Catalysts for the Next USD Downturn

The US dollar tends to move in well-defined, multiyear cycles. For the last decade, the pattern has been one of appreciation. For years, Citi has been a consistent and occasionally out-of-consensus USD bull. However, looming structural shifts in the global economy as well as potential changes in foreign investors’ incentive framework may cause a structural shift and potentially a multi-year decline.

A Historical Precedent

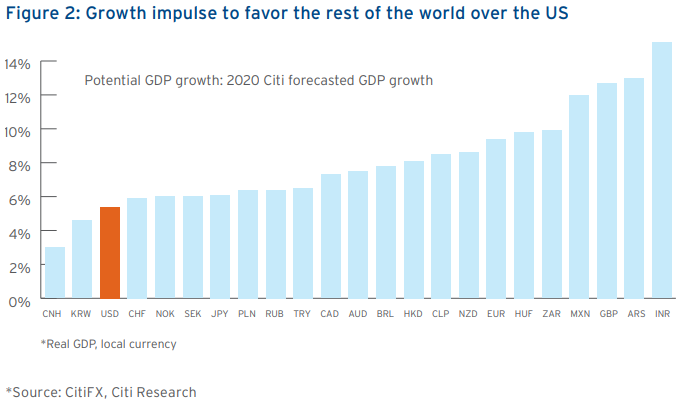

In 2001, the catalyst that kicked off the multi-year downtrend in the USD was China joining the WTO. This spurred a wave of globalization, pushing global trade volumes higher, leaving the relatively closed US economy lagging with a low beta to global growth. The world today has some compelling analogies to 2001. Widespread vaccination could renormalize the global economy and support a rebounding of global trade activity. As the US economy is still generally more closed and servicebased than other large economies, the rest of the world could enjoy significantly greater growth than the United States.

The Great Value Rotation

A key driver of anticipated USD weakness is the reaction function of the Fed. We believe that the Fed will remain very dovish, adding more stimulus in response to weaker growth and inflation, and erring on the side of caution before considering hiking rates. We also believe it will keep real yields from rising and allow nominal curves to steepen.

A rise in long-end interest rates tends to drive value stocks higher relative to growth stocks. This is important for FX as when investors begin to rotate to value, they will increasingly rotate out of the US given that both the Standard & Poor’s 500 Index and USD are richly valued compared to the rest of the world.

Institutional Investors and FX Hedging

For the past few years, the US has been the primary destination for asset inflows, much of which have been unhedged in terms of FX. We estimate that hedge ratios are 50% below their 2016 peak. Figure 3 plots the return to a Japanese investor of 10Y Treasuries, hedged by rolling 3M FX swaps. Once we move into the “landing zone” where Japanese lifers can earn an FX-hedged yield above their minimum return hurdles, we think this will prompt hedging activity.

The stock of foreign investors’ long-term fixed income holdings is $12 trillion (according to CitiFX and Federal Reserve data). A 10% increase in hedge ratios would result in USD sales of $600 billion (stripping out FX reserve holdings). If investors have the incentive to hedge FX next year, which we believe will be driven by the shape of the US yield curve, the outflow pressure from hedging will overwhelm (by magnitudes) any new buying of US fixed income at higher yield levels.

What This Means for Corporates

There is historical evidence to demonstrate that dollar weakness can materially influence shareholder value. Figure 5 and 6 show a simple regression analysis that tracks the beta between stock price and USD strength, controlling for global equity market movements. The analysis shows that sensitivity to the USD is not uniform within or across industries. It also demonstrates that USD weakness tends to have a favorable valuation impact on US multinationals that have an underlying business requirement to buy USD, and a negative valuation impact on EU multinationals that have an underlying requirement to sell USD.

This also points to the other key reason for why the USD cycle matters. Namely, it has historically been an important driver of business strategy. Whether through reorganized supply chains, revamped distribution channels, or tweaked hedging practices, corporates have generally paid close attention and adapted their overall business strategy to the USD cycle.

It is unrealistic for a treasury risk manager to make wholesale changes to a company’s hedging policy in light of a new market environment. Rather, they should follow a methodical approach to assess potential necessary adjustments to the program in order to meet any change in risk management objectives. Ultimately, regardless of the approach followed, an effective hedging strategy for a declining USD will likely require the risk manager to take a dynamic approach to managing risk based on evolving market conditions rather than systematically following the same strategy over time.