Supply chain disruption: eight actions for mid-sized companies

- Disruptions prompted by the pandemic and geopolitical tensions have created a shift in buyer/supplier relationships.

- Companies need to develop relationships with new buyers and suppliers as part of a more sophisticated approach to risk management.

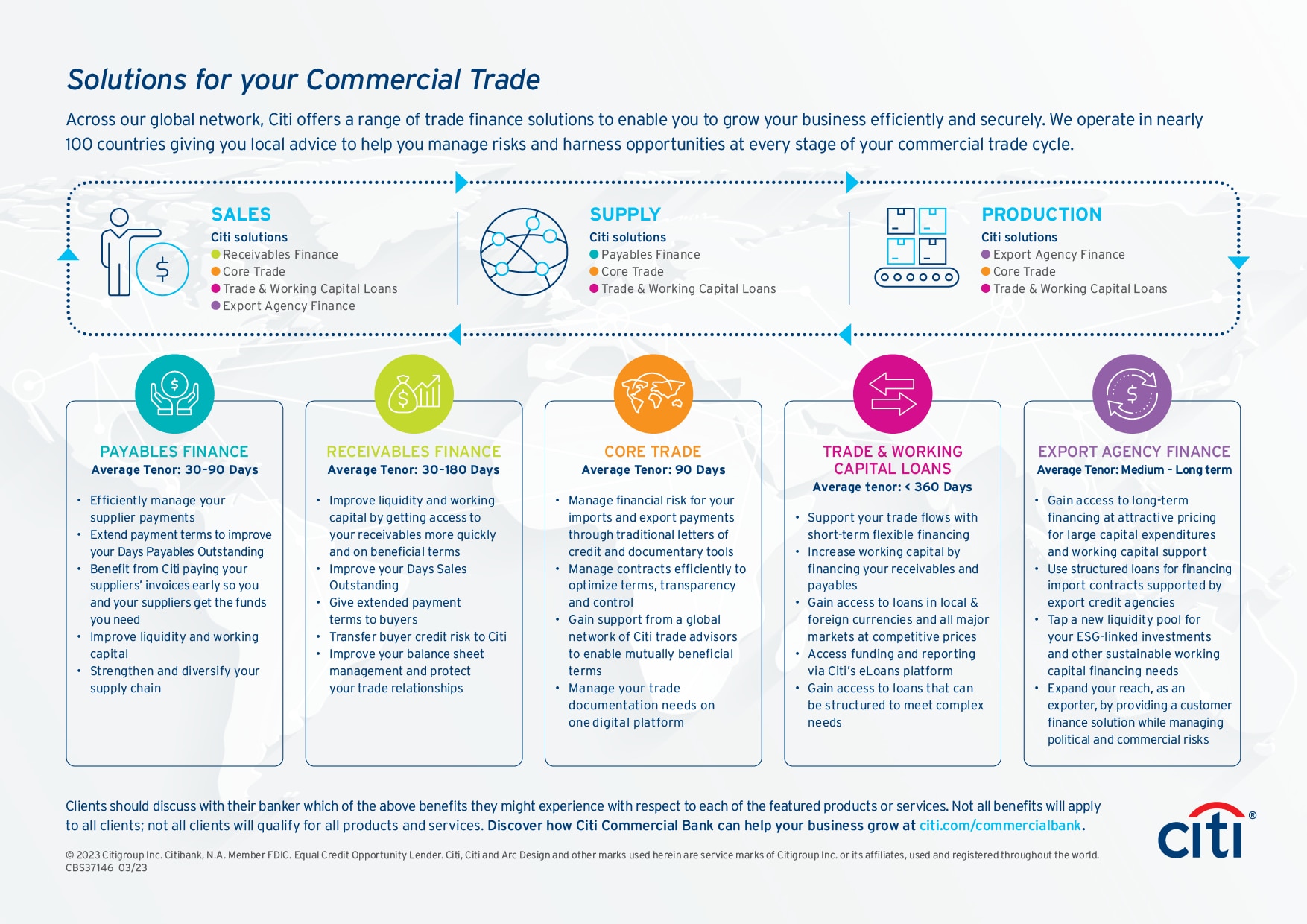

- Investment in skills and technology is required, as well as a reassessment of how trade is conducted (letters of credit may become more important, for instance) and consideration of supply chain finance and account receivables programs.

For mid-sized companies growing internationally, the last few years have been turbulent. Disruption caused by the pandemic and geopolitical tensions have highlighted the vulnerability of trade flows. Companies are also having to contend with higher inflation, rising interest rates, a liquidity squeeze (in some markets), and increasing FX volatility.

Against this uncertain backdrop, mid-cap companies are having to retool their businesses. Relationships with buyers and suppliers, including payment terms and methods, are changing. To succeed, companies should consider the following actions.

1. Broaden your buyer base and consider “near-shoring”

In the past, many companies have been dependent on one or two large buyers. But the pandemic and geopolitical tensions may have weakened relationships. As part of a recent Citi GPS Supply Chain Finance report, Citi Research recently surveyed 1,169 companies that participate as suppliers in Citi-managed supply chain finance programs. We will share highlights in this article.

Suppliers need to broaden the range of buyers they work with. Selling to additional buyers, in a wider range of geographies, can lessen risk and improve resilience. For companies in some sectors, it might even be possible to enter the business to consumer (B2C) market by using online marketplaces.

Suppliers also need to be aware of the trend towards “near-shoring” supply chains to avoid long distance logistical disruption. It is yet to be seen if “near-shoring” will change production patterns, but it is understandable companies across many sectors are considering this.

50% of companies surveyed with revenues over $20m had difficulty shipping goods to customers.*

45% of companies surveyed with revenues over $20 million had difficulty forecasting and planning for customer demand.*

2. Diversify your supply chain

While mid-cap companies are suppliers to larger corporates, many also have complex supply chains of their own. For instance, contract manufacturers depend on suppliers for key components or raw materials. In Citi’s supplier survey, more than a fifth of respondents have difficulty procuring from downstream suppliers.

Therefore, diversifying suppliers may reduce the impact of disruption caused by one or two suppliers. It’s important to build relationships with suppliers in multiple geographies to mitigate exposure to geopolitical risk and regulatory change. Companies should also assess the potential for insourcing or vertical integration for critical components to reduce risk.

3. Think strategically about payment terms and finance

While diversification of suppliers and buyers is critical, it’s also important to protect existing business relationships. Mid-cap companies should assess and consider implementing preferential payment terms (such as higher pricing or shorter tenors) for major suppliers or suppliers of critical components. Larger companies may be able to establish supply chain finance (SCF) programs as part of such efforts.

However, not all mid-cap companies will have the credit capacity to establish SCF programs. Instead, where possible, companies could seek to join their buyers’ SCF programs. Alternatively, companies should investigate receivables financing solutions, such as insurance-backed, portfolio or bilateral programs. Receivables financing solutions aim to improve liquidity and working capital by enabling you to collect funds more quickly and on mutually beneficial terms. Over 40% of respondents to Citi’s supplier survey are seeking financing earlier in the commercial cycle, such as at the purchase order stage.

23% of companies surveyed with annual revenues less than $20m have an issue with prohibitive financing costs / difficulty accessing financing.*

4. Develop a risk management plan and resource it properly

Diversifying the range of buyers that companies work with is the first step in managing the risks associated with changing buyer behavior. Mid-cap companies should also identify potential risks and develop a plan to mitigate them so they can respond effectively should disruption occur.

One risk is the potential for the credit profile of a buyer to deteriorate. Suppliers should consider building a credit risk management framework to minimize losses and processes to monitor payment patterns. Banks and factoring companies may help mitigate this credit risk to an extent by purchasing the obligations of the buyer and suppliers. This transfers risk at a low cost while optimizing cash flows.

A risk management approach is likely to require investment in people. While the company owner may have established relationships with buyers a while ago, the imperative to diversify buyers and suppliers and the complexity of today’s environment requires risk management specialists.

Similarly, suppliers may benefit by using technology designed to manage risk. Automation and digital payment solutions – provided by banks, FinTech's or other partners – may help companies to monitor disruption in near real time and respond more effectively by raising red flags about late payments from buyers or disruption to critical components.

71% of companies surveyed with annual revenues over $20m have difficulty with increased costs of goods / raw materials.*

5. Expand your network: you don’t have to do everything yourself

Many mid-cap companies have limited human resources and investment budgets. They should consider working with industry associations, multi-lateral associations, chambers of commerce and government organizations such as export agencies when developing a risk management strategy. Often these entities can provide access to technology that helps to better manage risk. Government organizations such as export agencies may help companies to gain access to a wider range of buyer and supplier relationships.

These organizations have programs that support the development of economies by promoting trade in certain goods and services. They are usually backed by the sovereign and can either fund these projects directly or provide guarantees via other financial institutions. Citi works with many of these agencies to help clients.

6. Reconsider how you pay and get paid

As companies begin to work with new buyers and suppliers, it is essential they rethink their payment terms and ways to ensure they match their risk appetite. While most trade remains on open account, the use of trade finance instruments, including documentary collections, letters of credit (LCs), and guarantees or standby letters of credit has surged in recent years as risk has increased through the need of new trading partners. In Asia documentary services remains 85% of bank intermediated trade finance at $7.7 trillion and globally LCs increased 2% from 2018 - 2021**.

7. Think carefully about how you manage your inventory

The changing marketplace means that companies should carefully assess their inventory and segregate it into critical and non-critical categories. More than 50% of respondents to Citi’s supplier survey anticipate ongoing disruption in 2023. Companies may need to be more proactive in their inventory management which could result in stockpiling critical components.

Higher inventory levels tie up working capital. However, banks may be able to leverage critical components or raw materials as additional collateral for asset-based lending or inventory financing to prevent cash flow being drained. At the same time, companies may need to implement “just-in-time” inventory management for non-critical components to lower their working capital requirements.

8. Consider ESG initiatives and strengthen your downstream supply chain

ESG has become a board level agenda item. To be competitive and relevant, mid-cap companies are increasingly thinking about ensuring compliance with disclosure requirements with external benchmarks which make them eligible for various ESG incentives. While this can could require initial investment, the opportunities make it worthwhile – perhaps even essential – for survival. In reference to point 5, there are plenty of multi-lateral agencies that can provide support and incentives here. It is also important to provide incentives for downstream suppliers so the whole ecosystem is sustainable.

Mid-cap companies should consider how their own suppliers could be equally or more exposed to market uncertainty and disruptions. Strengthening the downstream supply chain is as crucial as the upstream. One of the ways which banks like Citi are helping is via the introduction of deep-tier sustainable supply chain finance programs in which downstream suppliers are reviewed for their ESG credentials and provide access to liquidity at preferential rates using the credit of the ultimate buyers.

62% of suppliers surveyed are expanding second-tier supplier networks to increase resiliency.*

We hope these suggestions are useful. Whichever approach you decide to take, ensuring there is a close relationship between you and your buyers and suppliers is crucial.

Contact us today to find out how we can help you with your international trade and support your business growth

*Full survey results in Citi GPS Supply Chain Finance Report

**Source: Citi SWIFT data and ADB. 2022. Toward Inclusive Access to Trade Finance Lessons from THE Trade Finance Gaps, Growth, and Jobs Survey. Manila: ADB. © ADB. https://www.adb.org/sites/default/files/publication/819856/inclusive-access-trade-finance.pdf CC-BY 3.0 IGO.