Real investment in India took a massive hit from the pandemic. But a new report from Citi Research’s Samiran Chakraborty points to several signs that a period of sustained growth could be coming- with annual nominal investment poised to more than double to $ 2.4 trillion by 2030.

India last year suffered a 10.8% fall in real investment growth, its sharpest drop since independence in 1947.

And India’s capex story was struggling long before the pandemic slammed the brakes on global economic activity. But Citi analysts, although mindful of continuing Covid uncertainties, are noticing signs of a period of more sustained growth on the horizon. They reckon annual nominal investment could increase from ~$1trn in FY22 to $1.8trn in FY27 and ultimately cross $2.4trn mark by end of the decade. And in Citi’s framework, the $5trn nominal GDP target would be reached by FY27 and would further increase to $7trn by end of the decade.

And Citi’s scenario of 6.5-7.0% real GDP growth has the potential to generate ~45 million jobs between FY23-FY30- mostly in the non-farm economy.

Broadly, India’s recent investment story can be split into three phases.

Stage 1

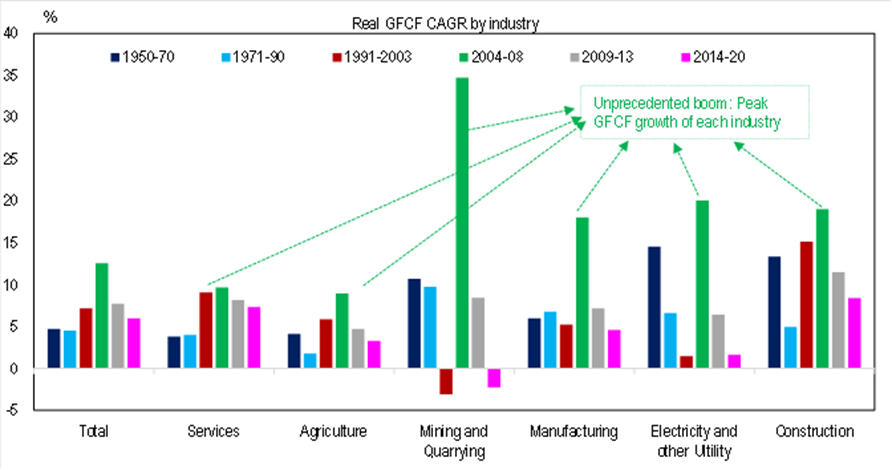

FY04-08 were the real boom years when investment fired on all cylinders led by manufacturing. Importantly, it was a unique period where CAGRs for all key sectors reached their all-time highs.

Stage 2

Post global financial crisis, the compound annual growth rate of real capex slowed to 7.7% but the investment-to-GDP ratio rose to 33.9%. This period was characterized by a sharp fall in manufacturing but resilient infra/construction capex. However, under pressure from weakening demand, excess capacity and funding constraints, the infra bubble burst abruptly around FY12-FY13

Stage 3

This led to the sharp slowdown in investment in the third phase from FY14-FY20 (avg. investment/GDP 29.2%, capex CAGR 6.0%). This investment slowdown was the culmination of years of lop-sided growth and excesses that ultimately led to risk aversion in the private sector and a sharp correction.

Investment fired on all cylinders during pre-GFC years - A period like no other in India's investment history |

|---|

|

Source: Citi Research, CSO |

A few themes emerge from this capex journey that might hold some lessons to understand future trends.

- Manufacturing capex has averaged only 17% of overall gross fixed capital formation (GFCF) in the last 10 years (15% in FY20), while 40% of total investment has happened in the broadly defined construction sector. Therefore, any stimulus that only targets the manufacturing sector might not be enough to increase the GFCF/GDP ratio meaningfully.

- Real estate and private capex are the two most important drivers. In the recent slowdown between FY14-FY20, the 2.5pp drop in GFCF/GDP was almost equally split between household GFCF/GDP (mostly real estate) and private corporate capex.

- The services sector remains an attractive investment destination. Services GFCF (CAGR 7.3% FY14-FY20) has consistently outperformed total GFCF (6.0%) and its share in total FDI has grown to 55-60% (from ~33% early 2010s).

- Digitization-related investment would get a boost in the post-pandemic world. In fact, the share of intellectual property products in total GFCF has consistently gone up over the last decade (7% in FY12 to 13% in FY20).

- Project delays forced banks to reduce funding toward large projects. Average size of bank funded infra projects was halved from INR14bn (FY09-FY13) to INR6.8bn (FY14-FY20). Banks will likely remain cautious in their sectoral preferences at least in the nascent phase of investment recovery.

Multiple tailwinds form the crux of Citi’s argument in favour of a capex recovery.

- Real lending rates are at their decadal lows. VAR model suggests that 100bps cut in real lending rate could increase investment by up to 300bps cumulatively over ten quarters.

- The effective corporate tax rate has come down to 25.17% from 34.95% earlier. There is evidence of corporate tax multiplier to be greater than one and boosting both private capex and FDI flows.

- Corporate leverage has improved steadily and is inversely related to capex. Debt-to-Asset ratio for Sensex companies is at its lowest since FY04-05 and interest coverage ratio of private listed firms is at highest levels since 2010.

- Corporate profitability has shown a strong rebound post-pandemic and we estimate that 100bps increase in net profit margins could push real investment growth by ~175bps.

- The free cash flow-to-capex ratio of listed firms is at multi year highs; this could reduce risk aversion and push private investment.

- Economic policy uncertainty has fallen to post-GFC lows and is shown to have strong statistical linkages with investment.. Private capex could benefit from exploiting complementarity with public infra push.

- Improved bank balance sheets could provide a supportive credit environment.

How much capex does India need?

Some sort of investment revival is bound to happen in the post-Covid period with a pent-up, demand-led recovery already underway. Looking beyond this near term recovery, Citi analysts tried to estimate India’s investment needs based on a real GDP growth target that is both desirable and relatively achievable. They first did a historical cross-country analysis under the framework that connects investment and productivity growth to GDP growth. Data for 27 economies shows that in ~47% of cases of 6-7% real GDP growth, investment growth required was at least 7%. Similarly, in more than 48% of cases of 6-7% real GDP growth, total factor productivity growth was between 1-3%.

This suggests that a broad range of investment-productivity growth combination has historically yielded 6-7% real GDP growth. In contrast, an 8%-plus real GDP growth needs productivity growth close to 3% and real investment of ~10%.

This makes a 6-7% growth target more achievable given the various economic shocks faced over the last five years. However, this would need a stronger than usual investment push as leverage-led consumption growth model has already played its course.

A gradual deceleration in investment growth preceded the pandemic induced fall |

|---|

|

Source: Citi Research, CSO, CEIC Data Company Limited |

Citi Research analysts reckon that in the post Covid years, real investment growth would have to be close to 7.5-8.0% for the virtuous cycle of employment-led more sustainable and equitable consumption growth to kick in.

Annual nominal investment could increase from ~$1trn in FY22 to $1.8trn in FY27 and ultimately cross $2.4trn mark by end of the decade. In Citi’s framework, the $5trn nominal GDP target would be reached by FY27 and would further increase to $7trn by end of the decade.

Based on historical employment elasticity analysis, Citi’s scenario of 6.5-7.0% real GDP growth has the potential to generate ~45 million jobs between FY23-FY30. Most of this job creation would likely happen in the non-farm economy.

While household savings would be the primary source to finance the investment cycle, India would still have to attract foreign capital. Even with a higher saving rate, household saving could likely cover ~60-65% of investment while corporate savings would cover around one-third of total investment. This leaves a saving investment gap during FY23-FY30 period of ~USD350bn but could be bridged easily through foreign investment.

Barriers to capex

The favourable pre-conditions for private investment growth discussed above keep hopes high, but by no means guarantee a sustained investment revival. The economy faces a daunting challenge from subdued consumer demand that has the potential to derail any nascent capex revival, especially in an environment fraught with uncertainties. There are significant challenges for sustained consumption recovery from structural labor market issues that have been worsened by K-shaped post Covid recovery. In particular, the lack of any meaningful employment recovery in industry ex-construction sector and among the younger population (below 40 age group) remains a key concern. Ultimately, for a sustainable recovery in investment to result, Citi Research analysts reckon strong consumer demand that pushes capacity utilization levels in the manufacturing sector closer to the long-term average will be essential.

For more information on this subject, please see Viewpoint | India Economics & Equity Strategy | 19-Jan-2022 (citivelocity.com)

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.