AUM growth has accelerated in recent years. |

Net flows – PE dominates, post COVID more balanced. |

|

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, Preqin |

Source: Citi Research, Broadridge |

Here’s a run-through of some of the different parts of the private assets continuum.

Private Equity

- PE invests capital in private companies (portfolio companies) across sectors with high growth potential and then helps those companies expand. After several years, the fund either takes the company public or seeks to sell it for a profit. Once this exit occurs, the proceeds are distributed to the fund manager and investors.

- The main categories of private equity funds are Venture Capital, Growth, Buyout, and Special Situations. Private equity funds can also be classified geographically, by sector, or both.

- Venture capital funds invest in very early stage companies or finance business ideas. Growth capital PE focuses on providing financing for more established companies in exchange for equity, helping expand into new markets and improve operations. Buyout PE provides financing for acquiring another company. PE funds also provide financing for special situations, as does private credit.

- Institutional investors can invest directly in private equity (and thus private companies). Private asset ETFs allow smaller investors, or those who value liquidity, to access some of the upside of private markets. Currently, the majority of private asset ETFs are focused on private equity. These ETFs contain the common stock of publically listed private equity companies.

Private equity investment outpaces a basket of small cap and PE ETF proxies. |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, Bloomberg |

Private Credit

- Private Credit, also known as direct lending, is a low liquidity, low transparency market. It is composed of any lending or debt agreement where the lender is a private entity—not a bank—and is issuing loans to a counterparty.

- Assets under management of funds primarily involved in direct lending surged to $412 billion at end-2020—including nearly $150 billion in “dry powder” available to buy additional private debt assets—according to financial-data provider Preqin.

- The private debt market is most easily accessed by institutional investors through unlisted private debt funds. These funds have six main strategies: direct lending, distressed debt, mezzanine lending, private debt fund of funds, special situations, and venture debt.

Real Estate

- Real estate is tangible buildings and land that is often broken into two areas: commercial and residential. It can be accessed as either a direct investment or through a fund. Direct investment simply means purchasing the property.

- General partners invest in a variety of properties from new development to existing properties to raw land. Another option is real estate funds that are similar to REITS, but private. Private real estate fund investment opportunities are limited to accredited investors due to the high amount of capital needed to invest and the lack of regulation around the funds, compared to traditional REITS.

- After a strong recovery from the financial crisis, acquisitions declined due to the pandemic but are climbing once more.

Real estate acquisitions recovering from the pandemic lows |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, RCA Analytics |

Infrastructure

- Investments are typically in equity or debt related to physical assets that provide essential public goods and services, like roads, highways, sewage systems, and energy systems. Recently there has also been a focus on sustainability assets like electric vehicles, renewable energy, and water conservation infrastructure.

An investment in private infrastructure equity or debt can provide stable and competitive returns as part of a larger portfolio of private assets. Private infrastructure can also be used for long-term inflation protection, as the contracts are frequently indexed to price levels.

AUM for private infrastructure funds has steadily grown… |

. …and the industry continues to expand |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

Source: Citi Research, Preqin |

Source: Citi Research, Preqin |

Natural Resources and Real Assets

- These are assets that are mined or collected in a raw form. For example, water, forests, mining and metals, energy, and agriculture are all included in this category. Natural resource private investment in lower risk/return situations is closely aligned with infrastructure, while more exploration focused natural resource investment is closer to private equity. Investment is typically through unlisted funds or direct investment—purchasing the natural resource in physical form.

The Benefits of Private Asset Investment

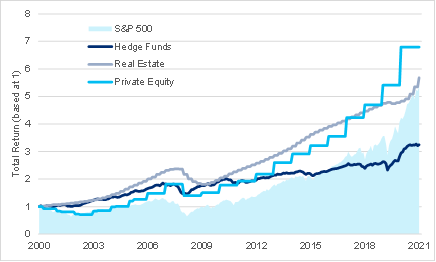

- Alternative asset returns can be attractive, though illiquidity and infrequent pricing can flatter by reducing reported volatility. The next chart shows the total returns for broad private assets vs the S&P and hedge funds.

Alternative Asset Returns vs S&P 500 since 2000 |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, Preqin, Bloomberg |

- Commonly identified benefits of private markets are high returns, close relationships between investor and investment company, and diversification.

- Private assets, by definition, do not trade on exchanges and are therefore subject to infrequent appraisals—usually quarterly. This can lead to a smoother and more lagged, return stream.

- Correlations to public markets are high for PE, Private Debt and VC and lower for real estate and infrastructure.

- Private assets generally fall in sympathy with equities, although real estate NAV changes are more subdued. Bonds have been a consistent hedge rallying in times of extreme price weakness. Commodities are sometimes a diversifier too. Private assets consistently provide negative returns during equity drawdowns, although real-estate usually falls by less.

The full report goes into more detail on dispersion of returns and how some private assets can help in an inflationary environment. For more information on this subject, please see Global Asset Allocation Strategy - A Quantitative Primer for Private Assets, published on February 14th.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.