Education: Learning for Life

The skills gap topic and how it is addressed is of critical importance. This is especially true in the current environment, where tightness in the labor market, coupled with the ever-present threats posed by automation, are having real world impacts on lives around the world.

Although a lot of stakeholders are impacted by this phenomenon, the focus of this report is on the role played by enterprises — i.e., large companies — in identifying the skills of the future and equipping their employees with the tools they need to survive and thrive in a world beset by change.

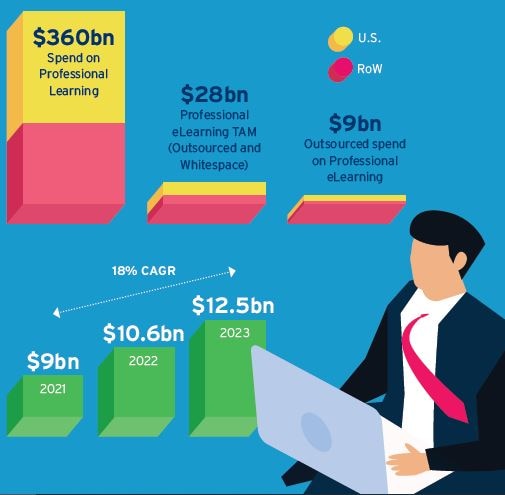

Our survey work shows that companies are ambitious and optimistic about the impact enterprise learning & development (L&D) programs can have not only on their businesses but also on employee welfare. It also shows these companies are “putting their money where their mouth is” and backing this ambition with significant budget increases (18%+ annual growth over the next 2 years).

In the report Citi’s Chief Learning Officer, Cameron Hedrick, and Head of Enterprise Learning & Talent Technology, Peter Fox, outline their vision of what the future of L&D looks like and what the benefits will be for those companies that take proactive steps to embrace the future. We also include a number of interviews with subject matter experts, including strategy consultants and best-in-class providers of content, technology, and services from across the professional learning landscape. Each has their own area of focus, but all are in agreement on the significant opportunity for growth in this large but fragmented market.

What, then, are the implications? As always, it is a question of concentric circles. At the center is a significant opportunity for those companies focused on closing the skills gap, both in terms of better direct financial performance (better productivity; lower costs) as well as higher employee satisfaction. There is also an opportunity for the professional learning companies that enable this.

The more interesting impact, though, is perhaps in the outer rings of the circle: the employees who move onto more remunerative and fulfilling jobs without the threat from automation/risk of redundancy; the minorities no longer deprived of access to education with long-term effects on their health, wealth, and happiness; and the benefit for economies from increased productivity and a more flexible workforce.

Authors: Thomas A Singlehurst, CFA,Nithin Pejaver, CFA,Cameron Hedrick,Peter Fox,Leah Belsky,Corey Thomix,Greg Siegel,Mike Howells,Jeff Tarr,Mark Orisk,David Somers,

The Next Frontier for Global Education

The Skills Gap is a Significant and Growing Problem

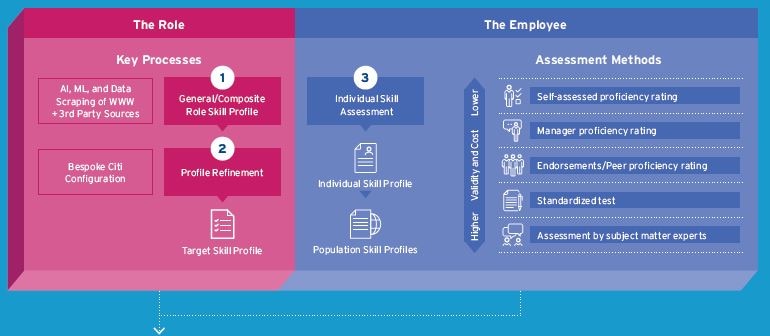

The Citi View on Enterprise Skills Optimization

Increased Focus on L&D Provides a Significant Market Opportunity for Private Capital