The supply chain relocation out of China that was becoming a trend pre-pandemic appears to have slowed or even reversed now. China’s effective containment of the coronavirus has allowed its factories to quickly reboot.

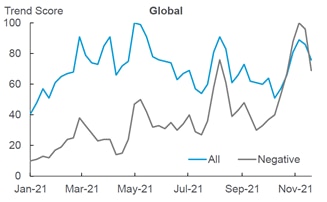

Indeed, supply chain relocation out of China is no longer a topical issue based on an index Citi analysts track. This is clearly visible in the second chart below.

The latest surveys of multinational companies (MNCs) back this up. More and more MNCs surveyed say they are not considering leaving China. Rather, MNCs still consider China as their favorite investment destination.

China’s market size, its potential, and its economy’s opening-up will continue to draw MNCs. Meanwhile, its labor force is industrious and efficient. Its infrastructure and logistics systems have progressed well; and its industrial system is largely complete and mostly self-contained, increasingly moving up the value-added ladder. In addition, the size of the investment required to replace Chinese supply chains is too huge to be possible in the near term.

Supply moving out of China most recently became a hot topic right after the start of the trade war between China and the U.S under the administration of President Trump. However, China’s effective containment of Covid-19 has allowed its factories to quickly resume production. Before the pandemic and after the eruption of the trade war, many MNCs thought their extensive reliance on China’s manufacturing sector could be a potential risk. After the virus outbreak, the global supply chain has been severely affected, and China’s supply chain resilience has made them think again. Now that move away from China has halted altogether.

China has the second largest consumption market in the world, and great potential to further boost amid its structural rebalancing. Citi analysts expect China’s household consumption to rise from 37.7% of GDP in 2020 to around 44% by 2025. Around 66% of U.S. firms surveyed say they would consider increasing China investment if China’s market was open on par with the U.S. For EU firms, 65% would like to increase investment, if market access were granted to foreign companies in the corresponding industry.

Huge investment required to rebuild supply chains in other economies

To estimate how much investment is needed to absorb lost exports from China, the asset turnover ratio (sales/assets) could be used as a rough benchmark. Asset turnover calculated based on MSCI EM Asia index suggests that asset turnover in EM Asia fell below 25%, after its peak at 41.1% in 2002. In other words, this ratio requires $4 investment in order to produce $1 sales.

The value-added share of manufacturing sector in China is higher than in most alternative countries |

|

|

|

|

|

Source: OECD, Citi Research |

|

|

Assuming an asset turnover of 25-50%, and that 50% of Chinese exports to the U.S. (U.S. $250bn) moved to non-China EM countries, this would require investment of US$500~$1000bn in other EM economies. As US$500bn is equivalent to ~20% of India’s GDP, ~1/2 of Indonesia’s, 100% of Thailand’s, 130% of Malaysia’s, 150% of the Philippines’ and 200% of Vietnam’s, Citi analysts do not think these EM Asia countries have the capacity to increase investment in a short period of time to replace Chinese capacity. They could eventually, but it would take a long time, if not a decade. For more information on this subject, please see China Economics - Has the Pandemic Slowed the Relocation of Supply Chains Out of China?

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.