When Assessing Exposure, Don’t Forget the Power of Politics

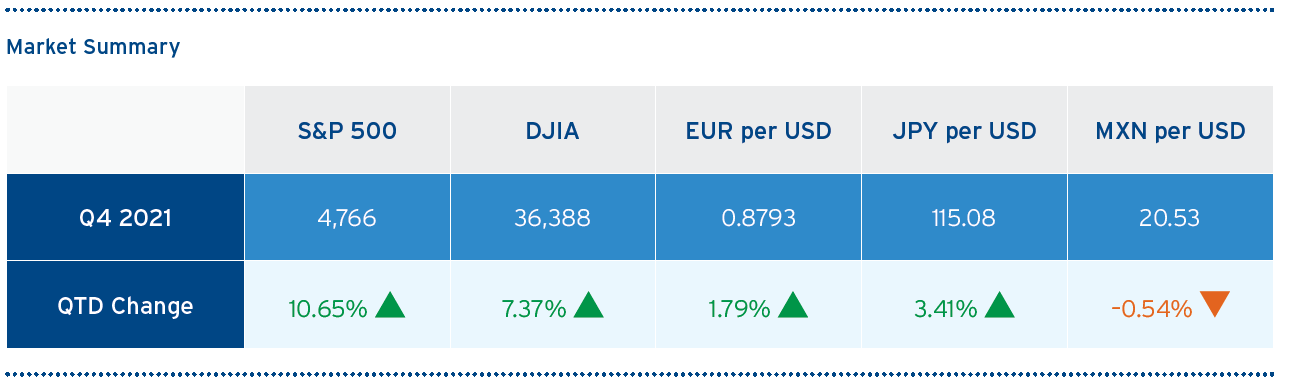

In forecasting exchange rates or understanding the macro backdrop that drives financial markets, the presumption is that key factors will reflect a combination of economic performance and policy variables. For much of 2021, the focus has been on the global surge in inflation and the central bank response – albeit more in the emerging markets than the main industrial countries. But this was starting to change toward year-end when the Fed started to ‘taper’ – that is, reduce the scale of its asset purchases – and market sentiment swung in a very short period from expecting no interest rate increases until the end of 2022 to at least four 25 bps hikes during the year, with more to come in 2023. The Bank of England has already started its tightening cycle. The European Central Bank, however, still exhibits a reticence toward tightening.

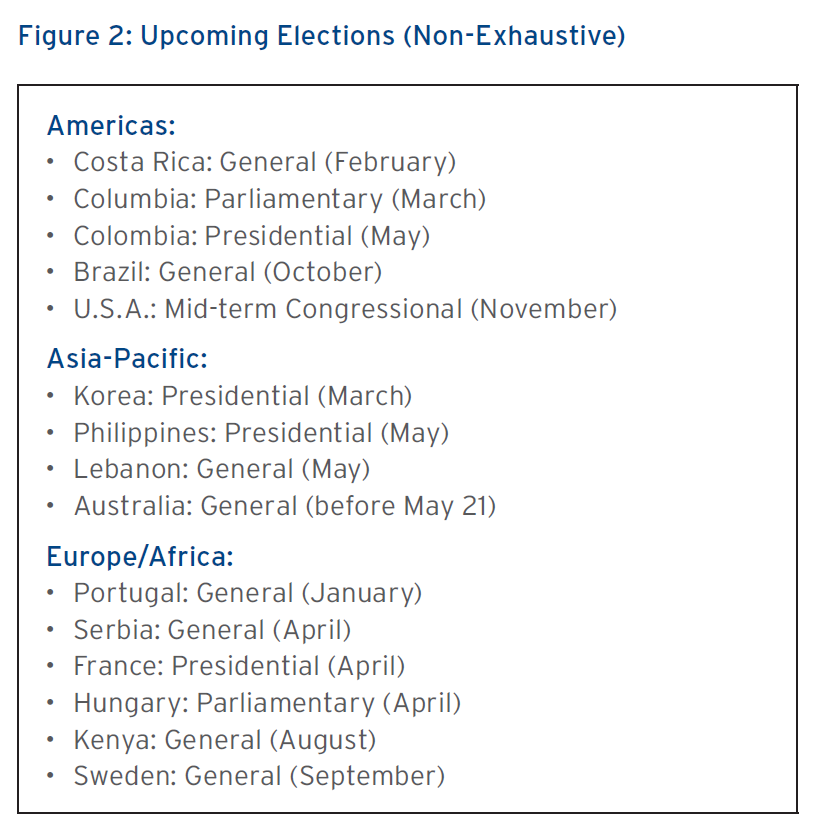

The reliance on economic measures allows for relatively smooth adjustments in forecasts but it falls short in one important dimension: it fails to account for the discontinuities resulting from political changes. Recent events and the electoral calendar remind us of the importance of global events – the crisis resulting from Russia’s new-found security “demands”, the continuing tensions between China and Taiwan, and the ever-present threat from North Korea as examples – as well as domestic politics, for which the electoral calendar looms large in Australia, South Korea, France, and Brazil, to name just a few.

Geopolitics

Although a more extreme example, the Russia/Ukraine situation shows just how important it is to account for geopolitical uncertainties in addition to the usual economic and market-related factors when reviewing a currency’s outlook. Prior to the recent escalation, the high level of oil prices and the aggressive tightening of monetary policy by the Bank of Russia would have led to the presumption of an appreciating Russian ruble. But as illustrated in Figure 1, the ruble had actually been depreciating since late October 2021, well before the February 2022 military escalation. Western sanctions against Russia in response to the conflict have obviously led to a sharp depreciation of the ruble, but even the threat of political instability alone last year was enough to overpower the traditional factors, before any sanctions actually came into place.

The key question then becomes: how should companies manage the uncertainties in advance? Much of the foreign exchange discussions between banks and their corporate clients center on risk management and hedging activities. But when geopolitics enters the equation, this may not be adequate. The threat of sanctions always raises the possibility that companies may not be able to gain access to their funds held in affected countries, so the number one question should potentially be: “can you get the money out?”, with a priority on how to answer that question in practice, rather than thinking about a hedging decision.

Electoral Politics

Elections can generate enough noise to overrule economic factors as well. Last year witnessed large depreciations of the Peruvian sol and Chilean peso ahead of presidential elections, which were won by left-wing candidates. The economic scenario of higher copper prices provided little benefit to either currency despite the fact Peru and Chile are top producers of the metal.

More recently, at least part of the weakness of the Korean won has been associated with concerns about the upcoming presidential election. The same is true with the Colombian peso. The question in all these cases is to what extent will the winning candidates seek to implement radically different policies from their predecessors or to what extent will they be forced to move to the political center in order to gain parliamentary support.

The three elections set to garner the most market attention are the presidential elections in France and Brazil, and the U.S. mid-term elections, which may present some risk for the U.S. dollar. With Democratic Senate wins in Georgia in January 2021, it became possible for the Biden Administration to adopt its initial stimulus measures, which in turn fed through to a more robust U.S. dollar. But should Republicans regain control of either, or both, houses of Congress, the risk is that the following two years could be characterized by policy stalemate, with negative implications for the U.S. economy and the U.S. dollar.

Brazil: In Focus

The presidential election in Brazil could see a contest between the incumbent right-of-center President Bolsonaro and the left-of-center former President Lula. When Lula first won election in 2002 (he took office in 2003), he largely maintained the centrist economic policies of his predecessor amidst a period of economic crisis. But what are the policy risks if the choice appears to be between two extremes? Does the market sell the Brazilian real ahead of the elections “just in case”?

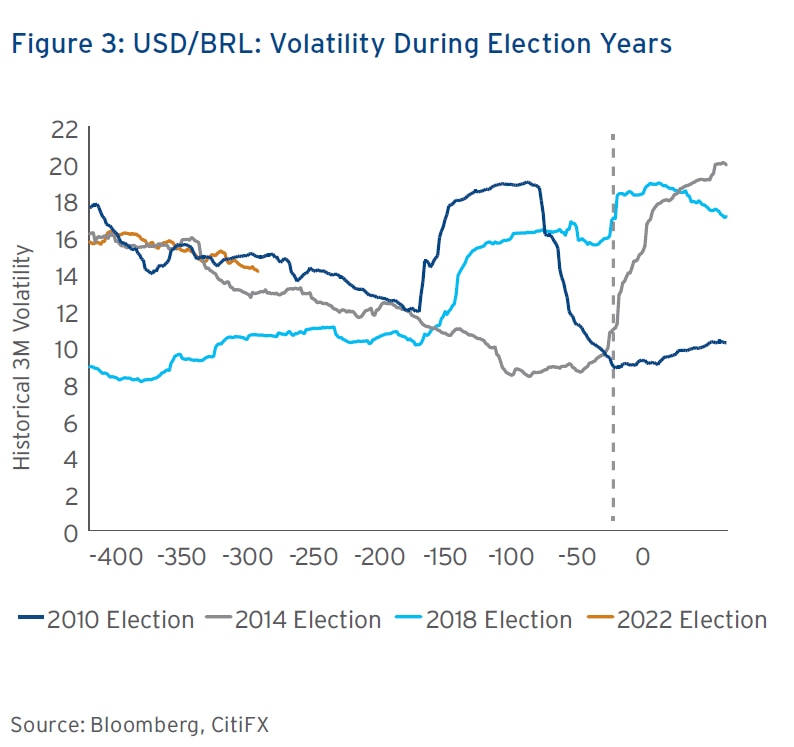

This kind of uncertainty is the reason why election time is often associated with higher volatility for a country’s currency. For USDBRL, the previous elections showed exactly that. Figure 3 shows three-month historical volatility of USDBRL from 400-days before voters cast a vote to 50 days after. Historical volatility is a statistical measure representing the standard deviation of spot changes over a period, in this case three months. The 2018 election occurred during a tumultuous time in Brazilian politics, and spot volatility started to rise well ahead of election day until it more than doubled. In 2014, USDBRL spot changes dampened until closer to election day but spiked sharply after. In 2010, volatility rose to a peak before reversing course. As history showed, it is difficult to predict the path of spot movements and market responses to news, polls and such. Prudent treasurers would be wise to look at potential scenarios, manage interim market volatility, and minimize market noise from financial results.

In conclusion

2022 is shaping up to be a big year for elections and geopolitics. Corporate treasurers who understand the impact of these factors on currency movements, and by extension their exposures, in addition to traditional economic and policy factors, can plan for the best strategies and solutions to protect themselves.