|

Landlords to the Global Economy |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research |

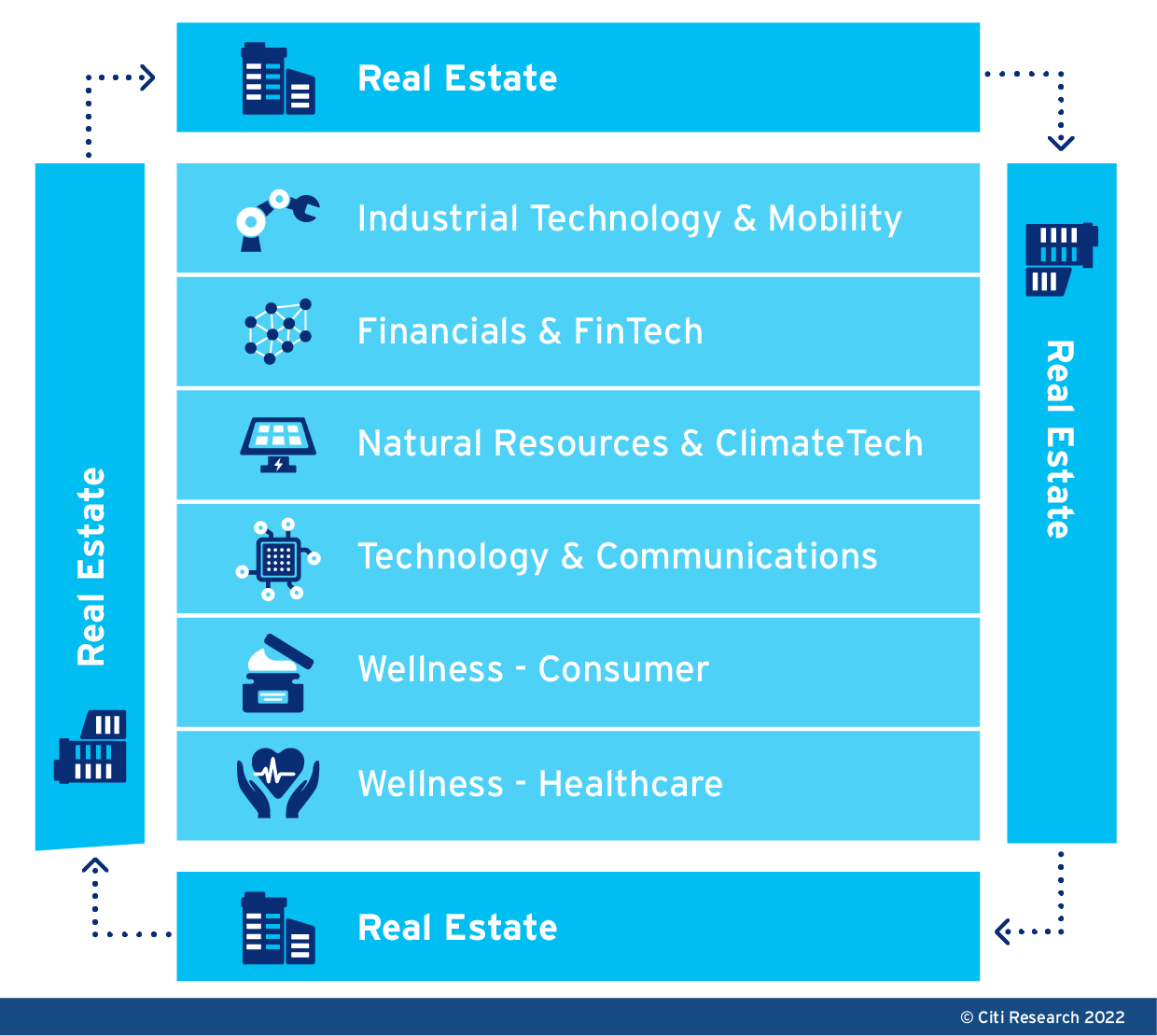

Citi’s report explores six property sector themes in depth. Below is a brief summary of each theme.

-

Work from Anywhere? – The “Office” of the Future

Office utilization and demand have clearly been impacted by the pandemic, although regional differences are quite significant as some geographies have almost fully returned to the office while others continue to stay conservative. Overall, Citi’s global view is that long-term demand for offices will likely be impacted as employee flexibility becomes increasingly important.

|

Pre-COVID and Post-COVID Work Environments Will Shift |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, Kilroy Realty, JLL, CBRE, SkB, Gensler |

-

The New Normal – E-Commerce vs. Brick & Mortar

With e-commerce penetration rising, retailers appear to be increasingly focused on omni-channel strategies. E-commerce as a % of total retail sales spiked during the pandemic as physical retail stores were closed and e-commerce adoption quickly grew, but this has moderated somewhat from peak levels as stores have re-opened and consumers returned for in-person experiences. Brick-and-mortar retailer sales still makes up the large majority of retail sales globally, but e-commerce is expected to continue to gradually take share over time. This also adds logistics pressure to retailers from shipping and fulfilment – and well-located physical retail can help to make last-mile fulfilment more efficient and cost effective for retailers.

-

On the Road Again – Lodging Demand and Recovery

For the lodging industry, the worldwide recovery in Revenue Per Available Room, or RevPAR, remains choppy by region, in large part reflecting how restrictive different governments are regarding COVID policies, including border restrictions and quarantine requirements. While the US looks to be further along the recovery trajectory, common themes include leisure trends while questions remain around the long-term displacement of some business demand due to improved technologies.

|

Travel Activity Relative to Pre-pandemic Levels (Sector Website Visits) |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, Similarweb |

- Staying Healthy – Healthcare Real Estate Post-COVID

Healthcare globally has been disrupted by the COVID-19 pandemic but regional differences are apparent.

In China for example, elderly care represents big opportunities for China property managers as services providers; China and HK developers are still exploring profitable business models for elderly housing despite supportive policies. China property managers continue to benefit from increasing need for home-based elder care, which remains unchanged post COVID-19, as China progresses towards a silver economy. The sector can be broadly classified into three main sub-sectors including elderly and specialist care, acute hospitals, and retirement living.

And in the US, many of the same drivers pre-COVID remain in place (namely positive demographic trends), with some accelerating and some abating. For senior housing, positive demographic trends should benefit demand for the next 20 years.

-

Finding a Home – Themes in Residential

The US residential sector is benefiting from strong demand and a shortage of housing overall. Meanwhile, in Europe governments have been underwriting low mortgage costs and job security. COVID upended the urbanization guarantee, with the future potentially remaining more balanced. The initial exodus away from London in particular has rebalanced and London rental markets in particular have rebounded. In city locations, amenities such as co-working areas or home offices are likely to continue to become standard.

Beam Me Up: The Cloudification and Distribution of the Digital Economy

The data centre industry has continued to benefit from the outsourcing of data to third party providers. Rather than using on-premise facilities, enterprises have increasingly favoured hybrid deployments, distributing their data between the public cloud and owned infrastructure within outsourced data centres (private cloud). Citi expects enterprises to continue to balance deployments between public and private clouds. In addition to balancing their hybrid deployments, analysts expect firms to pursue “edge workloads” as fiber and 5G create greater availability of bandwidth closer to end-users and devices. Early edge monetization will largely focus on enterprise-centric use cases that support an economic business case, which can justify the cost of reducing latency or optimizing data management. While generic consumer streaming video may not economically support the edge deployments, higher-value experiences, such as on-line gambling and AR/VR, could be early consumer applications that may warrant a more robust round-trip connection to user devices.

The full report goes into much more detail on all these areas, including a comprehensive look around different geographies. Here it is in full Global REITs and Lodging - Landlords to the Global Economy: Understanding the Future of Where and How We Live, Work, Shop, and Play, first published on March 3.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.