Global Economy: Resilience in the Face of Growth Concerns

Citi economists see growth slowing next year as restrictive monetary policy increasingly bites. But the combination of slower growth and tighter policy should finally push inflation back to target, they say.

That prediction of slower growth next year stands in contrast to recent weeks when Citi Research analysts have revised their forecasts for the U.S. and China and currently expect growth in both countries to be stronger than previously forecast for this year.

Their projection for global growth this year now stands at 2.5%, up from 2.3% in September and more than half a percentage point higher than anticipated when the year began—a performance that, while “hardly gangbusters,” has been an upside surprise.

Evolution of Citi Global Growth Forecast

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

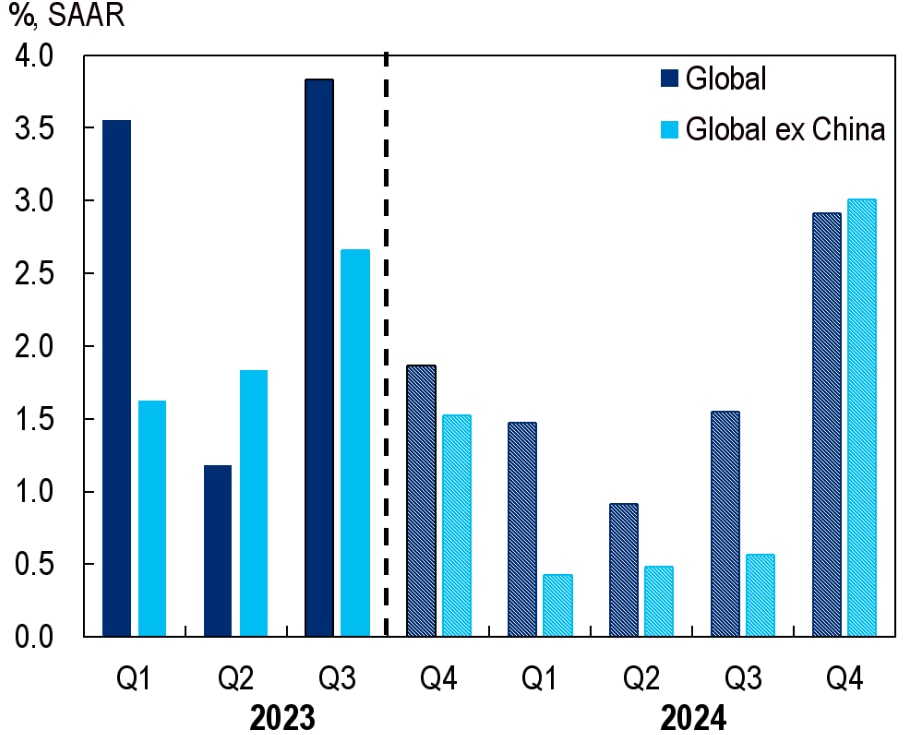

Citi Global Growth Forecasts*

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

*Note: Cross hatching represents Citi forecasts.

Source: Citi Research

But next year the economists expect global growth to slow to below 2% as the accumulated drag from tight monetary policy weighs more heavily on activity.

The global economy in aggregate is seen skirting recession, but many developed market economies are likely to see downturns, with the euro area remaining in recession through the rest of 2023 and early next year; the UK contracting through 2024’s first three quarters; and a U.S. downturn beginning in the second quarter of 2024.

Most major emerging markets should continue to see positive performance. All in all, global growth excluding China is likely to hover around 0.5% through next year’s first three quarters, ahead of a late-year bounce.

The authors note that their outlook is also shaped by two emerging developments: the “breathtaking” rise in global long-term interest rates and events in the Middle East.

They see the rise in rates as largely reflecting the persistence of inflation and central banks’ aggressive response, and note that it will further tighten financial conditions and amplify the central bank rate hikes.

On the subject of the Middle East, they observe that oil prices have risen and have shown volatility, with markets pricing in a risk premium. A sustained run-up in oil prices would be yet another adverse supply shock for the global economy, putting pressure on headline inflation, restraining spending, and further challenging central banks, which already must remain vigilant about persistent, above-target inflation.

Growth in the U.S. and China

The most striking change in the forecast over recent weeks, the analysts observe, has been a further upward revision to U.S. growth. The economy has shown strength during the third quarter, with real GDP growth tracking at a “blistering” 4.7% and September data especially buoyant. That has led the team to once again push back its forecast for the onset of a U.S. recession, now seen persisting for roughly two quarters. Growth has been marked up this year from 2.1% to 2.4% and next year from 0.3% to 0.9%.

Despite the economy’s resilience, the authors maintain their view that a recession will ultimately be needed to cool wage and price pressures. While they’ve seen some cooling in inflation—core PCE inflation has fallen from 5.6% in early 2022 to an estimated 3.7% in September—their sense is that slide was the comparatively “easy” part of getting inflation back to the 2% target, and a higher unemployment rate and a looser labor market will be required to unwind elements of inflation that remain hot, such as non-shelter services.

The report says two thorny questions are raised by their recession call: What will ultimately be that recession’s trigger? And do they have any confidence regarding the downturn’s timing?

“We approach the question of triggers for recession with humility,” they admit, adding that they’re surprised that the Fed’s rate hikes haven’t already slowed the economy more appreciably. They suspect that is because some fraction of the economic effects of this tightening remains lagged and are still working through several channels.

The authors have also raised their forecast for China’s 2023 growth from 4.7% to 5.3%, putting it a notch above the 5% official target. Their 2024 forecast is unchanged at 4.6%. The team notes early signs that the Chinese economy has reached a cyclical trough, with consumer spending looking like it’s climbing back and those consumers likely having ample savings to support a further cyclical bounce. The authors also note evidence that the Asian manufacturing cycle may be bottoming, which would also be supportive for China, and actions taken by the People’s Bank of China have helped put a floor under the ailing property sector as well as providing more general support.

But the authors note the importance of differentiating between cyclical improvement and China’s deeper structural challenges, which begin with elevated indebtedness and the need to make household consumption a more central part of the growth process and extend to challenging demographics and geopolitical tensions with the United States. Taken together, the authors say, it’s almost inevitable that China’s economy will grow more slowly than in past years. Still, they add, a good part of that slowdown reflects “the deeper laws of economic gravity.” China has seen a marked rise in per-capita GDP, and higher income levels mean a natural moderation to the pace of growth.

For more on this subject as well as country-by-country discussions, please see the full Citi Research report, first published on 25 October 2023, here: Global Economic Outlook & Strategy: The Resilient Global Economy.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.