Insurance could be in a sweet spot for our times – a sector whose very business model can positively influence behaviour and has a pivotal role in the energy transition and in delivering demonstrable environmental and societal impact.

The ESG attraction of the sector is already reflected in its MSCI SRI Europe weighting. However, Citi analysts believe that this is not fully translating into higher active management weights, which is where the majority of the AUM sits.

Company disclosure is improving but what is lacking, according to the Citi analysis, is a clear and concise framework to communicate the sector’s positive ESG impact on society-at-large.

Size of the prize

ESG as a theme has been gathering momentum in recent years. EU ESG mutual fund AUM reached €3.3 trillion at 1H’21, up from c.€1.7 trillion in 2019. ESG funds now represent c.32% of mutual fund AUM. There is little sign of slowing momentum, with PwC expecting ESG mutual fund AUM to grow to c.€5.5-7.6 trillion by 2025.

Insurance has the largest MSCI Europe SRI weighting relative to MSCI Europe (+5ppts) but Citi analysts argue that investors don’t yet naturally think of it as an ESG sector. They say therefore that the active weight is more in-line with the MSCI Europe weighting (i.e. is not an overweight sector).

MSCI Europe vs. MSCI Europe SRI sector weightings |

|

|

|

Source: Bloomberg priced on 11/4/2022, Citi Research |

Insurance Chimes with UN SDGs

Starting from the outside and working in, the Citi report shows how well the European insurance sector aligns with the UN Sustainable Development Goals. These 17 goals aim to address, by 2030, the biggest challenges facing society, the planet, and humankind.

Citi’s proprietary analysis in the chart below reviews all sustainability and annual reports across its European insurance coverage (>5% of MSCI Europe) to identify which goals the insurers themselves are identifying as key areas of focus. The analysis shows that all goals are mentioned as an area of focus by at least 4 insurers across coverage, highlighting the broad ESG reach of the sector. The goals that screen most in focus are SDG13 Climate Action, SDG8 Decent Work and Economic Growth, SDG3 Good Health & Wellbeing, SDG5 Gender Equality and SDG7 Affordable and Clean Energy.

European Insurance coverage alignment to UN Sustainable Development Goals |

|

|

|

Source: Company data, Citi Research, Scores reflect % of Citi Insurance coverage that identifies the SDG as an area of focus |

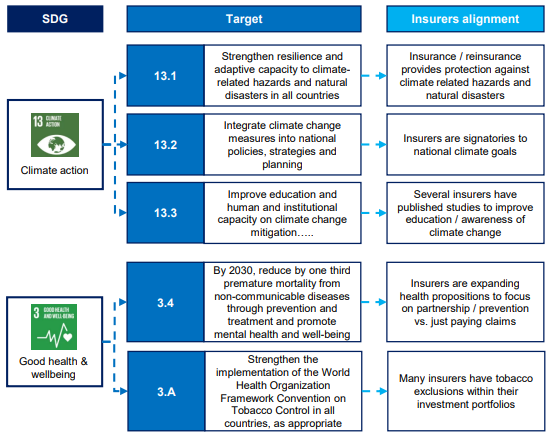

For the 5 SDGs on which Citi analysts believe insurers can have the greatest impact (SDG13 Climate Action, SDG3 Good Health & Wellbeing, SDG8 Decent Work and Economic Growth, SDG7 Affordable & Clean Energy and SDG11 Sustainable Cities and Communities), they drill down one level further to show the alignment with the 169 targets that underpin the 17 goals.

Insurers alignment with SDG targets |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research |

The table above shows this mapping for Climate Action and Good Health & Wellbeing. Greater detail on this and more can be found in the full Citi report first published on April 19th: Western Europe Insurance - Hiding in plain sight: An ESG sector that is part of the solution

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.