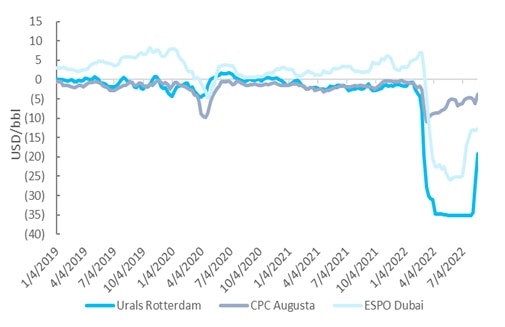

The outlook for Russian crude oil and condensates production remains uncertain. With exports resilient, Citi analysts see a turning point with a possible inability to sustain a steep discount for the longer term. With the looming EU embargo in Dec’22 for crude oil and in Feb’23 for refined products, a decline in Russian oil output could be more evident by year-end, with Russian oil producers trying to maximize profits westward while retaining market share eastward.

Despite financial and logistical restrictions implemented by the US, UK, Canada, and Australia, or restrictions set to take place in the next six months (the EU), Russian oil production has been rising since March-April.

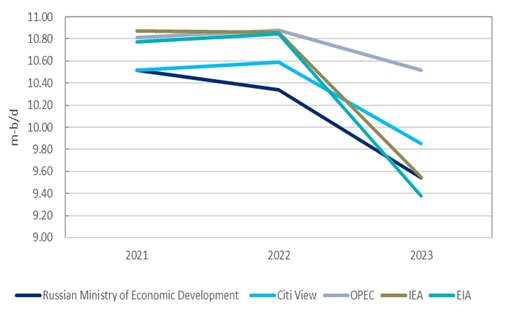

Russia’s Ministry of Economic Development recently provided its latest long-term outlook for the country’s oil and condensate production, sharply revising upward its expectations compared to its Apr'22 report. These official projections tend to be on the conservative side.

|

Russian oil production outlook |

Urals, CPC and ESPO differentials |

|

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, EIA, IEA, OPEC, Russian Ministry of Economic Development |

Source: Citi Research, Bloomberg |

Citi analysts note that smaller oil producers in Russia lack resources and are not able to compete with the country’s larger producers by offering equivalent steep discounts and covering higher costs of shipping and insurance.

Export flows have also been quite volatile, with multiple turns during 2022. In the last six months, energy companies in Russia have been working on diverting their flows from European and the US/UK markets to other parts of the world.

In Jul’22-Aug’22 Russian seaborne exports to Italy, Bulgaria and Turkey rose, as Russian companies directed flows to their own refineries in those countries. Lack of any coordinated response to the EU sanctions policy (each member country decides its own level of criminal, administrative, or financial liability) could provide a loophole for Russian products to continue to flow in some form.

According to Platts, Russian fuel flows directed to Fujairah increased, with the eastern port now a key supplier of fuel oil to the US and the EU. And Saudi Arabia has been snapping up cheap Russian fuel oil for power burn in order to re-market its own crude oil and increase exports.

Since Mar’22 it’s become apparent that Russia can divert its flows to China and India en masse, with the main variable being the price at which it is willing to sell its supplies.

Brazil is looking to start buying Russian diesel in the second half of the year. Afghanistan is offering a barter trade for ~25-k b/d for Russian products (gasoline and diesel) in return for raisins, raw material for medicines and minerals.

|

Russian seaborne oil exports to the world |

Only a few countries in the EU are accepting Russian supplies |

|

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, TankerTrackers.com |

Source: Citi Research, TankerTrackers.com |

Russia continues to play a pivotal role within OPEC+ and likely its cooperation will be extended after 2022. However, Russia has been lagging on its agreed quotas of raising oil production by 26-k b/d and underperforming now by over ~1-m b/d.

G7 members are trying to orchestrate ways to cut Russia’s oil revenues, while keeping the oil flowing in order to deprive Russia of its energy revenues and make it back down on its military efforts, as Citi noted previously. The idea is to impose a maximum official selling price for Russian oil, which would be enforced either via punitive tariffs on crude oil and petroleum product imports from Russia or via shipping insurance. Citi analysts have already expressed scepticism that such a price cap can be imposed rigorously even if the G7 are apparently striving to get it done. The US could enforce secondary sanctions, limiting Russian revenues by pushing supply off the market, though this could have detrimental consequences. Meanwhile. granting waivers to China and India to tame the impact would de facto nullify the intent of the secondary sanctions.

For more information on this subject, please see Energy Weekly - Russian oil at a crossroads with steady exports for now, but a looming EU embargo pointing to output erosion, not a collapse

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.