NextGenEU and National Recovery Plans

How much money will NextGenEU need to raise to support the National Recovery and Resilience Plans (RRPs)?

Nearly €400bn in EU non-repayable resources (2.8% of GDP) is available and all countries are expected to fully utilize this. However there is currently a reasonably low take up of the loans available, which could be attributed to a reluctance to increase public debt and loan stigma.

When will the spending take place?

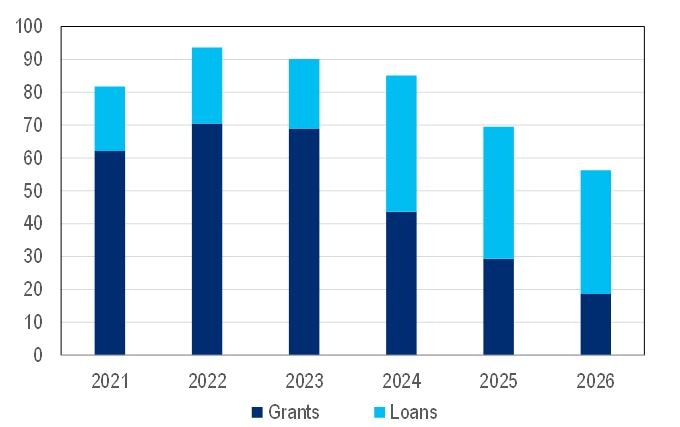

Grants to be paid first with loans following on. The team point to the plans being quite ‘front-loaded’ (2022-23) but they also caution that there could be delays to the start of payments this year.

EU: Estimated RRF Grants and Loans Payouts (EUR bn)

Sources: Citi Research, National Recovery Plans

Which sectors benefit most?

For most countries emphasis is on the Transport, IT and Construction sectors, with particular attention to environmental improvements. There is also focus on healthcare and education, through which the team see ‘the public sector’s role in the economy grow larger.’

What are the conditions?

The team identify two sets of conditions which the recipient states must fulfil. Firstly, they must actually spend the money on the projects agreed and secondly, the agreed reform agenda is adhered to. The reforms can fall into many categories such as labour market, tax system simplification and regulatory. Given the conditions the team conclude that the ‘Draw-down plans of EU funds should really be considered as maximum amounts available rather than base case transfers.’

Clearly this is a great opportunity for the EU to improve integration, but is not without obstacles to success.

For more information on this subject, please see European Economics: National Recovery Plans Unveiled

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.