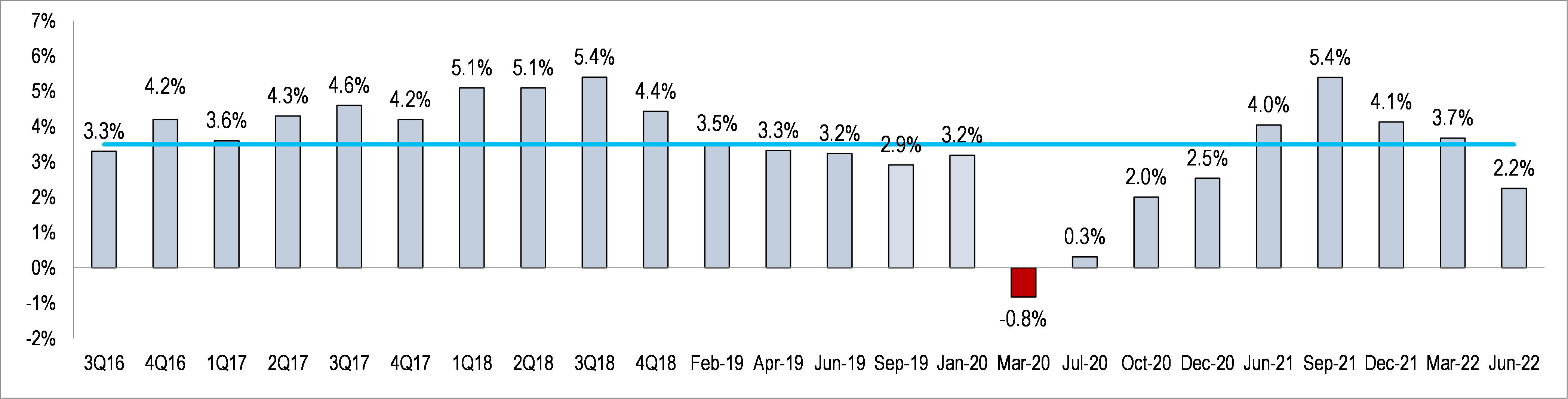

A Next Twelve Months (NTM) IT budget growth expectation of +2.2% compares to 3.7% in Mar. 2022, 5.4% in Sept. 2021 (the recent peak) and the historical average at 3.5% on tougher compares.

EMEA growth expectations saw a ~200 bps deceleration over the quarter.

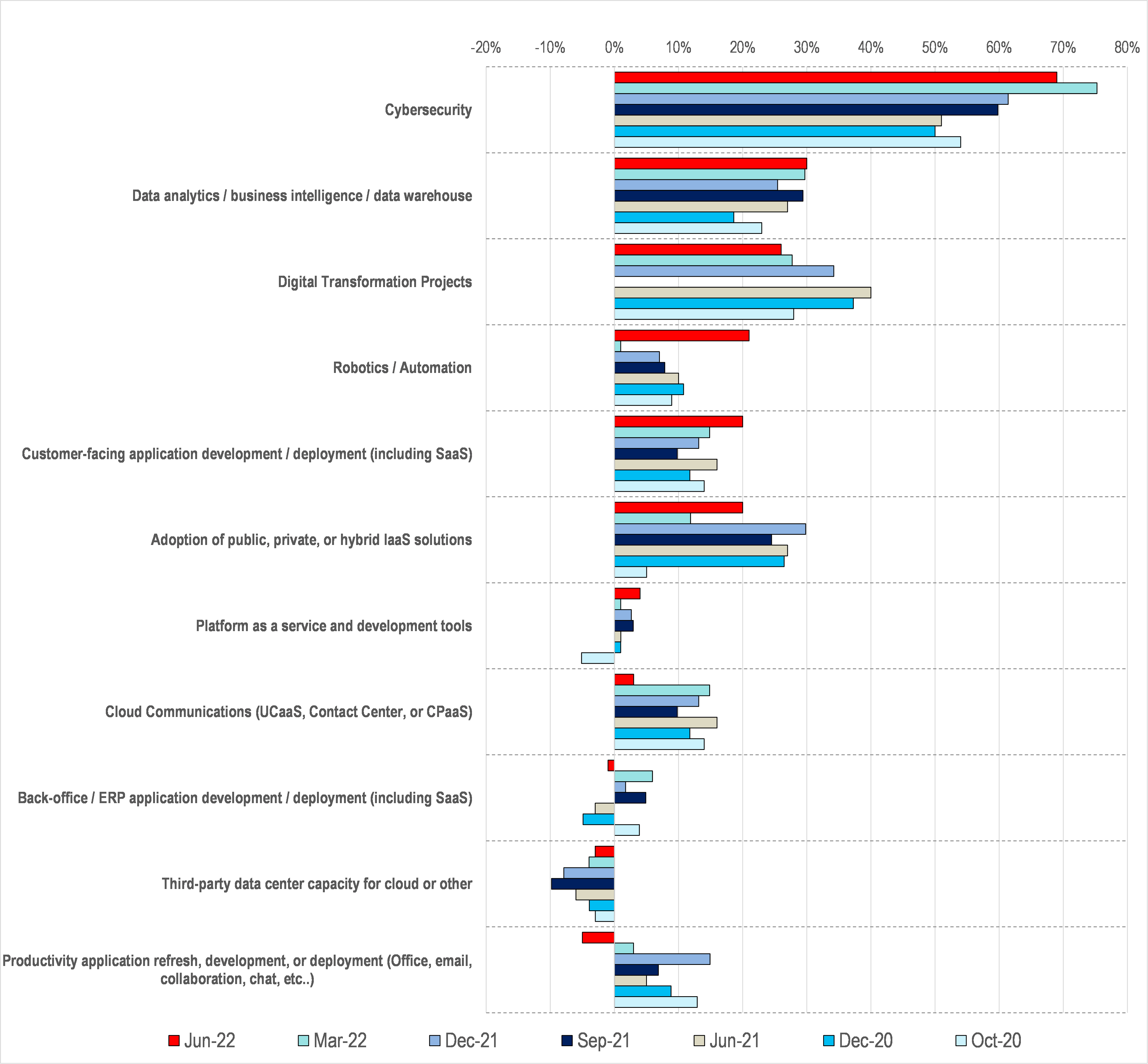

Security remained the #1 spending priority while data/analytics and digital transformation remained amongst the top initiatives.

Global IT budget growth expectation of +2.2% Y/Y, down from +3.7% in the Mar. survey

By how much do you expect your current IT budget to change over the next 12 months?

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

IT budget growth expectations fall below Dec-20 levels — CIOs expect to grow their IT budget by +2.2% over the next 12 months. The budget growth expectation is below the historical average, down from a recent high of +5.4% in the Sept. 2021 survey and +3.4% in the Mar. 2022.

Cybersecurity remains the highest CIO priority by a wide margin. Data / analytics continued to be a top two priority and saw consistent levels of prioritization vs. March. Meanwhile, digital transformation did see a modest tick down in prioritization but remained the third highest priority, with investments in customer facing apps (front office) seeing an uptick vs. last Q.

Top CIO Investment Priorities |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Net result of responses to the following two questions: Since the beginning of the year, which three initiatives have become a higher investment priority? Since the beginning of the year, which three initiatives have become a lower investment priority? |

|

Source: Citi Research |

Sector specific impacts — In software, analysts view the deceleration in spending as aligning with the view that 2H volatility is likely to continue.

Stable to positive intentions on cloud + consumption-software platforms – Public cloud spending intentions are expected to accelerate slightly over NTM vs. Last Twelve Months (LTM). Additionally, new to this survey was a clearer picture on budget patterns for consumption-based software solutions. More than 80% of respondents indicated their spending is tracking consistent with, to better than last year.

This feedback stands in contrast to pervasive investor concerns on the durability of these business models, especially when taken together with cloud spending intentions.

Network and cloud security continue to be top of mind, with more than 40% of respondents citing each as a top 3 investment priority.

EU Tech — For EU Tech, the survey suggests a continued deceleration in growth expectation within the European CIOs with a ~200bps moderation in the NTM IT budget growth expectations (vs. March quarter).

The softening macroeconomic backdrop is evident in ~70% of respondents (from Europe) stating the global economic condition has worsened over the past three months (vs. ~45% in the March quarter survey). However, despite the sharp decline in IT budget growth expectation, respondents (from Europe) NTM IT budget growth expectation is only moderately below the LTM period, and <20% of European CIOs cited decrease in their IT budget over the past 3 month period. Analysts say this is due to the current transitionary phase where CIOs are weighing shifting investment focus from growth to cost.

IT Hardware & Telecom Equipment — The downshift in spending intentions for PCs in the survey is notable. Citi analysts model -9% in 2022 and flat in 2023 following +14% growth in 2020 and +15% growth in 2021.

Cable, Satellite, & Telecom Services — Digital transformation initiatives remain a top priority and are likely to support favorable enterprise demand for software-based communication services, outsourced IT solutions, and further optimization of IT infrastructure. Analysts, while recognizing a rising level of fragility to the global economic outlook, remained encouraged by the majority of respondents indicating an interest in at least maintaining or increasing their IT budgets.

IT Services — Although IT Services companies have not indicated that they are seeing the slowdown in IT budgets indicated by the wider survey, analysts note that IT Services tend to be a lagging indicator of slowed budgets as it takes time for corporates to adapt and adjust their IT Services spend.

In past downturns the revenue impact for IT Services vendors lagged the slowdown with the greatest impact toward the end of the official recessions.

For more information on this subject, please see Global Technology: Citi CIO Survey: Further moderation in spend may suggest incremental estimate risk.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.