How COVID-19 Is Impacting Online Food Delivery Platforms

In the article “Is COVID-19 Lead to Accelerating Trends” we noted a Kantar survey conducted on February 15th of Chinese shoppers measuring the impact of COVID-19 found that 42% of respondents said they would use online more in the future for their grocery purchases while only 8% said they would reduce their use after the crisis. For those not cooking at home, online delivery service from restaurants is one way to limit the amount of trips outside the home. Below we look at what drives the online food delivery platform and how the COVID-19 pandemic has affected the demand and future prospects.

What is the Revenue Growth Opportunity for Online Food Delivery Platforms?

Revenue growth drivers for online food delivery platforms include (1) number of customers; (2) orders per customer; (3) take rate; and (4) gross merchandise value. Crucially, attention should be focused on how operators can maximize order growth (order value growth can largely be assumed to increase in-line with inflation) and take rates. Clearly order growth is, in turn, driven by customer numbers and how many orders each customer makes. For take rates, we focus on whether commission rate increases to restaurants are possible, or whether more can be done to drive placement revenues (where restaurants pay the platform to have a high placement in search results). Market maturity is a key differentiator in both the rate of revenue growth possible for online food delivery platforms, and in the types of levers companies should pull in order to maximize this growth. As a result, we consider separately the market growth potential for mature and nascent markets, as well as the factors that can deliver best in class growth in both.

REVENUE DRIVERS FOR ONLINE FOOD DELIVERY PLATFORMS

Inequality, minimum wage levels, and the negotiating position of restaurants vs. online platforms are more significant factors driving attractive delivery service economics than population density and traffic congestion. There are also idiosyncratic factors that influence the delivery economics of a country that we are unable to capture in this analysis. Some examples include: tipping culture (increases attractiveness of delivery economics in U.S. and Canada), customer price sensitivity to delivery fees (Western European customers highly price sensitive to delivery fees, worsening delivery economics), and weather (poor weather in Canada increasing customer willingness to pay for delivery).

Inequality, minimum wage levels, and the negotiating position of restaurants vs. online platforms are more significant factors driving attractive delivery service economics than population density and traffic congestion. There are also idiosyncratic factors that influence the delivery economics of a country that we are unable to capture in this analysis. Some examples include: tipping culture (increases attractiveness of delivery economics in U.S. and Canada), customer price sensitivity to delivery fees (Western European customers highly price sensitive to delivery fees, worsening delivery economics), and weather (poor weather in Canada increasing customer willingness to pay for delivery).

Globally, we believe the markets that will likely provide the most attractive delivery economics are certain Latin American countries (such as Brazil, Mexico, Paraguay, Panama) and some in the Middle East (such as Kuwait and Qatar). This is based on our assumptions that markets with attractive delivery economics have:

- Customers willing to pay a high delivery fee

- Delivery riders willing to accept a low wage

- Restaurants willing to be charged a high fee to use online platforms

These three factors are in turn driven by:

- The level of income inequality in a country: More unequal countries providing better delivery economics given the significant gap between what a customer is prepared to pay for delivery and the pay a courier rider would expect to receive. We measure both the Gini coefficient in each country and the ratio of the share of income in a country going to the 20% of income earners vs. the bottom 20%.

- The minimum wage and labor legislation (or lack thereof) in a country: Countries with poor labor protection and a lack of minimum wage legislation providing better delivery economics given the lower rider pay required. We measure the ratio of typical delivery fees charged in a country to the national minimum wage. A higher ratio suggests more attractive delivery economics. Where countries have no minimum wage we assume a default ratio of 3x (at the high end of our data).

- The proportion of branded restaurants in a country: Branded restaurants typically having better negotiating power with online food delivery platforms, which worsens delivery economics by lowering commission rates and delivery charges possible by platforms.

How has COVID-19 Affected Online Food Delivery Platforms?

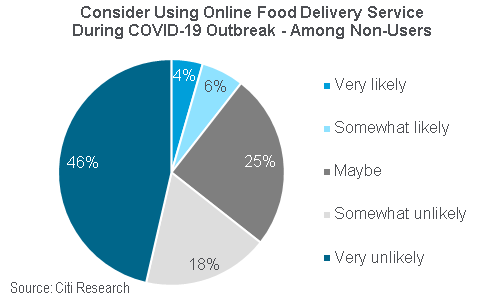

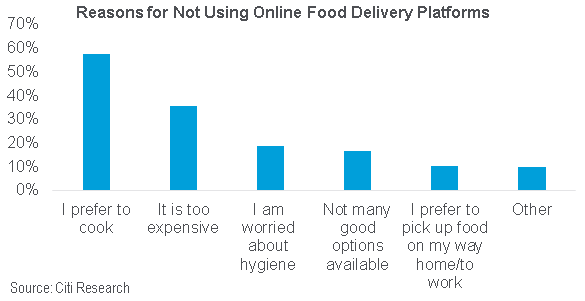

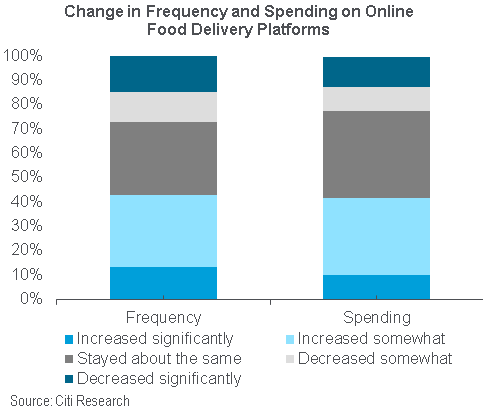

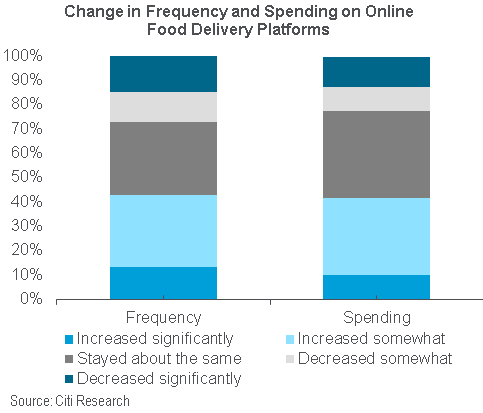

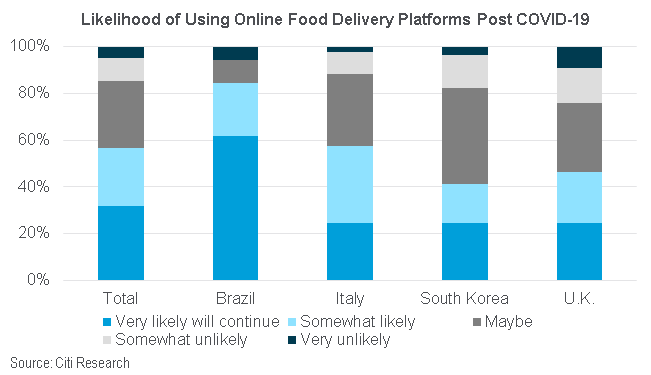

Between April 8 and April 20, we conducted an online food delivery survey among 3,606 consumers (both users of online delivery services and non-users) in the U.K., Italy, Brazil, and South Korea. The average age of users in the survey is 45 with heavier users of the platform younger than light users. Based on data from the results, we analyzed online food delivery platform usage, how it has changed given the COVID-10 pandemic and whether current changes could be long-lasting. Overall, COVID-19 has had a net positive impact on frequency and spending on online food delivery and the majority of new users (57%) are likely to use it again.

Click on the Key Findings below for more details from the Survey.

Key Finding #1: Positive Impact on Frequency & Spending Level in All Markets Except the U.K.

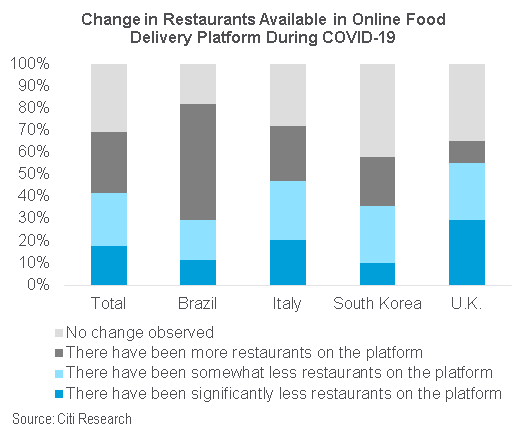

Key Finding #2: Restaurant Choice & Promotions During COVID-19 Outbreak

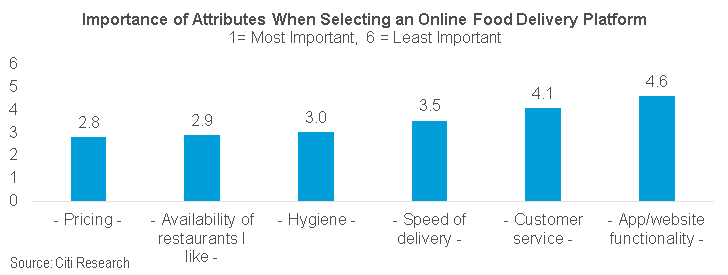

Key Finding #3: Price & Choice Are the Main Selection Criteria for Platforms

Key Finding #4: Brazilians Most Likely to Continue Using Service

Key Finding #5: Non-Users Not Fully Convinced