Navigating Global Uncertainty: Perspectives on Supporting the Healthcare Supply Chain

The Working Capital Landscape in Healthcare

Quantum computing and artificial intelligence may shorten drug development time and regulatory approved smart medical devices are likely to foster positive patient outcomes. All this requires significant investment, and supply chain structure considerations. Based on our analysis from S&P’s healthcare industry’s working capital metrics, there are some unique challenges and opportunities treasurers and procurement leaders may have to optimize working capital.

Working Capital in the Pharmaceutical Sector

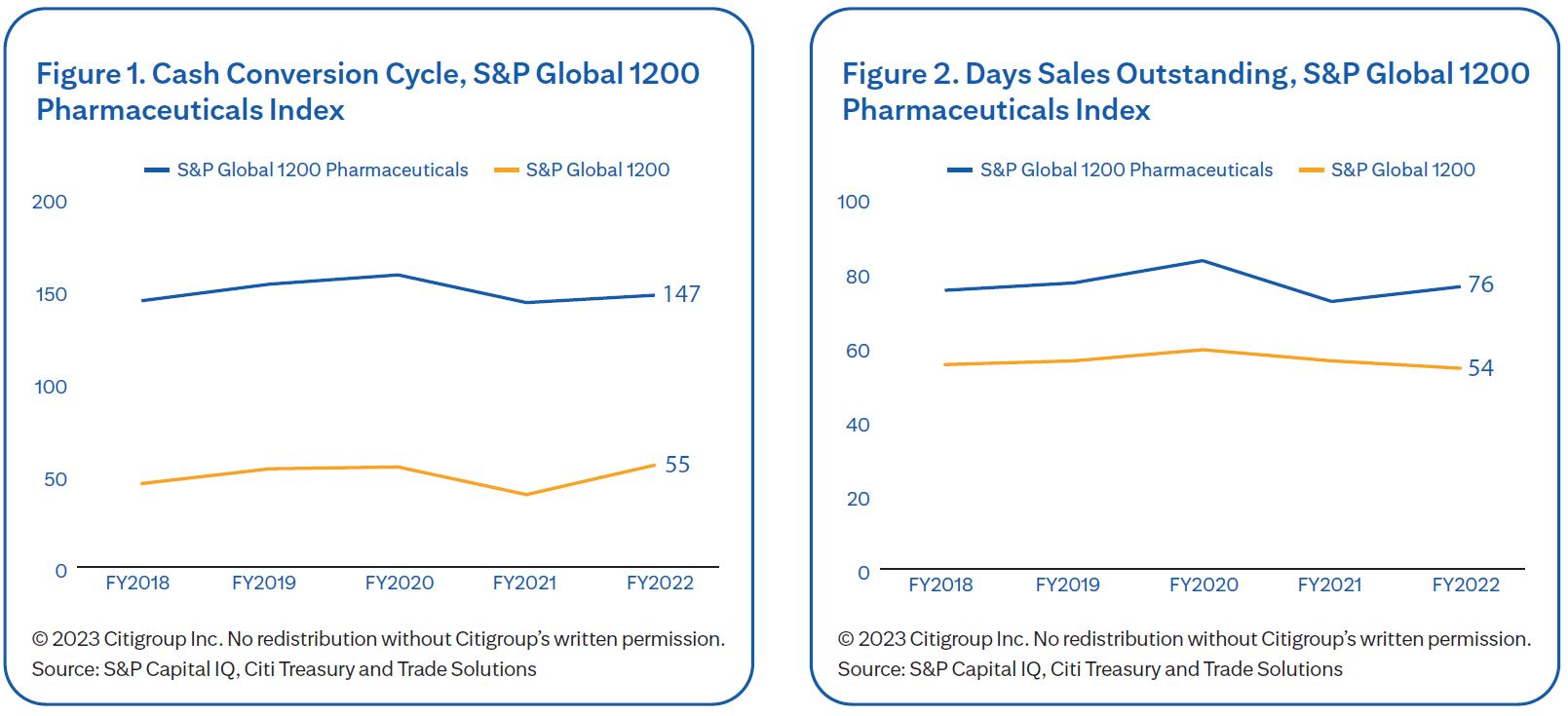

Pharmaceutical industry participants’ cash conversion cycle (CCC), or the time it takes a company to disburse and collect cash, is far longer than that of other industries (see Figure 1). This is due in part to days inventory outstanding (DIO). The industry tends to hold onto larger levels of buffer stock, especially for drugs or products that can be lifesaving. In some cases, pharmaceutical firms may begin building inventory prior to receiving regulatory approval to meet forecasted demand. Also, buyers continue to seek longer payment terms, putting upward pressure on days sales outstanding (DSO). Slightly offsetting increases in DIO and DSO, days payables outstanding (DPO) has improved as pharmaceutical companies have focused on harmonizing payment terms along with industry standards.

One of the world’s largest pharmaceutical firms has focused on optimizing working capital through payment terms harmonization to offset high DIO. Viewing its suppliers as strategic partners, this firm also sought a solution that allowed for its suppliers to benefit from its strong credit rating while helping the firm market itself as a more attractive customer.

To support the need for harmonizing payment terms, a supply chain finance program was the logical choice. For the client, who’s complex buying structure includes over 50 buying entities in over 30 markets, it was imperative that any solution have minimal impact on their payment structure.

To help manage the complexity of the firm’s vast network, Citi offered a supply chain finance solution on Citi’s global platform supporting 30+ markets over 40 currencies. This win-win solution aims to help clients, like this client, with their payment structure and its qualified suppliers gain access to competitive financing.

Working Capital in the Medical Device Sector

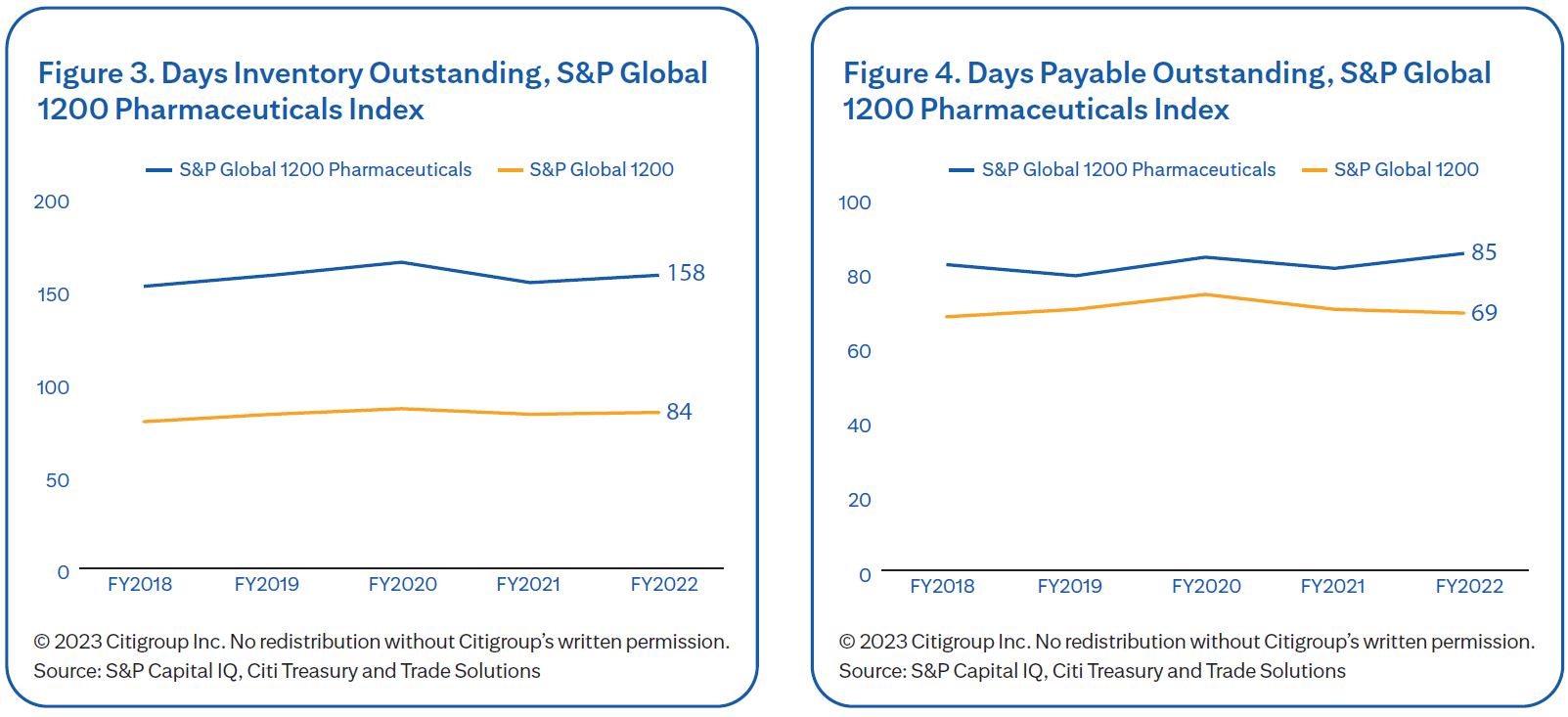

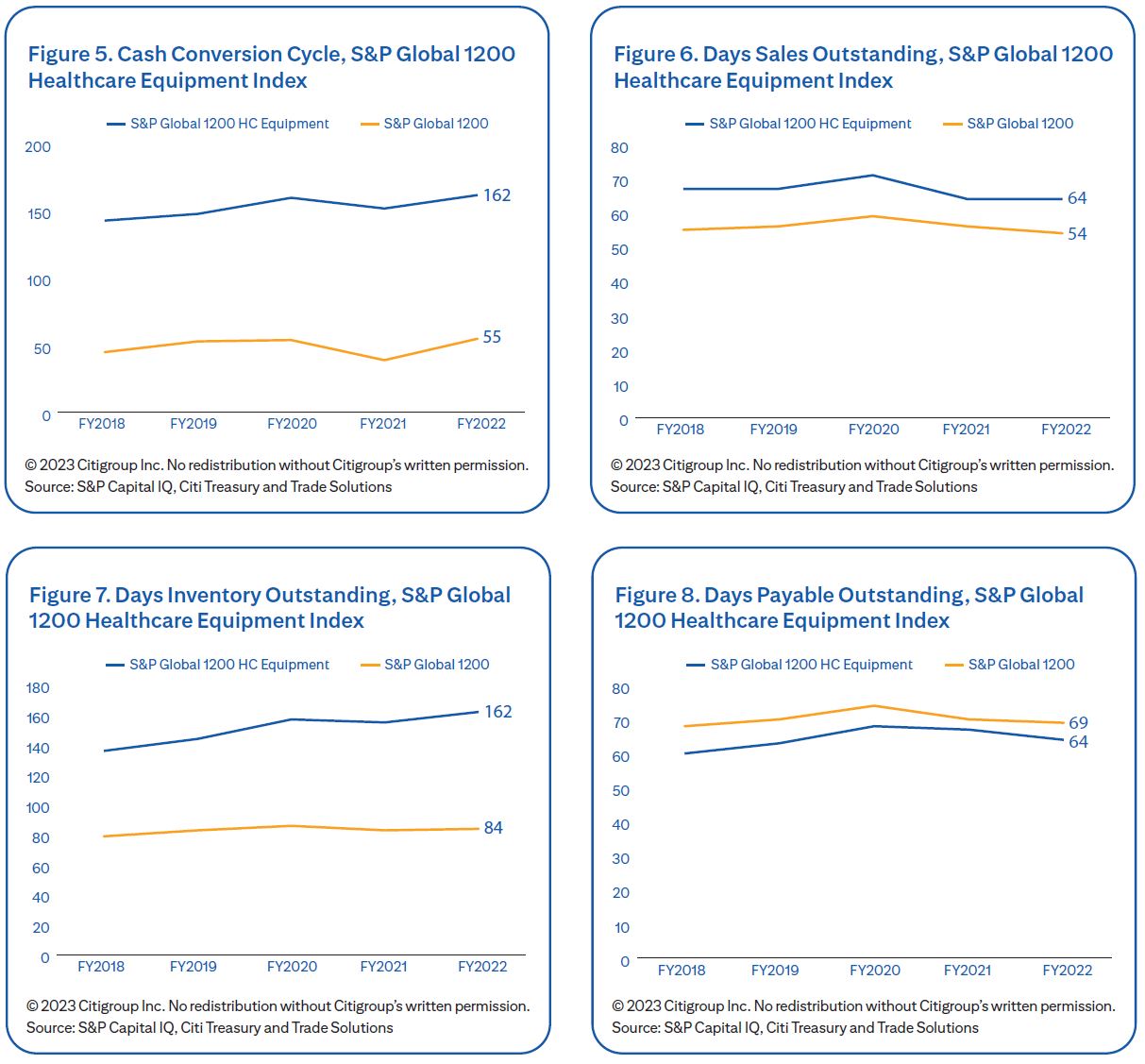

Like Pharmaceuticals, Medical Device firms show high levels of DIO. The medical device industry may use inventory consignment practices, a practice where unused devices sit on a supplier’s balance sheets until they are used. DIO has increased meaningfully in recent years, while DPO and DSO were improved due to focused efforts to manage the CCC. Given the levels of trapped liquidity within healthcare companies CCC, treasurers and procurement leaders have an opportunity to release trapped value and optimize performance.

A global medical device company with a global working capital optimization strategy, initiated a payment term standardization initiative in Asia in order to align terms with industry peers. The company is also focused on cultivating new relationships with local suppliers across Asia capable of supporting each of their manufacturing locations.

The medical device company partnered with Citi for a Supply Chain Finance program providing access to suppliers to monetize their receivables with the bank. The program was rolled out to qualified suppliers across Asia in a systematic manner, seamlessly reaching local currency as well as approved foreign currency suppliers. Many large-volume suppliers were already on the Citi platform, expediting their access to the program. The platform also allows flexibility for change in invoice currency.

A pharmaceutical industry corporate explored solutions to increase liquidity at competitive rates. The client required an accounts receivable finance solution that could meet their multi-seller, multi-currency needs. In total, they needed a solution capable of covering 30+ obligors across five different currencies for six different seller entities. With Citi’s guidance, the client elected to use a Credit Insured Accounts Receivable (CIAR) financing structure.By electing this structure and securing trade credit insurance, the client, efficiently sourced credit-approved funding and add diversification to their funding mix, while also managing risk.

Fueling Growth Strategy with Working Capital

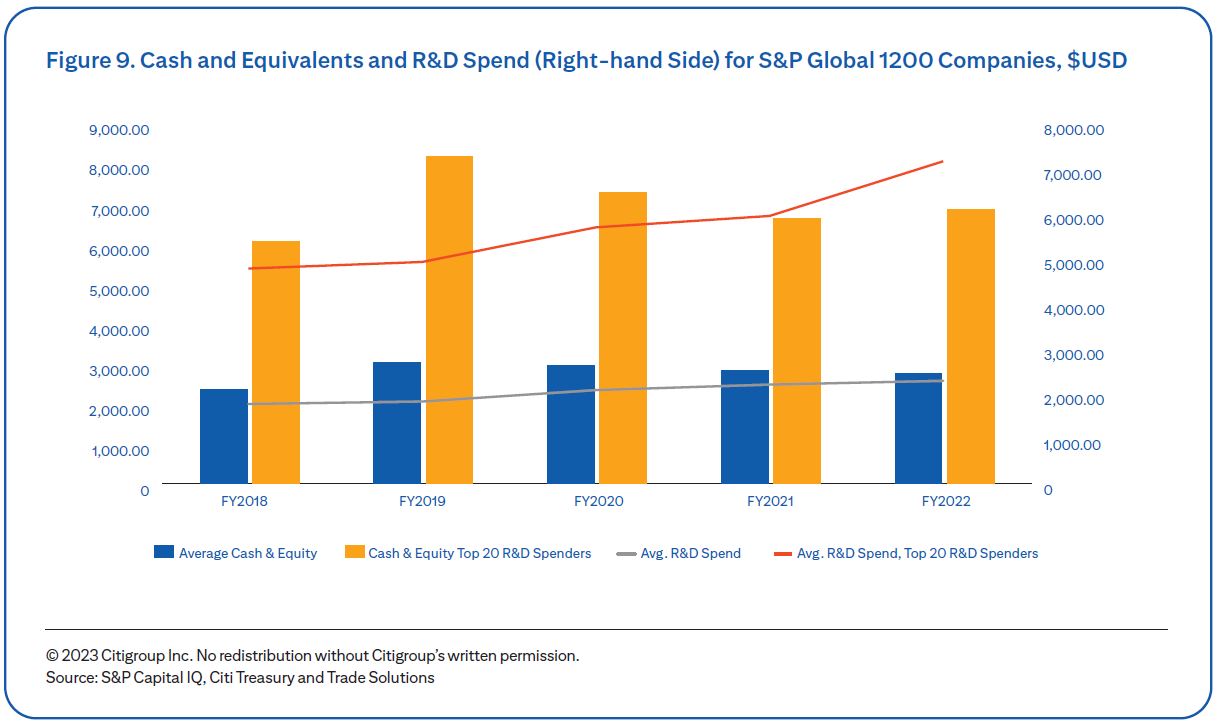

Healthcare companies, including those in the pharmaceutical and medical device sectors, may strategically acquire companies to bolster their long-term stability and jumpstart research and development efforts in a new product. Experts from Citi Research find that more than any other sector, healthcare companies are least likely to target acquisitions in other sectors, meaning that for healthcare companies, when considering an acquisition, their primary focus is on adding capabilities rather than increasing exposure up or down the supply chain.3

Players in the pharmaceutical industry face a looming patent cliff while medical device names are looking to expand their value-add service offerings. Efficient working capital management may increase liquidity available to help fund opportunities when they arise.

Corporates can consider utilizing a trade financing solution to increase their liquidity. Monetizing accounts receivable is one of the types of financing structure available to corporates. The availability of trade credit insurance for credit-approved clients has expanded the use of these structures. These structures may be offered on a single name or on a portfolio of receivables.

Post closure and during the integration phase, organizations will aim to create working capital efficiency by aligning payment terms across venders. Citi’s supply chain finance program will also support qualified suppliers by offering liquidity management services.

Reducing Tension in the Supply Chain

Following the vast supply chain disruptions, corporates will continue to explore supply chain management strategies. Shifting supply chains continues to emerge as a strategy for mitigating supply chain risk. Governments may play a role in redirecting supply chains as structured by export credit agencies in their product offerings.

To contextualize what the global healthcare cross-border supply chain looks like, Citi Global Trade Working Capital Advisory (TWCA) in partnership with Citi Global Data Insights (GDI) examined a range of data sources as proxies to some of the unique attributes of the supply chain. For this analysis TWCA and GDI have examined international shipping data,4 which includes active pharmaceutical ingredients (API) trade data by value and weight, as well as Citi’s own global payments data for both the pharmaceutical and medical device industries. While the resulting analysis is robust, it is important to note that it is limited to the extent which data is available.

Understanding the Pharmaceutical Cross-Border Supply Chain

For pharmaceutical organizations, maintaining a resilient supply chain hinges on their ability to procure the active pharmaceutical ingredients (APIs) that power their therapeutics. The pharmaceutical industry traditionally operated under a contract manufacturing centric business model. The pandemic shed light on the limited options for substitution pharmaceutical organizations may face, and the additional risks associated with having single suppliers. This can include location specific risks such as climate risk, geopolitical risk, and interest rate risk.

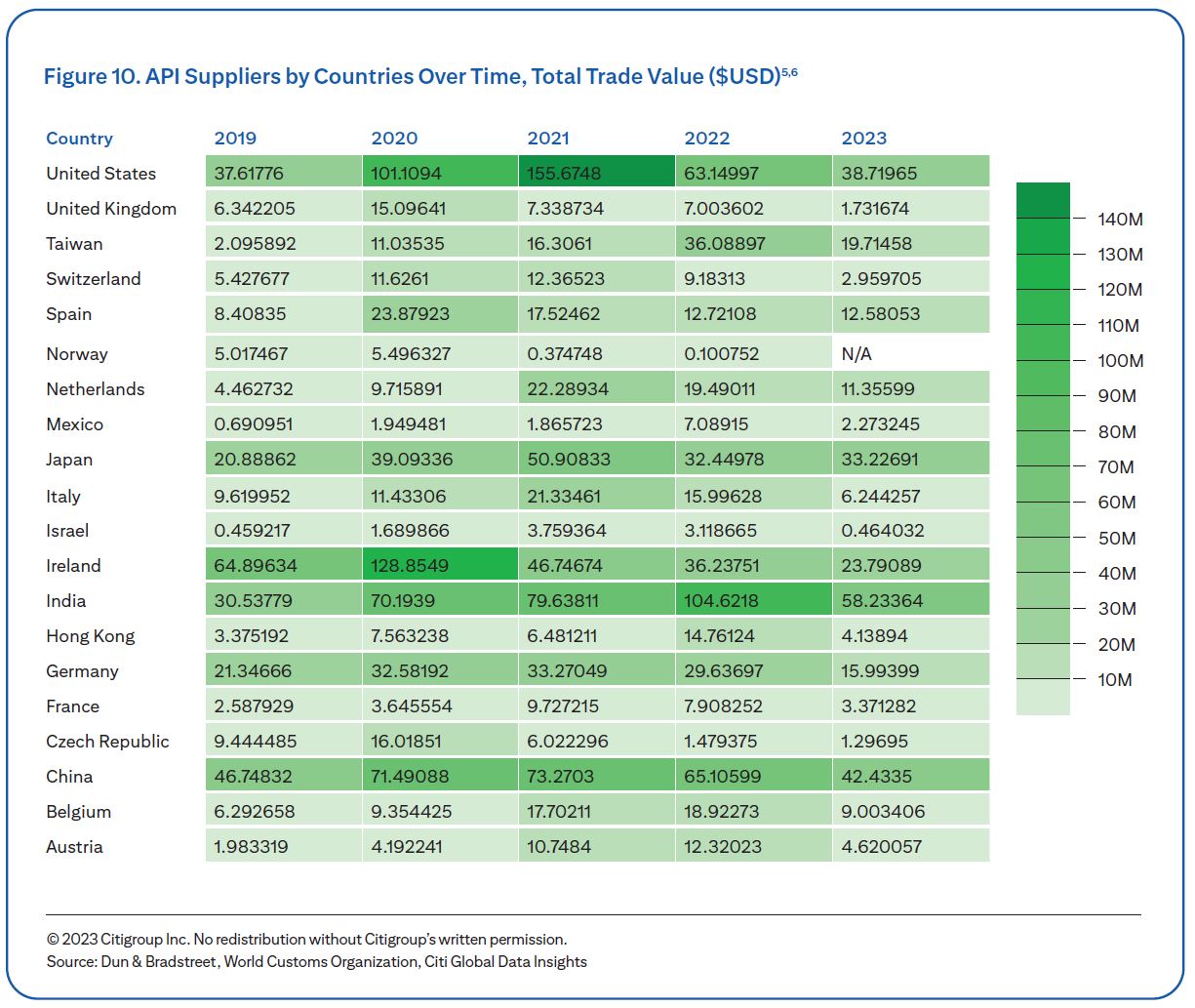

Traditional players in the space emerge as top producers, led by the China, India, Ireland, and the United States. The US appears to peak in 2021, amid the mass roll out of Covid-19 vaccines globally. China’s presence appears mostly consistent. It is worth noting the relative growth of India’s capacity, showing over 30% growth from 2021 to 2022. This comes at a time when many are considering shifting a portion of their supply chains.

When examining the total weight of APIs in Kilos supplied to the pharmaceutical industry by supplier country, familiar countries emerge, including China, India, Ireland, Japan, and the United States. The weight supplied by the US measures nearly 13 times that supplied by India and roughly 22 times that supplied by China. This perhaps could be indicative of the relative scale needed to support the production of Covid-19 vaccine and treatments, especially when considering the extent to which “tolling” or the fashioning of ingredients into a finished product can occur away from the original producing country.

Most large multinationals operate with a complex global network of buyers and suppliers that spans a wide range of countries. To help offset the risk of unknown parties or new markets, parties may request a bank guarantee or letter of credit for an added level of assurance. For instance, local tax authorities required a bank guarantee that Citi issued for a credit-approved global pharmaceutical corporation needing an import license.

In order to satisfy the taxing authority’s pre-license requirement, Citi’s global team, in conjunction with the parties’ due diligence, approved a €500mm bank guarantee in two business days and issued on third. With taxing authority satisfied by the bank guarantee the client was pleased to able to import the critical goods needed without delay.

Understanding the Medical Device Supply Chain

Medical devices like other areas of medicine continues to evolve in ways previously unimaginable. What makes the medical device supply chain particularly unique is the number of materials used by the sector including a vast number of alloys and polymers.7 Also, a key difference in today’s devices from those of yesterday is that many devices now feature connected capabilities, exposing products to the dynamics of an evolving semiconductor industry.8

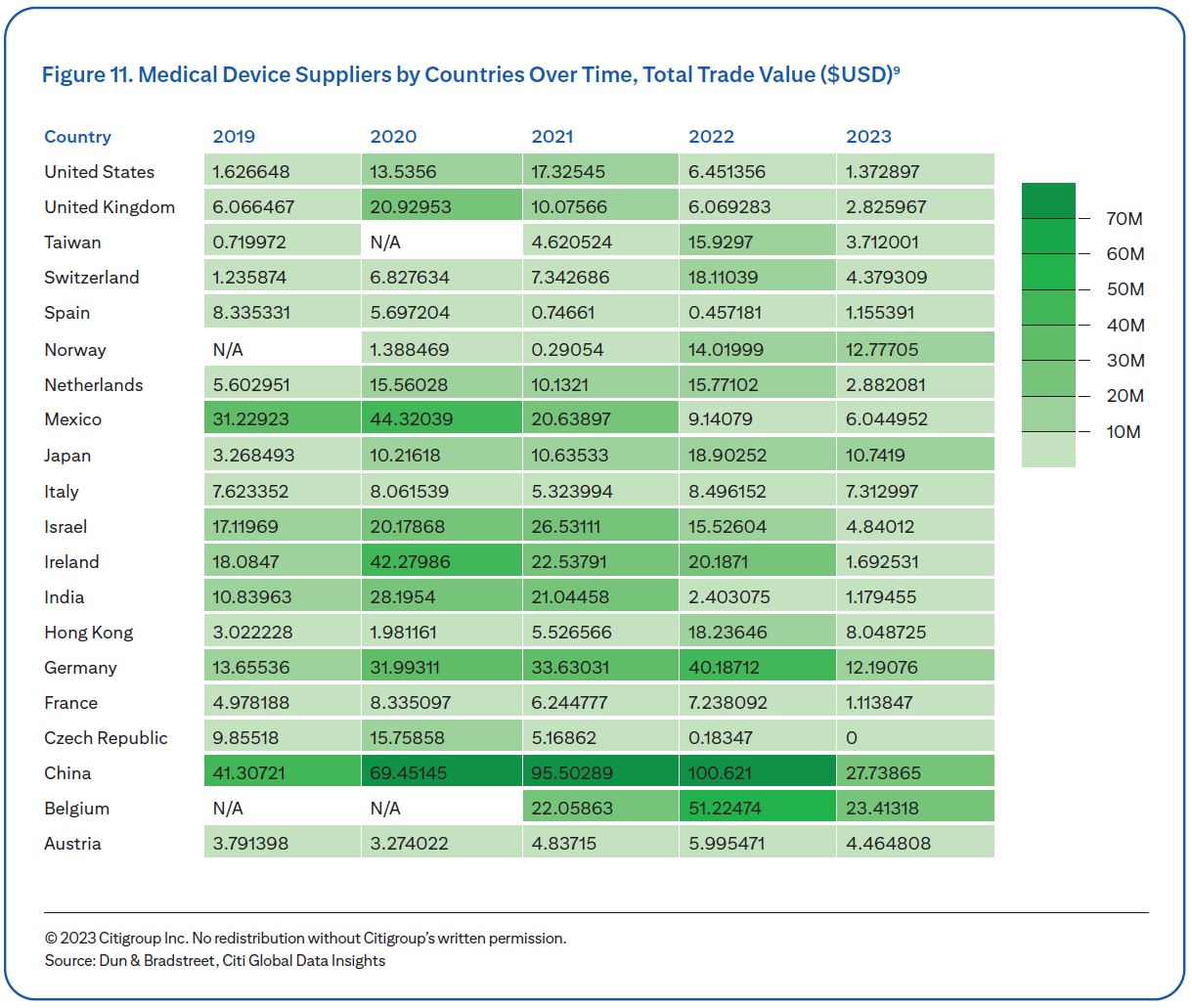

Our cross-border supply chain analysis for the medical device industry is driven by first identifying a population of the world’s largest medical device suppliers by revenue.

China’s overall dominance as a supplier to the medical device industry is expected as the country is home to much of the world’s smelting capacity for a diverse range of alloys, including titanium, aluminum, and copper. In Europe, the Netherlands appears to have ceded some market share while Germany with its robust polymers industry shows sustained strength.10 Poland, home to a thriving manufacturing and mining industry, also shows signs of continued strength. Taiwan, one of the world’s largest semiconductor producers, has shown considerable growth, growing by nearly 150% from 2021 to 2022, as the industry’s dependence on semiconductors continues to grow.11

According to Citi Global Data Insights, Taiwan’s reported a near fivefold increase in weight exported from 2021 to 2022. By weight, China’s reported figures remain steady, growing 15% from 2021 to 2022 while other countries appeared to have exported less weight. Germany and Ireland, historically two of the largest medical devices producing countries in Europe, each showed signs of decline, posting decreases of 32% and 19% respectively.

Supporting Customers and Distribution Channels

Taking steps to reduce tension in the supply chain requires understanding the dynamics of both upstream suppliers as well as downstream consumers. Healthcare distributors fill key supply chain and logistical needs between producers and patients. In the pharmaceutical industry, it is estimated that nearly 80% of total receivables come from the health distributor industry.12 For the medical device industry, it is estimated that roughly 60% of total receivables is attributed to the healthcare industry.13

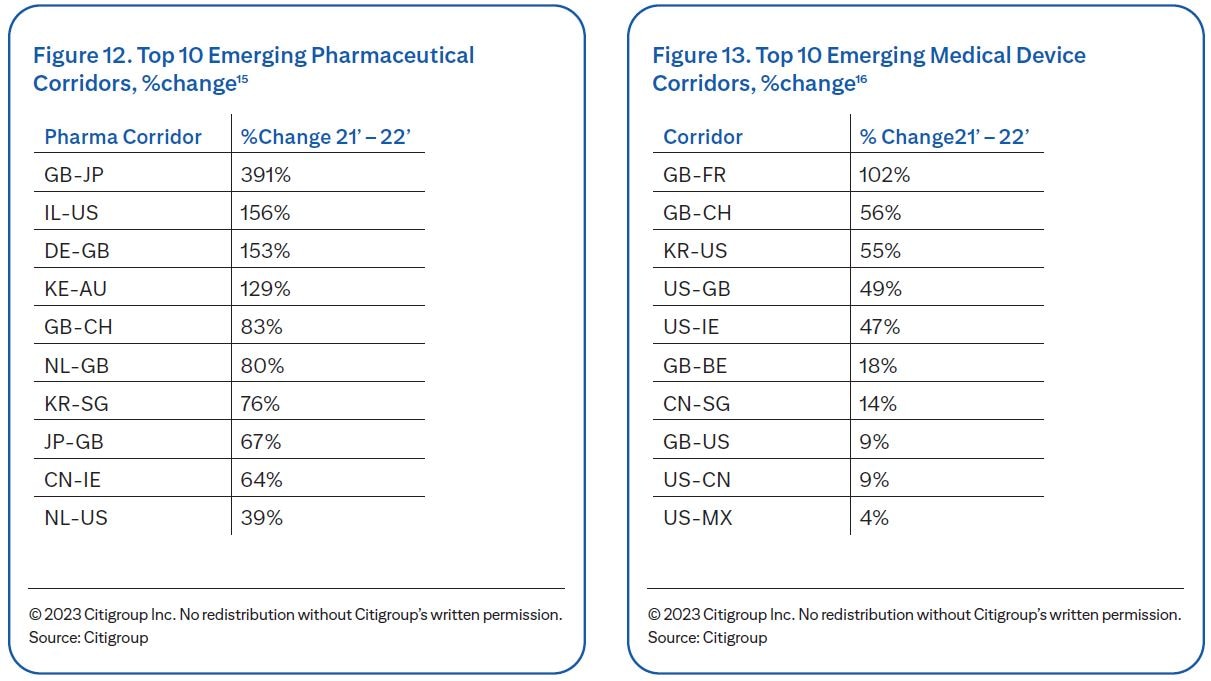

Country-to-country flows have proven to be dynamic for the pharmaceutical and medical device industries. Based on Citi Services’s global payment analysis,14 Citi’s Global Data Insights in partnership with Citi Trade Working Capital Advisory have observed growth across the healthcare industry in several corridors. The chart below highlights some the noteworthy trade corridors that have emerged.

Change percentages in pharmaceutical trade data tend be large given the underlying product being exchanged. Growth in the Israel to US corridor is supported by Israel’s healthcare system, which is advanced by many global standards and trade between Israel and the US is well established, especially in the healthcare sector.17 Strength in the Germany to UK flow is supported by both countries’ robust pharmaceutical industries and pharmaceutical products rank in the top five products exported by both countries to one another.18

Many of the top increases in flows for the medical device space are indicative of a trading relationship. While a relatively small increase in comparison, a 4% increase in US to Mexico flows for the medical device industry is of interest given the emergence of Mexico as a nearshoring destination for many US based corporates.

As trade corridors and distribution partners shift and grow, healthcare corporates can learn how Citi’s trade finance experts will aim to structure Accounts Receivable (AR) finance solutions that can help improve liquidity management while supporting customers’ need for longer payment terms. Corporates may work with Citi to establish commercial letters of credit or bank guarantees to help mitigate the risk of new trading partners. Healthcare supply chain partners have an important role to play, bolstering access to essential therapeutics and devices in both their home and foreign markets.

Working Capital in Healthcare

For healthcare corporates, minimizing trapped liquidity while ensuring financing continues to reach suppliers, customers, and distribution channels with limited access to capital remains as important as ever. Healthcare corporates have a few points to consider when making decisions on their working capital management strategy.

- Resilient healthcare supply chains require reliable financing: Ensuring that financing reaches manufacturers up and down the supply chain can help secure stable access to APIs and other critical components.

- Maximize excess liquidity to fund acquisition finance and R&D: Skillful working capital management may help maximize liquidity for healthcare corporates interested in bolstering their long-term stability.

Citi’s Global Working Capital team can help firms assess how to benefit from working capital improvements and support clients in undertaking comprehensive working capital management solutions.

1 PhRMA, 2023 PhRMA Annual Membership Survey, July 2023

2 Based on healthcare companies listed on the S&P Global 1200 Index; data as of Sept. 2023

3 Citi Velocity, Searching for Alpha: M&A - Identifying Potential Takeover Target, 2022

4 Shipment data is provided by Dun and Bradstreet. D&B collects and provides maritime shipment data from the USCBP and global industry partners which captures granular shipment details such as shipper, consignee, date of shipment, port locations and product details on a daily basis.

5 Based on an analysis of data from Dun & Bradstreet and World Customs Organization, data as of Sept. 2023

6 The pharmaceutical component of the analysis was derived using a list of Harmonized System (HS) codes that aligns to the International Nonproprietary Names (INNs) of nearly 6,000 active pharmaceutical ingredients

7 FDA, Safety of Metals and Other Materials Used in Medical Devices, 2022

8 NIH, An Overview About Connect Medical Devices and Their Risks, 2023

9 Based on an analysis of data from Dun & Bradstreet and World Customs Organization, data as of September 2023

10 OEC, Propylene Polymers, 2023

11 NIH, The changing landscape of semiconductor manufacturing: why the health sector should care, 2023

12 Based on an analysis of Bloomberg data of top pharmaceutical companies by revenue; data current as of Sept. 2023

13 Based on an analysis of Bloomberg data of top medical device companies by revenue; data current as of Sept. 2023

14 Citi’s Treasury and Trade Solutions processes in excess of $4 trillion of daily payment flows globally.

15 Based analysis of Citi’s payments data, adjusted to eliminate first time or immaterial relationships; data as of Sept. 2023

16 Based analysis of Citi’s payments data, adjusted to eliminate first time or immaterial relationships; data as of Sept. 2023

17 International Trade Administration, Israel Country Guide, 2019

18 Department for Business & Trade, Trade and Investment Factsheets: Germany, September 2023