Improving visibility of accounts and transactions for Tek Experts

Article • May 02, 2023

Tek Experts is a leading global provider of technical talent solutions and a trusted partner to some of the world’s largest, most-respected organizations. They help enterprises deliver exceptional customer experiences and results at scale, offering a range of flexible solutions including tech support, customer success and tech talent sourcing.

Founded in 2010, Tek Experts operate in a follow-the-sun model 24/7/365, throughout Costa Rica, USA, Nigeria, Rwanda, Bulgaria, China, and Vietnam. They employ more than 6,000 people across the globe.

The Challenge

With multiple subsidiaries across five continents, rapid geographic and business growth, Tek Experts’ treasury operations expanded to include a mix of local banking relationships and platforms. Cross-border funds transfer activities often involved manual interventions which are now replaced with cumbersome processes for making payments.

When making payments toward subsidiaries in U.S. dollars, Tek Experts had to exchange funds into domestic currencies locally, based on local foreign exchange (FX) rates and using applicable local banking setups. Each subsidiary used a different platform and bank — making this process difficult to track and manage at group level.

To gain greater visibility and control over fund flows, Tek Experts sought a global banking partner who could offer centralized payments and FX solutions.

The Solution

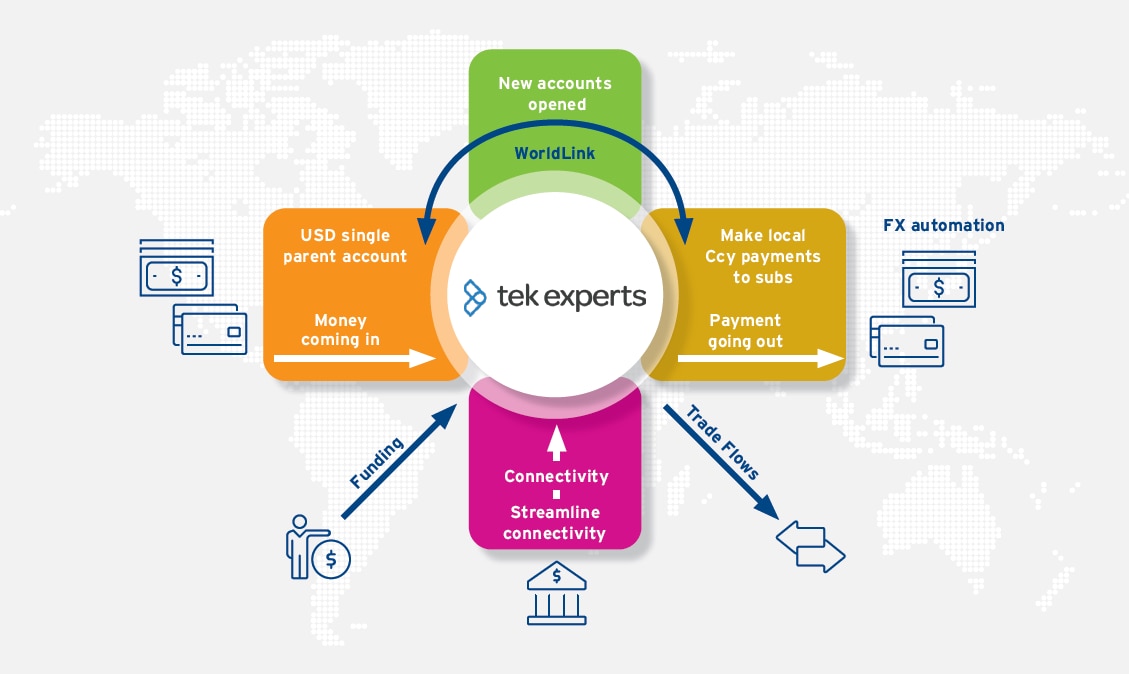

Drawing from its decades of experience simplifying cross-border payments, Citi is implementing WordLink Payment Services for Tek Experts and several of its subsidiaries.

WorldLink, which integrates with the CitiDirect global banking platform, provides a centralized view of a company’s accounts and transactions — helping to streamline fund transfers and automate FX transactions at competitive rates.

Using WorldLink, Tek Experts can view transactions and automate payments using one platform. The company now has improved visibility across its global subsidiaries and can issue payments in different local currencies from a single US dollar account.

The Benefits

In addition to being able to centralize payment processes and flows, Tek Experts can potentially benefit from

- Greater visibility into accounts and transactions across multiple jurisdictions via a consistent global banking platform and comprehensive reporting.

- Increased control over fund flows, including the flexibility to set up different layers of transaction approval for all accounts and users.

- More efficient processes and a reduction of manual interventions as the result of automated FX conversions.

- Multiple levels of control and verification of funds release

- A simpler account structure and the ability to make

- cross-border payments in multiple currencies from a single account.

- Easier, less time-consuming authorization process using Citi mobile application