High energy prices are taking their toll on European demand – which is falling as consumers look to make savings. But, as uncertainties mount over future supplies of Russian gas, the debate is rapidly moving from one of price-led rationing of demand to mandated rationing.

European governments are having to face the uncomfortable trade-off between preserving industrial output and ensuring adequate energy supplies for winter heating demands.

Gas meets one-quarter of Europe’s energy needs

Gas is a key pillar of Europe’s energy mix, used for residential heating and cooking, industrial heating and feedstock and as a fuel for power generation.

Residential gas usage is captive – in other words, it cannot be switched to alternatives – as is much of what is used by industry given the role of gas in feedstock or high-heat processes.

Gas used in power generation competes more with other energy sources, and in particular demand tends to swing inversely with the output from renewables and hydro.

Europe has a high reliance on Russian gas…

Europe’s gas industry grew up around agreements to take supply from the USSR in the 1960s. While supply sources have since expanded through a combination of domestic production (mainly the UK), alternative imports (Norway, Algeria, Libya) and LNG, there is still a heavy reliance on imports from Russia. Today a large, legacy pipeline infrastructure brings gas from East (i.e. Russia) to West across Europe.

While Europe’s oil and coal supply also relies on Russia, these fuels are pretty fungible in the way they are moved around the world.

In contrast, gas delivered by pipeline creates a supply chain that is much less flexible. As such, the EU’s sanctioning of Russian energy has focused on oil and coal, taking advantage of inherent flexibility, whereas politicians have been much more circumspect when it comes to how to deal with Europe’s reliance on Russian gas.

…but Russian gas exports to Europe are dropping rapidly

Looking at the data, it is hard to think that Russia is not politicizing its gas sales into Europe. Exports to Europe are down 40% 1H22 vs 1H21.

Exports have dropped off almost completely recently, with the scheduled annual maintenance (by Russia) of the key pipeline. That maintenance is scheduled to last through 21 July, although given the behaviours of recent months, the market has concerns over whether those exports will re-start as planned. Russian gas at zero is a big ask for Europe as a whole to replace, although most impactful to Germany and Italy.

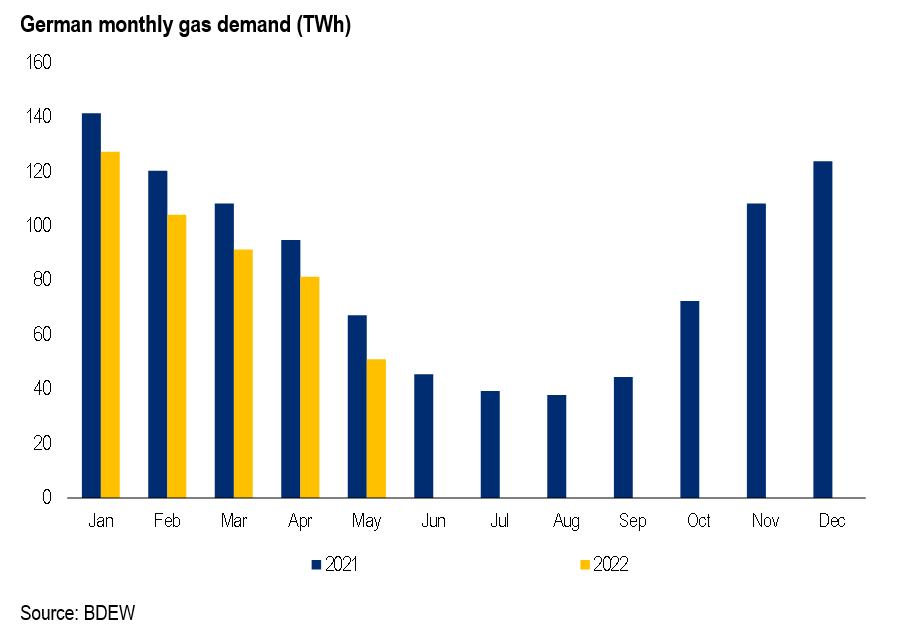

German gas demand already seeing price-rationing effects

Switching from the supply side to the demand-side of the equation, the trends across Europe have been negative. German gas demand is down 16% YTD or around 10% on a weather-adjusted basis (2H winter was warmer than normal, so heating demand was lower). The decline reflects a combination of higher output from renewables (better climatic conditions) and demand-destruction from record-high gas prices.

Because of the use of gas for residential heat, winter demand is 3x that of mid-summer (now). That is based on average demand. A cold-snap can bring daily demand even higher.

And this is where Europe relies on gas inventories to help balance the market. Inventories are filled in spring and summer, and drawn down in winter. A loss of Russian supply this time of year means that there is a risk that inventories will not fill ahead of peak demand, and this could create untold problems in winter, especially if the climatic conditions are colder than normal.

Industrial demand for gas is broad-based across sectors

While energy rationing is an unheralded concept in developed Europe, it has been relatively commonplace in South Africa, India and China over the past couple of decades. Experience suggests that, where it is organized, industry and supply-chains cope much better; disorganised cuts have ended up with nightmarish situations such as mine workers trapped (South Africa).

Rationing will likely see considerable horse-trading between industries and market regulators. It is not clear exactly how industrial demand for gas splits in countries like Germany – the data is not very granular – but the European picture is one where demand is broad-based over a number of sectors. The full Citi report goes sector-by-sector through the ramifications of scaling back demand.

The additional consideration to rationing is the second-order effects. Industrial Germany has developed into a just-in-time economy, so the partial shutdown of one section of the supply-chain can have amplified effects through the rest of the chain.

Part of the consideration therefore to any rationing is to what extent that supply-chain can be supplemented elsewhere in Europe. For more information on this subject, please see European Gas Rationing: A look at Sector-Level Impacts

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.