Citi GPS has tackled a range of themes over the past 11 years, but sustainable investing is one that we find ourselves frequently returning to. The rise of environmental, social and governance (ESG) investing has revolutionized capital markets as investors increasingly recognize the need to fund technologies required to help markets evolve towards decarbonization.

Growth in ESG funds under management has also been driven by a change in how people think about their effect on the planet and by a generational shift in attitudes, which increasingly focus on “doing good” in addition to making money. As these investors look for investment opportunities, they are focusing their money towards sustainable investment.

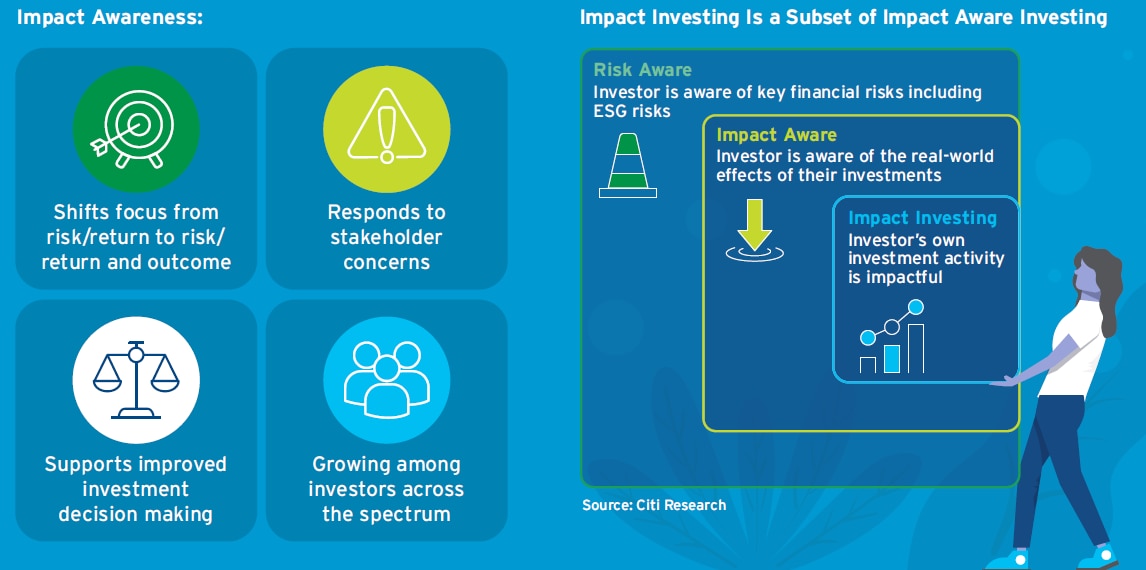

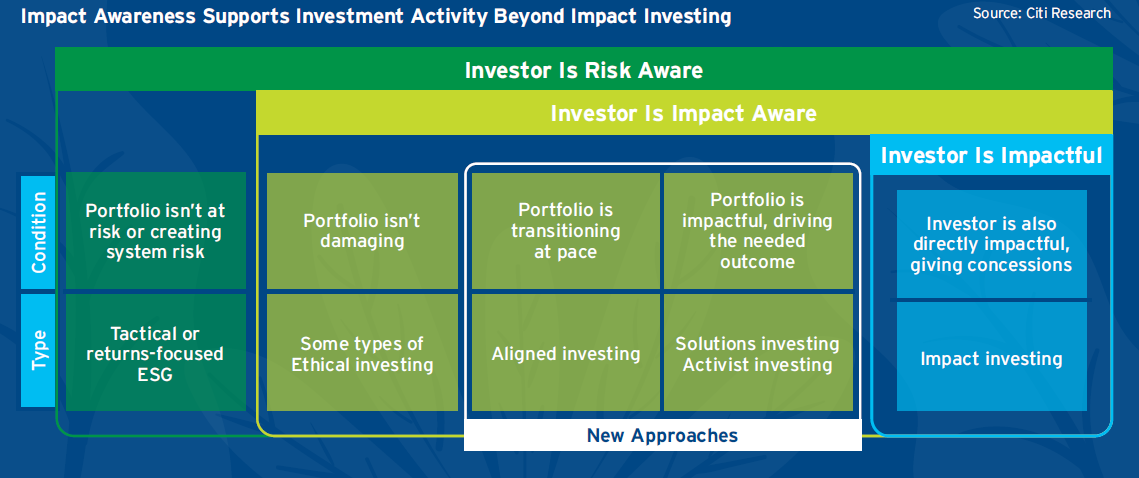

Another type of investing — impact investing — has also gained popularity as the flow of funds into ESG-type investments increases. Impact investing goes beyond ESG investing as the investment must not only target impactful activities, but also be impactful in and of itself. This sounds simple, but there is a big debate on how to measure impact as well as the ways in which an investment can be impactful.

The recent focus on impact investing has shifted the conversation from focusing solely on the risk and return of an investment, towards focusing on risk, return, and outcome. Investors are increasingly interested in the real world effects of their investments more broadly and they want to understand the outcomes of their investment activities.

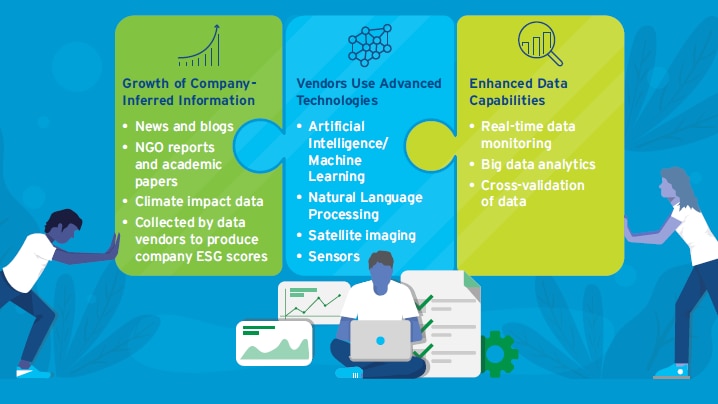

Measuring the impact of investing activities requires quality data. New vendors have come to the market that are able to process large amounts of information at scale and provide “inferred” data on what a company actually does on the ground. This marks a shift from when investors could only access “disclosed” data, based on what a company says it does.

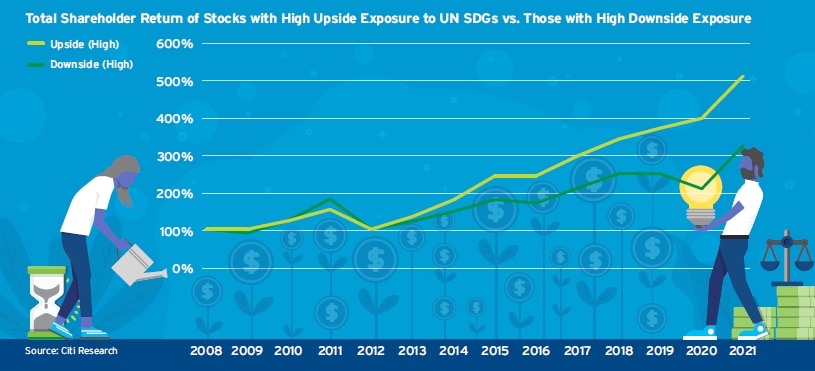

With a growing body of investors interested in the outcome footprint of their investments across the board, rigorous ways to think about these footprints will be extremely useful. Citi’s ESG team believes taxonomies will play a significant role in developing impact awareness and provides a useful framework to attribute economic activities to investment. Once the analysis for all economic activities has been mapped, investors can both quantify and visualize how a portfolio might look. The team proposes building a global taxonomy using the UN Sustainable Development Goals as an underlying framework, which will help aggregate visibility across global portfolios.

As Sir Ronald Cohen notes in the report’s foreword, “There is more than enough capital tied up in the ESG market to generate the changes we need. The problem is directing that capital effectively to where it can bring the greatest improvement.” Strengthening impact transparency is a step towards progress.