A recent Citi Research report, from a team led by global chief economist Nathan Sheets, offers a global growth forecast for this year and next, with the team’s outlook “soft” but still not a full-blown global recession. The authors note that risks to their forecast are skewed to the downside, but the features of those risks vary notably across major regions, each of which has a distinct and idiosyncratic narrative.

The desynchronized nature of global performance, they observe, is a striking feature of the current global outlook. The team notes that the global economy continues to face multiple headwinds—including high inflation, tight central bank policies, and ongoing geopolitical tensions—but growth has remained resilient.

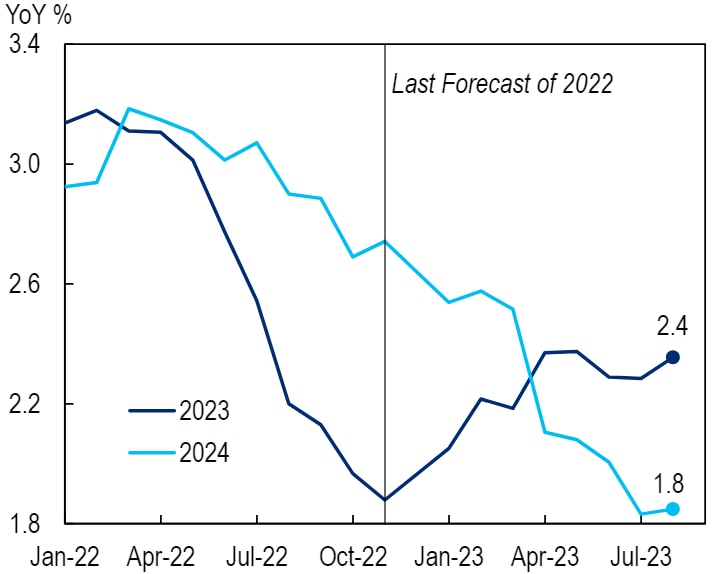

All told, Citi Research analysts see global growth coming in at 2.4% this year, somewhat below the 3% estimate of trend, and falling below 2% next year as the US and UK potentially fall into recession early and growth in China slows further. They see the first half of next year as the low point for global growth, with the pace of expansion dipping to 1% before picking up in the second half. Excluding China, global growth early next year is seen falling to just slightly above zero.

Global Real GDP Growth Forecasts

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

To the authors, the recent performance of global PMIs is broadly consistent with this story. The manufacturing PMI has languished in recessionary territory, a sustained weakness that largely reflects the post-pandemic rotation back toward services, and this weakness has significantly restrained the performance of global goods producers, notably Germany and China.

The services sector looks to be cooling a notch. The authors note that while the global services PMI remains comfortably above 50, it has retreated in recent months, suggesting red-hot services spending may be starting to normalize. This combination—deceleration in the services sector and still-weak manufacturing performance—highlights the challenges that currently plague the global economy.

Still-tight monetary policy should be an important contributor to the expected slowing in global growth. Central banks in both developed markets (DM) and emerging markets (EM) have raised rates aggressively through this cycle, with DM rates approaching their peaks.

The authors expect DM central banks will need to maintain peak rates until sometime next year; the major EM central banks, on the other hand, started hiking rates sooner than their DM counterparts, and several countries are now bringing rates back down. China is an important exception, having recently moved to ease policy, albeit tepidly, in an effort to support its flagging economy.

Risks vary across regions

The authors characterize their baseline outlook as soft but still a notch stronger than a full-blown global recession. They observe that global performance this year has been an upside surprise, one that has prompted them to raise their 2023 projection for global growth by 0.5 percentage point since the end of last year.

But that has not brought a sigh of relief, and the authors remain concerned about fundamental challenges that they see as still in play. That has led them to cut their 2024 growth projections by more than 0.75 percentage point, and they judge that risks to that forecast are probably still skewed to the downside.

Global Growth Forecasts

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

The authors offer region-by-region capsules looking ahead:

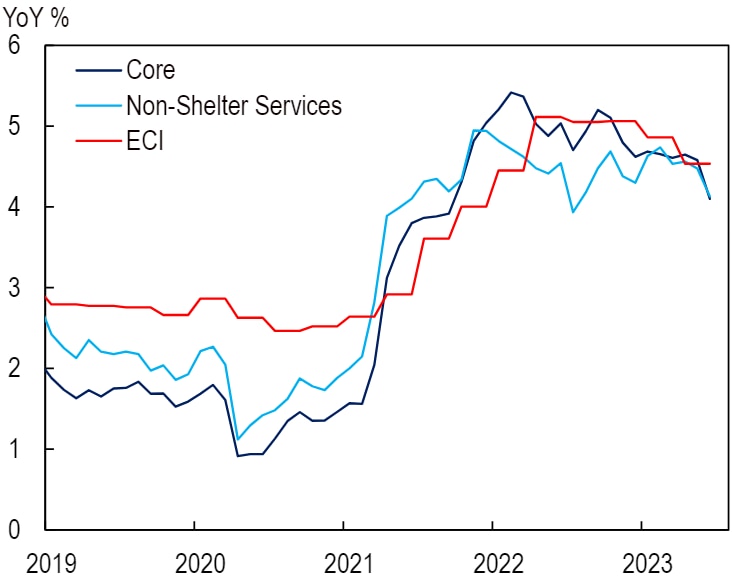

- United States: The authors believe the risks look to be approaching balance. They continue to expect a recession during the first half of 2024, but signs of one have refused to emerge, with consumers staying resilient and growth proceeding at roughly a 2% pace in recent quarters. Meanwhile, signs have been seen of gradual disinflation. That has moved the authors meaningfully in the direction of a soft landing, and prospects for inflation falling further lead to a key question: “Could we move the rest of the way to near 2% inflation over the next 18 months even with continued growth and low unemployment?” The authors’ baseline forecast answers that question with a no, assuming that a recession and higher unemployment will be needed to get inflation back to 2%. While the authors do see a “soft landing” as more likely than they did six months ago, they also consider a more pessimistic interpretation of recent resilience, one in which solid growth is letting imbalances keep building, which would ultimately require a sharper, deeper correction to bring the economy back into balance.

- China: The authors see China’s economy as facing significant downside risks. Growth has sputtered, leading Citi Research to cut its China growth forecast to 4.7%, below the authorities’ 5% target. Consumer spending has been weighed down; the global manufacturing recession is hitting China hard; and China faces challenges including high youth unemployment, heavily indebted economic sectors, a deflating housing market, and geopolitical tensions with the US. Authorities have shifted their economic policy toward stimulus, but the authors warn that China’s macro policy looks increasingly handcuffed. Fiscal policy is constrained by the economy’s high levels of debt and leverage, and policymakers fear reflating the property bubble.

- Euro area: The authors also see risks skewed to the downside, though not as severely as in China. The euro area successfully navigated the winter’s energy disruptions, but has since been hit by a painful contraction in the industrial sector. At the same time, though, real GDP growth in aggregate has held up comparatively well. Going forward, the authors see euro-area growth “doddering along” at an average (annualized) pace of less than 1% through the end of 2024, with the economy narrowly avoiding recession. The ECB is expected to hold policy rates at 4% well until 2024, which would likely mean ongoing headwinds for growth. It all makes for a baseline forecast that is lackluster at best.

- Emerging markets (ex-China): Here, the story is one of surprising resilience, with emerging markets generally avoiding financial crises and, in most cases, continuing to grow. By the authors’ reckoning, EM domestic engines of performance look stronger than in previous cycles. And by launching their rate hike campaigns in 2021, before DM authorities took action, EM central banks reinforced the credibility of their policies and supported their currencies. The authors expect EM central banks to broadly ease policy through the second half of this year, with moderating inflation giving them room to safely cut rates. All told, the authors see growth accelerating to more than 3% next year from roughly 2.25% this year.

For more information on this subject, and if you are a Velocity subscriber, please see the full report, first published on 23 August 2023, here: Global Economic Outlook & Strategy: The Surprisingly Desynchronized Global Economy.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.