US Infrastructure Upgrade: No Disputing the Need, So Why the Delay and How to Pay?

We summarize the key takeaways from a recent report by Citi's Vikram Rai and the municipal strategy team. In the report, Vikram and team discuss a problem that few Americans would dispute: US infrastructure needs an upgrade. Less clear is why little progress has been made for decades and what is the best way to pay for this much-needed work. We explore these questions, including how to get from a C- grade to a possible solution.

US Infrastructure: Critical and Crumbling

US infrastructure is critical to sustaining the US economy and quality of life, and US infrastructure is crumbling. Most agree that it needs to be upgraded.

The American Society of Civil Engineers assigns an overall grade of C- to America's infrastructure. Justifications for this report card include the following:

- A water main break occurs every two minutes, with an estimated 6 billion gallons of treated water lost each day in the United States – enough to fill over 9,000 swimming pools.

- 43% of US public roadways are deemed to be in poor or mediocre condition.

Cost to Fix

It is widely believed that an investment of $2.0 trillion to $2.5 trillion would be required over the next decade to address US infrastructure issues and improve that C- grade. Given the high estimated price tag, it may not be surprising that little has been done for decades. However, Citi's strategy team contends that the outlay does not need to be anywhere near $2 trillion. The team explains that the cornerstone of US infrastructure financing since the Great Depression has been the US municipal market, and the team argues that a municipal financing tool, Direct Pay bonds, could be used to finance infrastructure projects at a much lower cost. To understand why, we briefly discuss what Direct Pay bonds are and how they work.

Possible Solution: Direct Pay Bonds

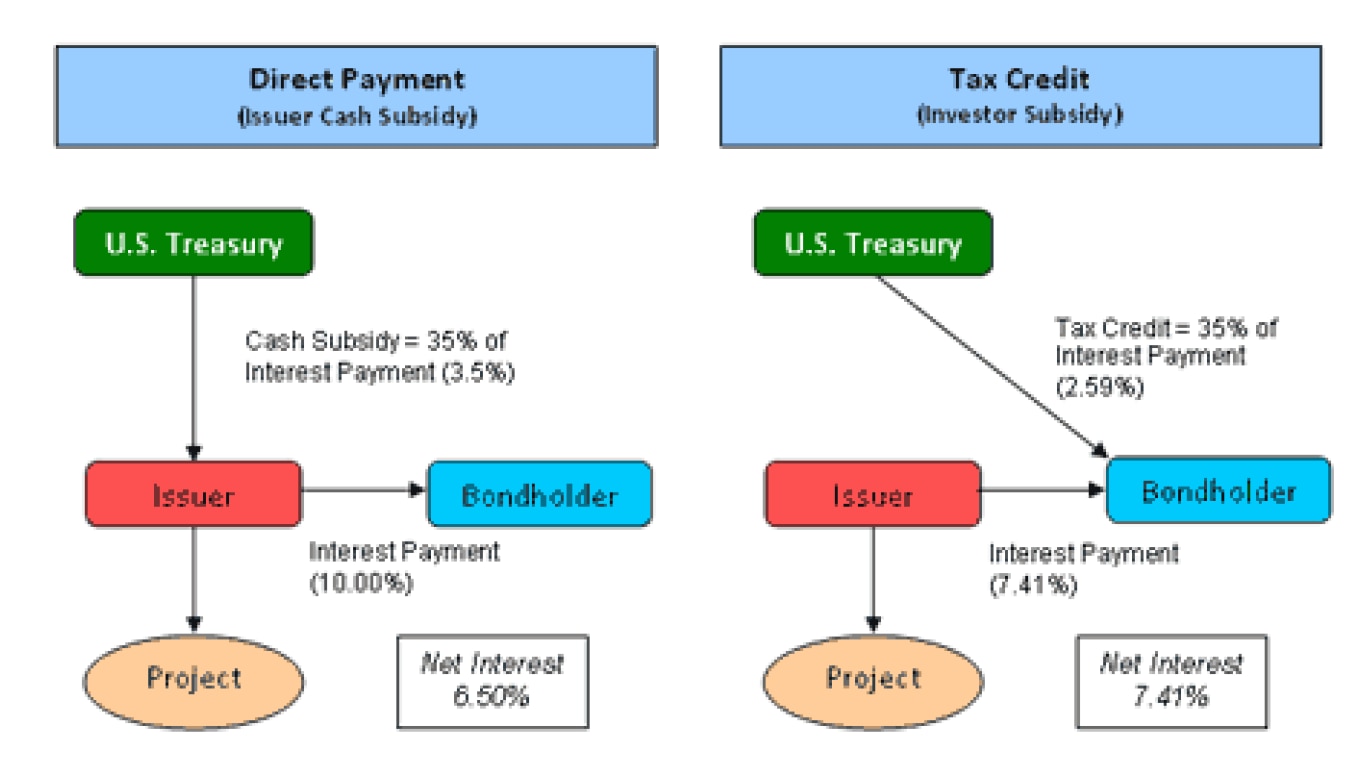

Direct Pay bonds were last used as a part of the Build America Bond (BAB) program, which was created by the American Reinvestment and Recovery Act of 2009. Direct Pay BABs are taxable bonds for which the US Treasury Department pays a direct subsidy to the issuer to offset borrowing costs (Figure 1).

Subsidy is the key word. Here's why: State and local governments would finance the infrastructure projects, not the federal government. The federal government would "just" be responsible for the subsidy. The key assumption is that the projects would be self-sustaining and would generate the revenues to cover the cost. The subsidy would be nominal compared to the $2+ trillion price tag. For example, in their report, Citi's muni strategists show two hypothetical Build America-type Direct Pay bond programs with federal subsidies of 32% and 28%. By virtue of just paying the subsidy, the federal government’s cost for a $1 trillion program with a 32% subsidy could range from $128 billion to $320 billion, depending on coupon rates. And the range would obviously be lower for a 28% subsidy ($112 billion to $280 billion).

Caveat: Federal Government Would Still Have to Pay for the Subsidy

As noted, even if the federal government were to decide to utilize this approach, it would still have to come up with the revenues to pay for the federal subsidy (likely hundreds of billions of dollars). How would it do so, especially amid the pandemic?

Citi's strategists expect that the Biden administration would utilize the Budget Resolution for FY 2022 to address both infrastructure and tax reform. Under the Senate’s Byrd rule, reconciliation bills cannot increase deficits in years beyond the budget window (typically 10 years). That is, the spending must have a revenue offset in year 11 and beyond. Although this would enable the administration to increase deficits during the first 10 years, the purpose of combining infrastructure and tax reform would be to generate the revenues to offset the cost of the infrastructure program. The cost of the federal subsidies for a Direct Pay bond program could be offset by a rollback of some of the Tax Cuts and Jobs Act (TCJA) provisions.

A Catch

As promising as this approach sounds, Direct Pay bonds would not solve all the problems associated with the US infrastructure upgrade program. A key reason is that it is unrealistic to expect that $2.0+ trillion worth infrastructure projects could be greenlit and shovel-ready even if the federal government were willing to subsidize the interest costs of these projects.

A Practical “Combination” Approach

Direct Pay bonds could be utilized to reduce the upfront outlay of an infrastructure program. However, they would not address all the complexities associated with the funding and implementation of such as initiative. Thus, as Vikram Rai and team suggest, a more practical approach to the much-needed US infrastructure upgrade would likely be a combination of grants to state and local governments and innovative financing tools, such as Direct Pay bonds.

| Figure 1. Illustration of Build America Bonds (BABs): Direct Payment vs. Tax Credit Structure with 10% Return |

|---|

|

| Source: DOT. Note: The original subsidy was 35% but was later reduced as a part of sequestration. |

For more information on this subject, please see North America Politics Focus: How shall we pay for U.S. Infrastructure?.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation.It is not investment research. The comments expressed herein are summaries and/or views on selected thematic content from a Citi Research report. For the full CGI disclosure, click here.