Global Supply Chains

In the Citi GPS Global Supply Chains: The Complicated Road Back to “Normal” report published in December 2021, we examined the multiple challenges that have afflicted global supply chains. We concluded that supply chain conditions remained remarkably tight, but we saw reasons for hope that the situation might improve over the course of 2022.

The Complexities Multiply

We expected improvement in shipping and logistics during the first part of 2022 as seasonal pressures associated with elevated fourth-quarter demand were reversed, steps were taken to unclog the ports, and oil prices began to moderate. Through the second half of 2022, more fundamental adjustment in the afflicted sectors — including semiconductors, autos, and other industrial goods — seemed likely as rising production gradually cleared backlogs that had accumulated.

But the first quarter of 2022 brought significant downside surprises. The Omicron variant emerged, which has slowed — and in some regions stalled — any appreciable improvement in the pandemic. Ultimately, an unwinding of supply chain pressures requires sustained progress in managing the pandemic. COVID-19 risks are again flaring with the upsurge of cases in China and the ongoing lockdowns.

These challenges have been accompanied by the eruption of armed conflict between Russia and Ukraine. While the full implications of the conflict for supply chains are yet to be determined, what is clear is that it has opened a significant new chapter in the supply chain saga.

In this report, we update our analysis of supply chain tensions to account for the extraordinary developments of recent months. We begin by considering five fundamental macro drivers of these pressures, which we identified in our previous report. Notably, the lion’s share of these factors remain in play. We then turn to an assessment of recent supply chain performance and sketch out the unsettling risks flowing from the Russia-Ukraine conflict, which reflect the pivotal role of these countries as exporters of commodities and raw materials. We conclude with some broader thoughts on how supply chains are likely to evolve in the aftermath of this episode.

Bottom line, we find that supply chain pressures have proved to be more persistent, and apparently deep rooted, than we had expected even a few months ago. And the Russia-Ukraine conflict seems to be further amplifying the stresses. Given these realities, any hopes of near-term improvement in supply chain conditions have been shattered. The challenges in the months ahead look to be as acute as at any time over the past two years.

How Did We Get Here?

Relieving the Stress

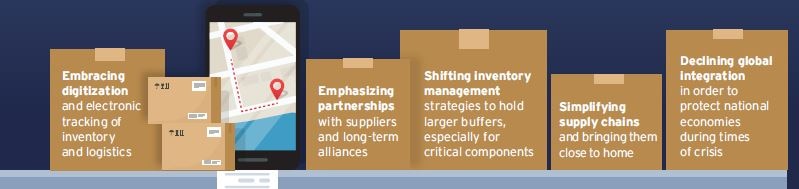

Future Supply Chain Management Strategies