In the Asean region, a number of telcos and web companies are securing digital banking licenses to pivot beyond their traditional businesses.

These digital entrants don’t need branch build-out to drive scale – their prime real-estate is the mobile handset, which affords extensive touchpoints with customers ranging from e-commerce to e-wallets.

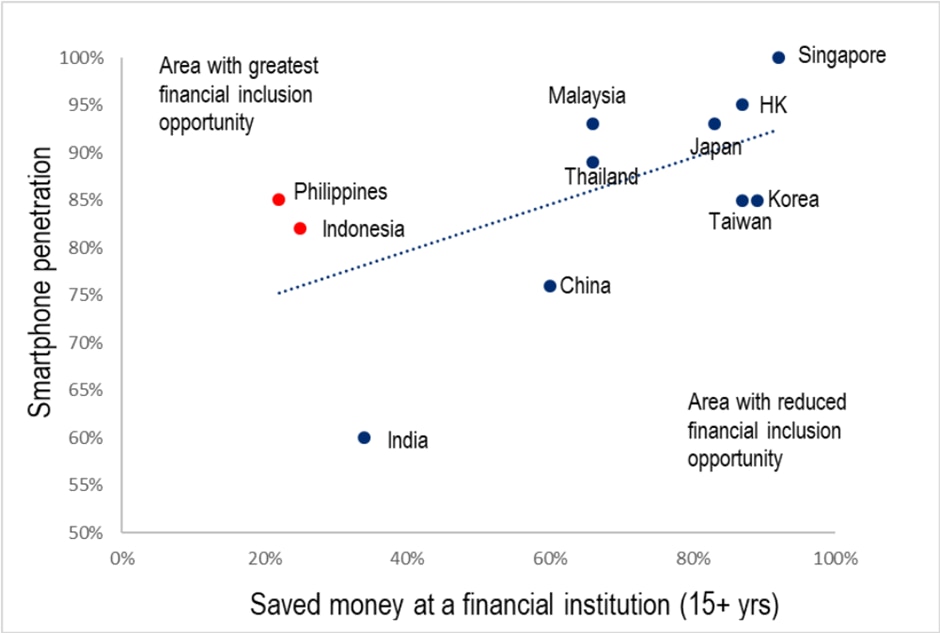

Digital penetration in Asean is high, at >80% for smartphones and >100% for mobile more broadly. Financial inclusion, by contrast, can be much lower: <30% of the adult populations in the Philippines and Indonesia have saved money in a bank and <20% have had access to credit.

Among the digital banks, a number have e-commerce or e-wallet tie-ups. This allows for value storage in the digital bank to value disbursement via the wallet or e-commerce.

Digital penetration vs. financial inclusion

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission

Source: Citi Research, World Bank

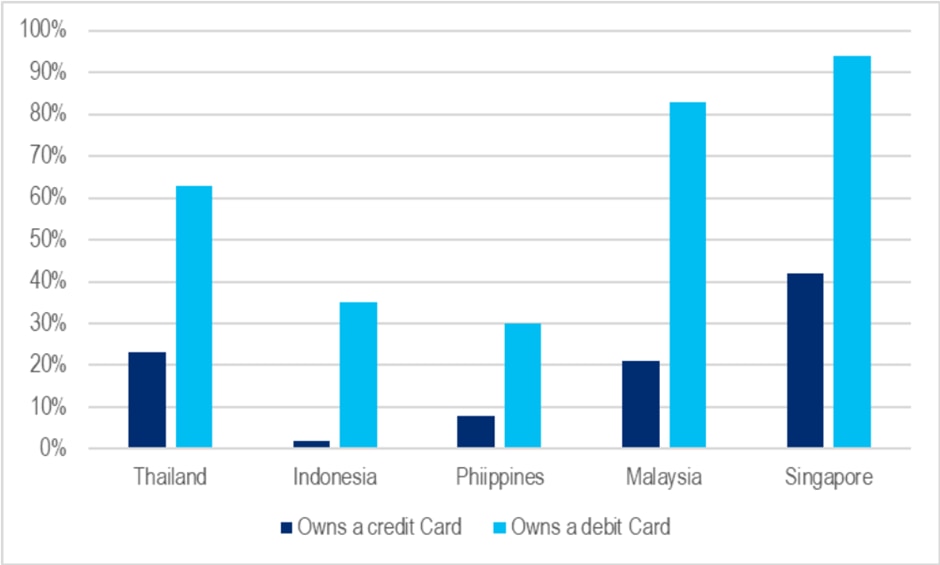

Within Asean, some markets are significantly underbanked/underserved. For instance, credit and debit card penetration in Indonesia and the Philippines is in the single digits and bank account penetration is <25% (a figure that could be over-stated given some bank customers have multiple accounts).

The reasons for a market being underserved by traditional banks vary. Among them, a low savings rate that translates to relatively low returns (as the banks rely on more expensive branch networks) and a lack of customer proximity to a bank branch.

Credit and Debit Card Penetration for 15+ Yrs. Credit card penetration in single digits in some ASEAN EM markets

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, World Bank

Access to the internet is pervasive in Asean. Mobile SIM card penetration in these markets typically exceeds 100%. Smartphones are critical to the enablement of mobile payments and mobile/digital banking, and thus their widespread usage is a pre-requisite of the expansion of web and telco players into financial services. Even for EM Asean markets, smartphone penetration is high at 82-94%.

For more information on this subject and if you are a Velocity subscriber, please see ASEAN Internet, Telecommunications and Banks - Telco & Web Plays Push to Enter the Banks’ Vaults

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.