Third Quarter 2019 Results and Key Metrics

HIGHLIGHTS

- Net Income of $4.9 Billion ($2.07 per Share)

- Revenues of $18.6 Billion

- Returned $6.3 Billion of Capital to Common Shareholders

- Repurchased 76 Million Common Shares

- Book Value per Share of $81.02

- Tangible Book Value per Share of $69.035

Read the full press release with tables and CEO commentary.

View the Financial Supplement (PDF)

View Financial Supplement (Excel)

New York – Citigroup Inc. today reported net income for the third quarter 2019 of $4.9 billion, or $2.07 per diluted share, on revenues of $18.6 billion. This compared to net income of $4.6 billion, or $1.73 per diluted share, on revenues of $18.4 billion for the third quarter 2018.

Revenues increased 1% from the prior-year period, including a gain on the sale (approximately $250 million) of an asset management business in Mexico in Global Consumer Banking (GCB) in the third quarter 2018. Excluding the gain on sale, revenues increased 2%, reflecting solid performance across both GCB and the Institutional Clients Group (ICG). Net income increased 6% from the prior-year period, driven by a lower effective tax rate and the higher revenues, partially offset by higher expenses and cost of credit. Earnings per share of $2.07 increased 20% from the prior-year period, primarily driven by a 10% reduction in average diluted shares outstanding and the lower effective tax rate. These results include a net benefit of approximately $0.10 per share in the current quarter related to discrete tax items6.

Citi CEO Michael Corbat said, "Despite an unpredictable environment throughout the quarter, we continue to deliver on our strategy of improving shareholder returns through consistent, client-led growth while also executing against our capital plan. Our Global Consumer Banking franchise performed well in the quarter, showing solid underlying revenue growth of 4% and an EBT increase of 17%.

"In the US, Branded Cards increased revenues by 11% and we saw continued deposit momentum through both digital and traditional channels. Our Institutional Clients Group also had balanced performance, with solid results in both the market-sensitive and accrual-type businesses. The backbone of our leading global network, Treasury and Trade Solutions, had strong revenue growth of 7% in constant dollars.

"Consistent with the commitment we made in 2017, we remain on track to return more than $60 billion of capital to our shareholders over a three-year period which ends next year. Buybacks have lowered our common shares outstanding by 259 million shares, or 11%, in the last year alone. When combined with 6% growth in net income, they have also helped drive our Tangible Book Value per share up 12% over the same amount of time," Mr. Corbat concluded.

Percentage comparisons throughout this press release are calculated for the third quarter 2019 versus the third quarter 2018, unless otherwise specified.

Citigroup

Citigroup revenues of $18.6 billion in the third quarter 2019 increased 1%. Excluding the gain on sale, revenues increased 2%, reflecting solid performance across both GCB and ICG, partially offset by Corporate / Other.

Citigroup operating expenses of $10.5 billion in the third quarter 2019 increased 1%, as volume-driven growth and continued investments in the franchise more than offset efficiency savings and the wind-down of legacy assets.

Citigroup cost of credit of $2.1 billion in the third quarter 2019 increased 6%, primarily driven by volume growth and seasoning in Citi-Branded Cards and Citi Retail Services in North America GCB.

Citigroup net income of $4.9 billion in the third quarter 2019 increased 6%, driven by the lower effective tax rate and the higher revenues, partially offset by the higher expenses and the higher cost of credit. Citigroup's effective tax rate was 18% in the current quarter compared to 24% in the third quarter 2018. Excluding the previously mentioned discrete tax items in the quarter, the tax rate would have been approximately 22%.

Citigroup's allowance for loan losses was $12.5 billion at quarter end, or 1.82% of total loans, compared to $12.3 billion, or 1.84% of total loans, at the end of the prior-year period. Total non-accrual assets declined 6% from the prior-year period to $3.8 billion. Consumer non-accrual loans declined 8% to $2.2 billion and corporate non-accrual loans declined 1% to $1.5 billion.

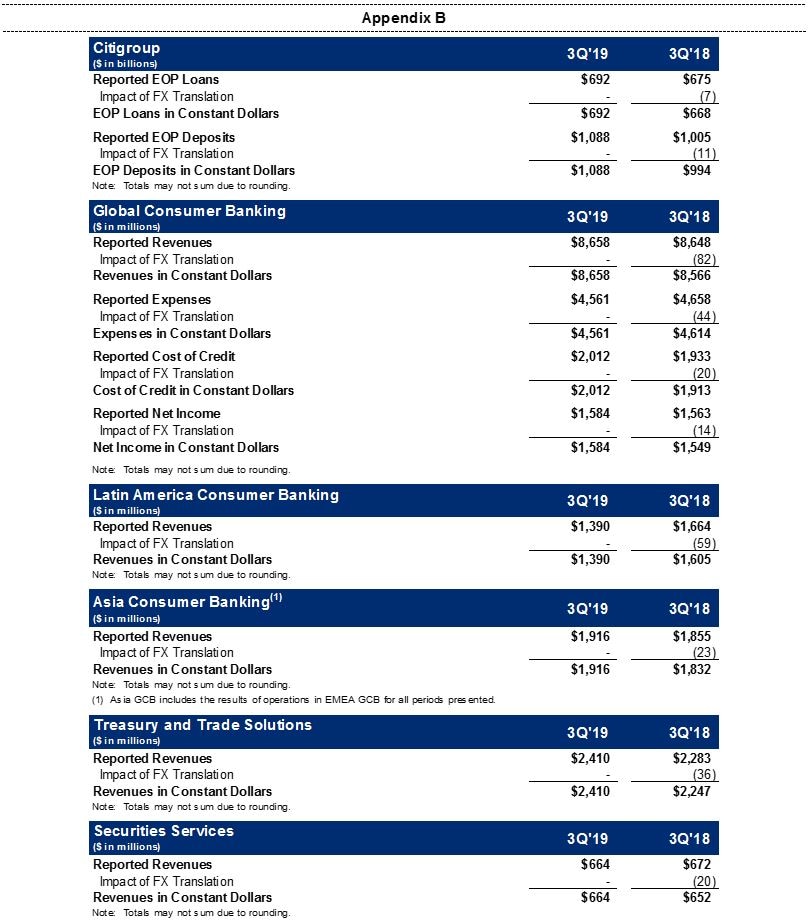

Citigroup's end-of-period loans were $692 billion as of quarter end, up 2% from the prior-year period. Excluding the impact of foreign exchange translation7, Citigroup's end-of-period loans grew 4%, driven by 5% aggregate growth in ICG and GCB, partially offset by the continued wind-down of legacy assets in Corporate / Other.

Citigroup's end-of-period deposits were $1.1 trillion as of quarter end, an increase of 8% from the prior-year period. In constant dollars, Citigroup's end-of-period deposits increased 9%, driven by 11% growth in ICG and 5% growth in GCB.

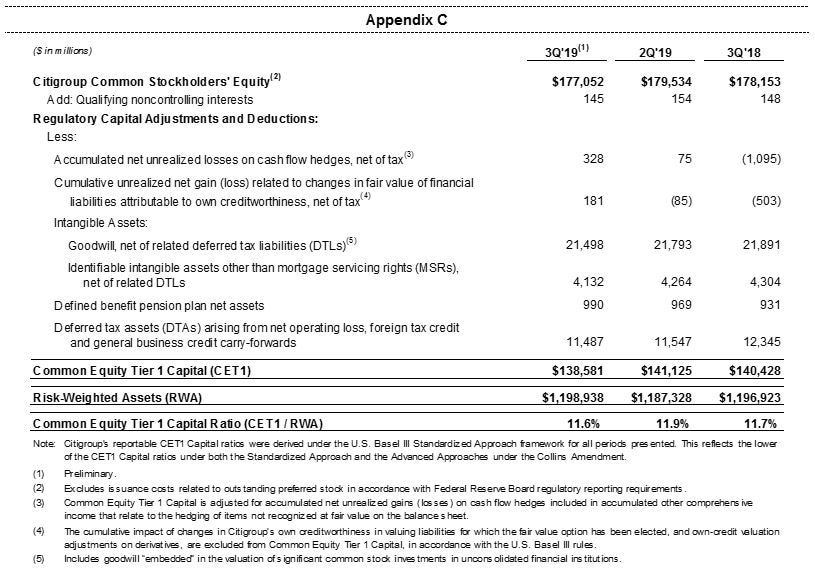

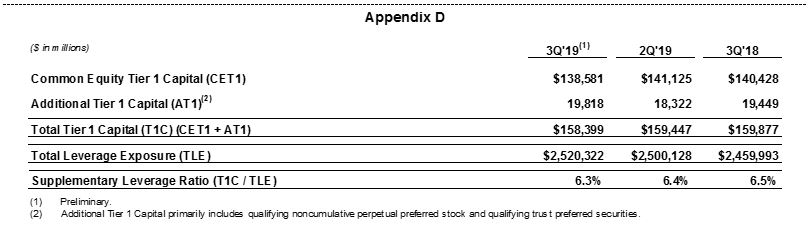

Citigroup's book value per share of $81.02 and tangible book value per share of $69.03, both as of quarter end, increased 11% and 12%, respectively, versus the prior year, driven by higher net income and reduced share count. At quarter end, Citigroup's CET1 Capital ratio was 11.6%, down from the prior quarter, as net income was offset by common share repurchases and dividends, along with an increase in risk-weighted assets. Citigroup's SLR for the third quarter 2019 was 6.3%, a decrease from the prior quarter. During the quarter, Citigroup repurchased 76 million common shares and returned a total of $6.3 billion to common shareholders in the form of common share repurchases and dividends.

Global Consumer Banking

GCB revenues of $8.7 billion remained largely unchanged on a reported basis and increased 4% in constant dollars, excluding the gain on sale in the prior-year period, driven by growth in all regions.

North America GCB revenues of $5.4 billion increased 4%. Retail Banking revenues of $1.3 billion decreased 2%, as the benefit of stronger deposit volumes was more than offset by lower deposit spreads. Citi-Branded Cards revenues of $2.3 billion increased 11%, primarily driven by continued growth in interest-earning balances. Citi Retail Services revenues of $1.7 billion increased 1%, driven by organic loan growth.

Latin America GCB revenues of $1.4 billion decreased 16% on a reported basis and 13% in constant dollars. On this basis, and excluding the gain on sale in the prior period, revenues increased 3%, primarily driven by an increase in cards revenues and improved deposit spreads.

Asia GCB revenues of $1.9 billion increased 3% on a reported basis and 5% in constant dollars, driven by higher deposit and investment revenues.

GCB operating expenses of $4.6 billion decreased 2%. In constant dollars, expenses decreased 1%, as efficiency savings more than offset continued investments in the franchise and volume-driven growth.

GCB cost of credit of $2.0 billion increased 4% on a reported basis and 5% in constant dollars. The increase was driven by higher net credit losses, primarily reflecting volume growth and seasoning in Citi-Branded Cards and Citi Retail Services in North America GCB.

GCB net income of $1.6 billion increased 1% on a reported basis and 2% in constant dollars, driven by the higher revenues and the lower expenses, partially offset by the higher cost of credit.

Institutional Clients Group

ICG revenues of $9.5 billion increased 3%, reflecting continued momentum in Treasury and Trade Solutions and the Private Bank, along with growth in Investment Banking and stability in Fixed Income Markets, partially offset by softness in Equity Markets and Corporate Lending.

Banking revenues of $5.0 billion increased 5% (including gain / (loss) on loan hedges)8. Treasury and Trade Solutions revenues of $2.4 billion increased 6% on a reported basis and 7% in constant dollars, reflecting strong client engagement and growth in transaction volumes, partially offset by spread compression. Investment Banking revenues of $1.2 billion increased 4%, largely reflecting continued strength in debt underwriting and solid results in advisory, particularly in EMEA. Advisory revenues increased 5% to $276 million, equity underwriting revenues decreased 5% to $247 million and debt underwriting revenues increased 7% to $705 million. Private Bank revenues of $867 million increased 2%, driven by higher lending and deposit volumes, as well as higher investment activity, with both new and existing clients, partially offset by spread compression. Corporate Lending revenues of $527 million decreased 6% (excluding gain / (loss) on loan hedges), reflecting lower spreads and higher hedging costs.

Markets and Securities Services revenues of $4.5 billion increased 1%. Fixed Income Markets revenues of $3.2 billion were largely unchanged, with improved activity with both corporate and investor clients, and strength in rates and currencies, particularly in G10 rates. Equity Markets revenues of $760 million decreased 4%, reflecting lower client activity and lower balances in prime finance, partially offset by strong client activity in derivatives. Securities Services revenues of $664 million decreased 1% on a reported basis, but increased 2% in constant dollars, reflecting higher volumes from new and existing clients.

ICG net income of $3.2 billion increased 1%, as the revenue growth was partially offset by higher expenses and cost of credit. ICG operating expenses increased 4% to $5.4 billion, driven primarily by investments, volume growth and higher compensation costs, partially offset by efficiency savings. ICG cost of credit included net credit losses of $89 million, compared to $23 million in the prior-year period, and a net loan loss reserve build of $2 million compared to $48 million in in the prior-year period.

Corporate / Other

Corporate / Other revenues of $402 million decreased 18%, primarily driven by the wind-down of legacy assets.

Corporate / Other expenses of $485 million increased 6%, primarily reflecting higher infrastructure costs, partially offset by the wind-down of legacy assets.

Corporate / Other loss from continuing operations before taxes of $68 million compared to income of $64 million in the prior-year period reflecting the lower revenue and the higher expenses.

Corporate / Other income tax benefit of $255 million compared to income tax of $116 million in the prior-year period, primarily reflecting the benefit of a discrete tax item and a pre-tax loss in the current period.

Citigroup will host a conference call today at 10 a.m. (ET). A live webcast of the presentation, as well as financial results and presentation materials, will be available at https://www.citigroup.com/global/investors. Dial-in numbers for the conference call are as follows: (866) 516-9582 in the U.S. and Canada; (973) 409-9210 outside of the U.S. and Canada. The conference code for both numbers is 9968118.

Additional financial, statistical, and business-related information, as well as business and segment trends, is included in a Quarterly Financial Data Supplement. Both this earnings release and Citigroup's Third Quarter 2019 Quarterly Financial Data Supplement are available on Citigroup's website at www.citigroup.com.

Citi

Citi, the leading global bank, has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. Citi provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management.

Additional information may be found at www.citigroup.com | Twitter: @Citi | YouTube: www.youtube.com/citi | Blog: http://blog.citigroup.com | Facebook: www.facebook.com/citi | LinkedIn: www.linkedin.com/company/citi

Certain statements in this release are "forward-looking statements" within the meaning of the rules and regulations of the U.S. Securities and Exchange Commission (SEC). These statements are based on management's current expectations and are subject to uncertainty and changes in circumstances. These statements are not guarantees of future results or occurrences. Actual results and capital and other financial condition may differ materially from those included in these statements due to a variety of factors, including, among others, the efficacy of Citi's business strategies and execution of those strategies, such as those relating to its key investment, efficiency and capital optimization initiatives, governmental and regulatory actions or approvals, various geopolitical and macroeconomic uncertainties, challenges and conditions, for example, changes in monetary policies and trade policies, and the precautionary statements included in this release and those contained in Citigroup's filings with the SEC, including without limitation the "Risk Factors" section of Citigroup's 2018 Form 10-K. Any forward-looking statements made by or on behalf of Citigroup speak only as to the date they are made, and Citi does not undertake to update forward-looking statements to reflect the impact of circumstances or events that arise after the date the forward-looking statements were made.

Contacts:

Press: Mark Costiglio (212) 559-4114

Investors: Elizabeth Lynn (212) 559-2718

Fixed Income Investors: Thomas Rogers (212) 559-5091

Click here for the complete press release and summary financial information.

1 Citigroup's total expenses divided by total revenues.

2 Preliminary. Citigroup's return on average tangible common equity (RoTCE) is a non-GAAP financial measure. RoTCE represents annualized net income available to common shareholders as a percentage of average tangible common equity (TCE). For the components of the calculation, see Appendix A.

3 Ratios as of September 30, 2019 are preliminary. For the composition of Citigroup's Common Equity Tier 1 (CET1) Capital and ratio, see Appendix C. For the composition of Citigroup's Supplementary Leverage Ratio (SLR), see Appendix D.

4 Citigroup's payout ratio is the sum of common dividends and common share repurchases divided by net income available to common shareholders. For the components of the calculation, see Appendix A.

5 Citigroup's tangible book value per share is a non-GAAP financial measure. For a reconciliation of this measure to reported results, see Appendix E.

6 The discrete tax items include an approximately $180 million benefit of a reduction in Citi's valuation allowance related to its Deferred Tax Assets (DTAs).

7 Results of operations excluding the impact of foreign exchange translation (constant dollar basis) are non-GAAP financial measures. For a reconciliation of these measures to reported results, see Appendix B.

8 Credit derivatives are used to economically hedge a portion of the corporate loan portfolio that includes both accrual loans and loans at fair value. Gains / (losses) on loan hedges includes the mark-to-market on the credit derivatives and the mark-to-market on the loans in the portfolio that are at fair value. The fixed premium costs of these hedges are netted against the corporate lending revenues to reflect the cost of credit protection. Citigroup's results of operations excluding the impact of gains / (losses) on loan hedges are non-GAAP financial measures.