David Lubin, looks at how the increasing focus of investors on ESG factors, in their asset allocation, could impact Emerging Markets countries’ access to capital. We take a look at the key themes covered, including the potential impact of a move away from risk-based investing, to values-based investing.

Figure 1: Will ESG Push Capital Away from EM? |

|---|

|

Source: Citi Research |

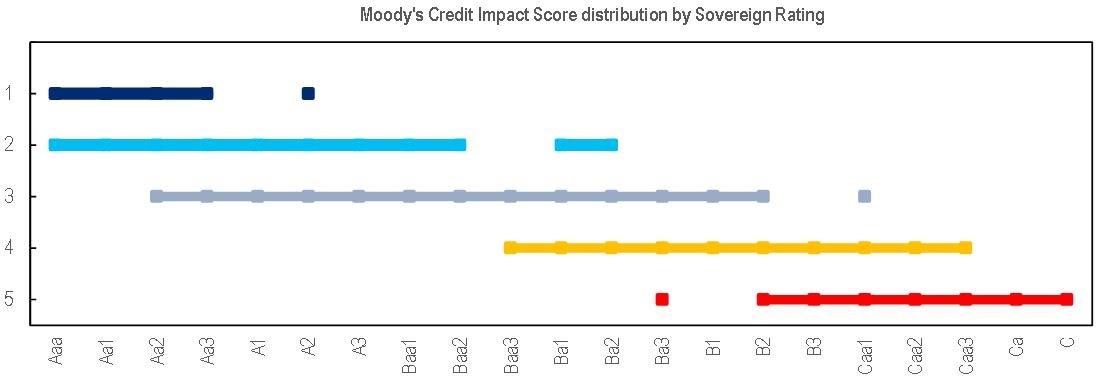

David views the link between negative ESG factors and a country’s creditworthiness as currently strong, citing a briefing from Moody’s which includes ESG factors in its risk assessments and which states ‘that there is an 87% correlation between sovereign credit ratings and the agency’s ESG ‘credit impact scores’ (CIS) that it uses to reflect ESG considerations’. Of the 144 sovereigns that Moody’s gives scores for 20 (all EM) have CIS of 5, which means ‘ESG considerations have a “Very Highly Negative” impact on credit quality’.

Figure 2. Moody's 'Credit Impact Score' Distribution by Sovereign Rating |

|---|

|

Source: Citi Research, Moody's |

Negative credit quality and ESG evaluation are not new concepts. The ‘G’ and ‘S’ factors (political stability, law, regulation etc) have for decades had their place in risk assessment. Issues arise when trying to agree what constitutes good sovereign environmental performance by ESG data providers, but David thinks there is little doubt that ‘the weight of E will increase as environmental risks come closer into view of consumers, investors and governments.’ With the rise of analysis of ‘E’ factors the more EM countries are likely to be affected, specifically those reliant on fossil fuel revenues and could result in ‘stranded assets’.

Historically, ESG factor analysis has been based around the risks associated with investing in a sovereign, however with a shift towards a values-based approach, there will be an impact for EM countries. David sees that ‘Values-based’ considerations will be aimed at ‘improving countries’ behaviour’, but sticks accompany carrots, and so investor boycotts are imaginable,’ which ultimately could restrict capital flows in EM countries.

For more information on this subject, please see Emerging Markets Economic Outlook & Strategy: Will ESG push capital away from EM?.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research. The comments expressed herein are summaries and/or views on selected thematic content from a Citi Research report. For the full CGI disclosure, click here.