Advanced Driver Assistance Systems: A Crash Course

Advanced driver assistance systems (ADAS) are getting more advanced.

These systems combine onboard sensors, software, and electronics to alert drivers to potential hazards and even temporarily take control of a vehicle to avoid dangerous situations.

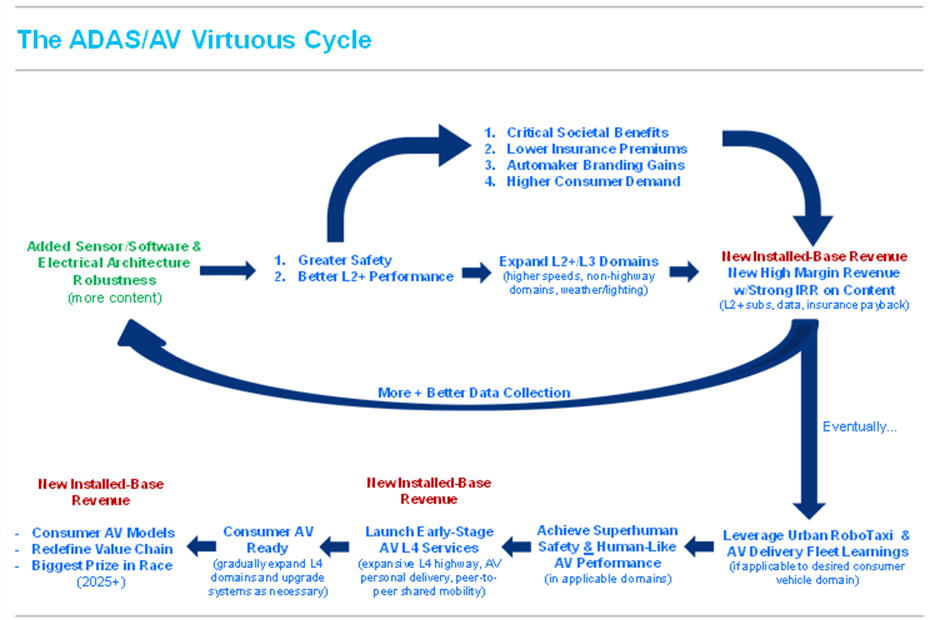

Citi analysts say the next generation of ADAS/Autonomous Vehicle capabilities will likely catalyse a virtuous adoption cycle - shown in the chart below - fuelling the market for light vehicles.

As adoption rises, the resulting data yields valuable information that serves to further improve system performance.

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

ADAS 1.0: This is the original set of features that have been penetrating vehicles for over a decade. These mainly include forward-facing features like automatic-emergency-braking (AEB), lane-departure-warning (LDW), lane-keep assist (LKA), and to some extent pedestrian detection, traffic sign recognition, and other object detection.

ADAS 1.0 has achieved a lot. Studies by the IIHS in the U.S. found that AEB/Forward Collision Warning (FCW) cut rear-end crashes in half, while pedestrian detection systems were able to cut crashes by 27%.

A more recent U.S. study showed that vehicles equipped with AEB/FCW resulted in a 53% reduction in injury crashes, a 49% reduction in overall crashes, and a 42% reduction in serious crashes.

Of course, ADAS 1.0 was never designed to eliminate car crashes entirely; rather, it was an important first step in the journey.

Much Work to Be Done: Road fatalities still claim more than 1 million lives around the world each year. In the U.S. alone, annual fatalities top 40,000. Speeding, erratic driving, and alcohol remain primary contributors, as do yielding failures, lane keeping, and distraction. Besides the human toll, there is also a substantial economic toll.

In the U.S. alone, the annual economic toll of car crashes has been estimated at $300 billion, or ~2% of GDP. This consists of several buckets including property damage, productivity, medical, legal, and congestion. Of course, automotive safety also affects a vehicle’s cost-of-ownership through insurance premiums. There is also an environmental toll from resulting traffic congestion contributing unnecessary tailpipe emissions. In some of the largest U.S. cities the average commuter spends 60+ hours-per-year stuck in traffic. So there is still much work to do to achieve vision zero.

ADAS 2.0: The good news is that the next-generation of ADAS solutions promise to contribute step-functions improvements towards safety over the next several years.

Examples include: Cheaper sensors (high-resolution cameras, imaging radars, lower cost/high-res LiDAR, DMS), far more powerful compute platforms, new software stacks (redundant perception, mapping, and driving policy), and new electrical architectures that enable robust data collection.

In addition, companies with separate AV/RoboTaxi developments have also begun migrating some of their capabilities to ADAS. From a regulatory perspective, expected upcoming requirements will also push the envelope for more advanced detection and wider field-of-view sensors.

Citi analysts think consumer AVs, operating even under limited initial operating domains, promise to gradually reshuffle the entire automotive value chain over the next 10-20 years.

For more information on this subject, please see Sights, Cameras, Action!:

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here