Tomorrow’s transactions

The financial institution and fintech space in ASEAN is among the most exciting and fast-changing corners of the treasury world.

The patterns that shape consumer behavior worldwide are most sharply defined here. Customers demand that financial services be a seamless part of their digital lives. In ASEAN jurisdictions such as Indonesia and the Philippines, this digital expectation has been a powerful engine for inclusion, bringing millions into the financial mainstream as more prosaic brick-and-mortar models are leapfrogged. ASEAN has 440 million internet users, 80% of them are digital consumers; the region is on track to be a US$1 billion digital economy by 2030.

The financial institutions and fintechs who serve this emerging consumer force must provide new and dynamic business models. Citi is proud to help them do so: we work with our clients to connect the dots, anticipate change and galvanize economies as they grow.

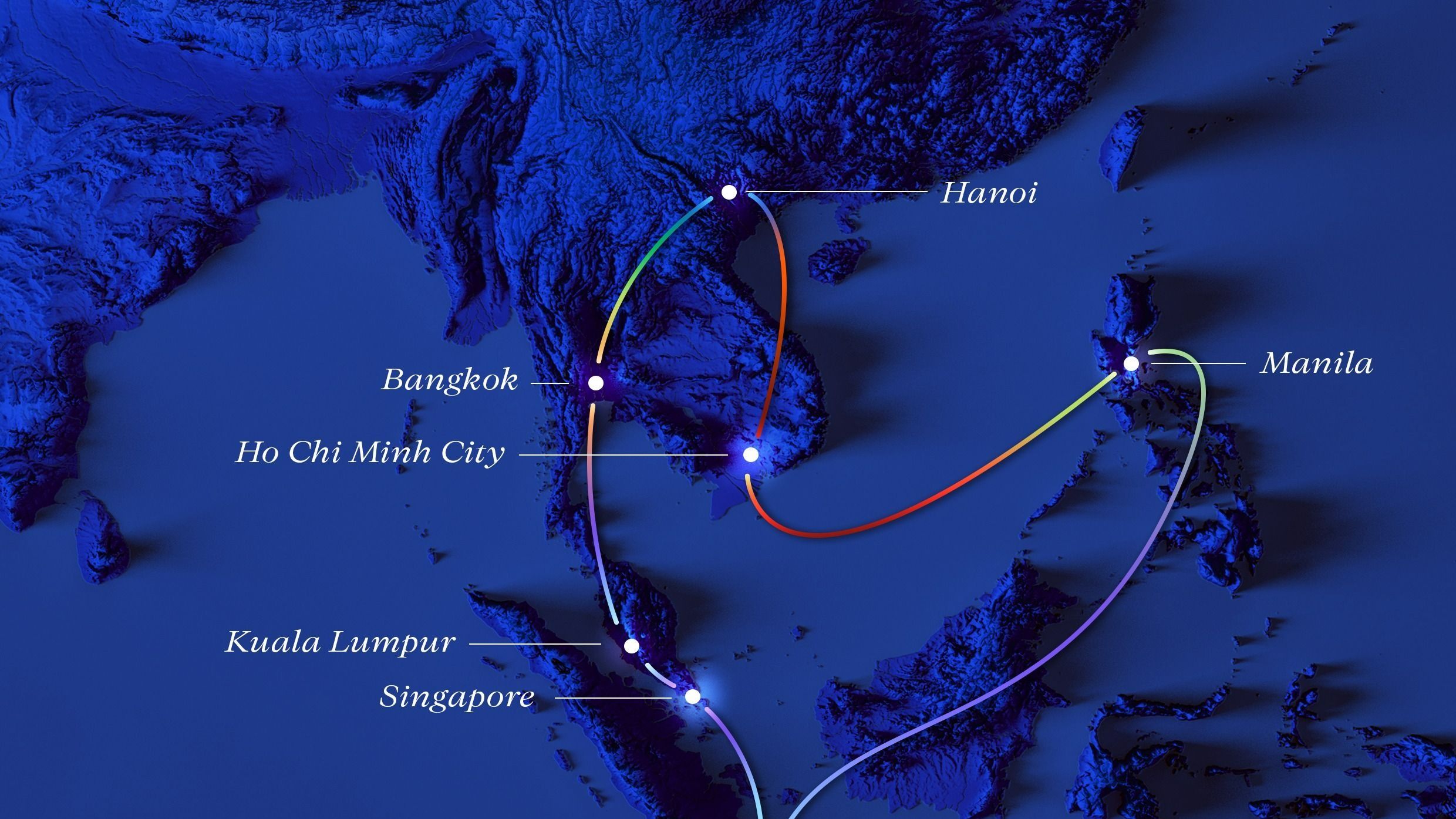

ASEAN is fertile ground for growth in cross-border payments activity. There is a compelling demographic picture of youth, growing middle class wealth and widespread comfort with digital finance. Bringing these things together, there is great potential here not only for innovation but scale.

The opportunity for clients in ASEAN is far bigger than just payments. Front-to-back solutions offer transformational possibilities. Citi has an innate understanding of what liquidity solutions, payments and trade finance really mean: not just mundane matters of cash management but real transactions touching real lives, creating wealth and delivering efficiency to businesses. This understanding helps the bank support its clients on their treasury journeys.

With that opportunity comes challenge. ASEAN has a fragmented regulatory environment, and a client trying to build business in Vietnam will have very different options and hurdles to one in Singapore or the Philippines.

But financial institutions and fintechs with the right support from a multinational partner will be aligned with a vibrant, growing market. Citi is ready to help them take advantage