Corporate Mindset on Reopening

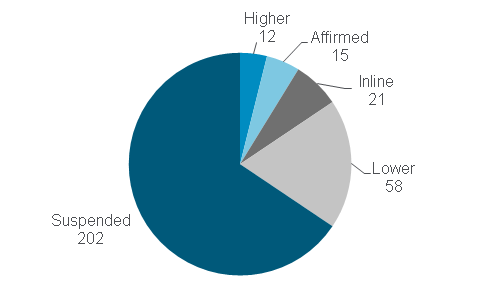

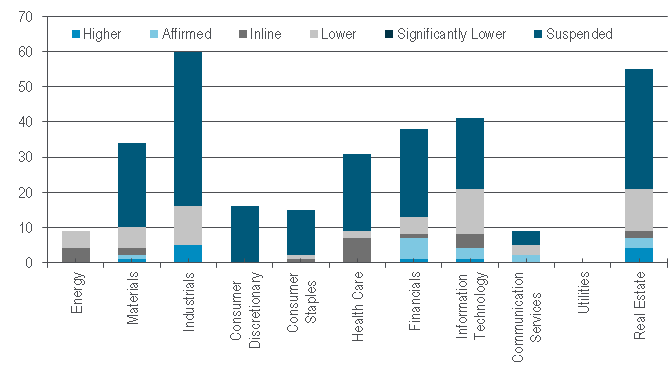

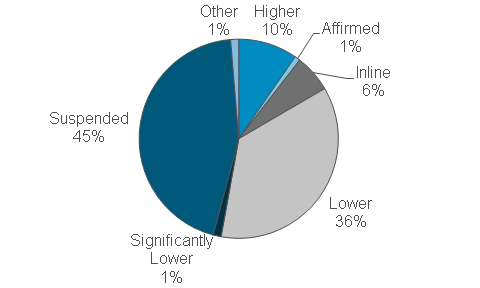

Commentary gathered from first quarter 2020 management calls showed an unwillingness to make bold statements to the Street. Roughly two-thirds of the almost 310 companies who discussed full-year guidance suspended forecasts, with about 20% lowering outlooks. Roughly 100 (of near 230) pulled their second quarter 2020 projections while 80 cut them and a mere 20 firms lifted their quarterly earnings views.

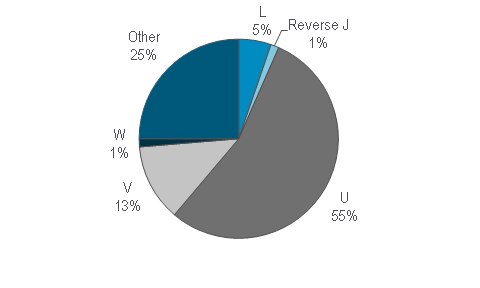

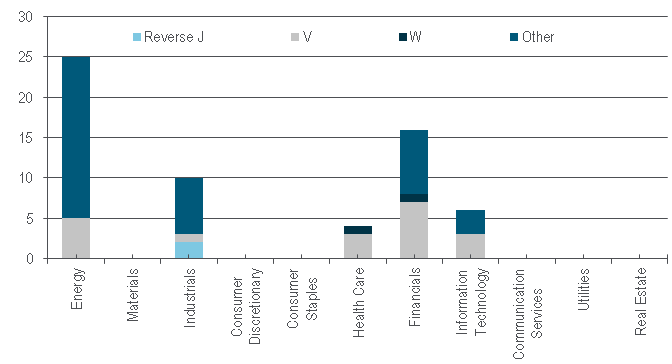

In reviewing timing and shape of recovery, more than half of companies perceived a U-shaped trend with almost 325 corporates providing no timeline. Only 10%+ saw a V-shaped rebound emerging and an almost equal number (less than 35 each) thought that recovery would occur in the third quarter of 2020 or in the third quarter of 2021 and beyond. The lack of confidence was clear from the data, in our opinion, reflecting the unique nature of the health crisis which appears to be determining potential business developments and the various unknowns related to it (vaccines, treatments, second waves, global impact, etc.).

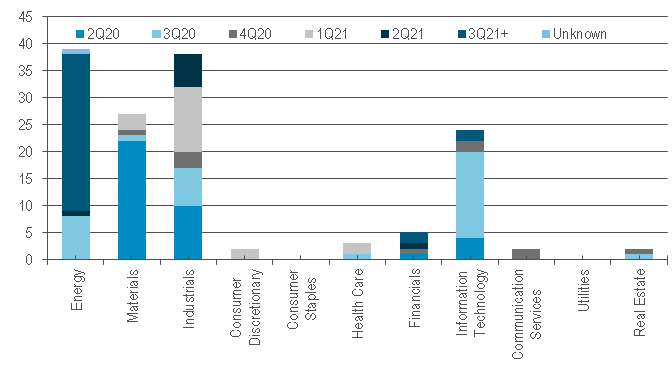

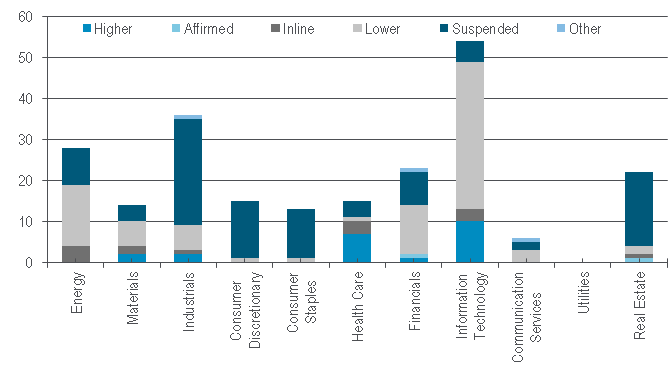

There was a clear cyclical company aspect to pulling their 2020 guidance, with 44 of 60 Industrials management teams doing so and the same could be seen at 24 of the 34 Materials companies. While 11 Industrials names lowered full-year earnings predictions as well, five surprisingly raised them as did four Real Estate firms. In this context, 83 of the 152 entities that foresaw a U-shaped GDP pattern were also comprised of Energy, Materials and Industrials companies.

Note that 20 of 41 IT firms, 25 of 38 Financials names and 22 of 31 Health Care managements also suspended their annual outlooks, indicating that the uncertainty goes beyond just economically-sensitive businesses. Notably, only one technology upgrade occurred on full-year forecasts and no Health Care names upped projections, while 13 and 2 lowered estimates, respectively. Amongst REITs, 34 of 55 suspended and 12 cut expectations.

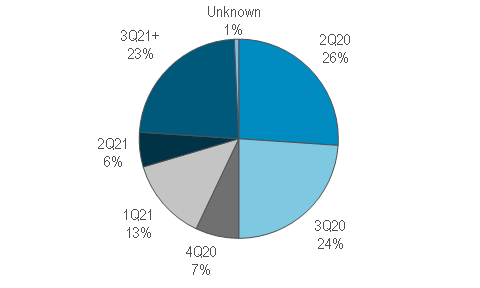

We did find it fascinating that even 13 of the 15 Consumer Staples companies also pulled full-year forecasts in comparison to the arguably more cyclical Consumer Discretionary sector which saw the same thing happen for 16 of 16 names that commented on it. Hence, the impact of the coronavirus has been felt quite broadly across the universe of investable ideas. Also, in terms of timing for recovery, Energy dominated the third quarter 2021+ schedule while the Materials and Industrials sectors were the heavyweights in second quarter 2020 turning point views.

Shape of the Economic Recovery?

Timing of the Recovery?

Guidance for Next Quarter?

Guidance for Full Year?