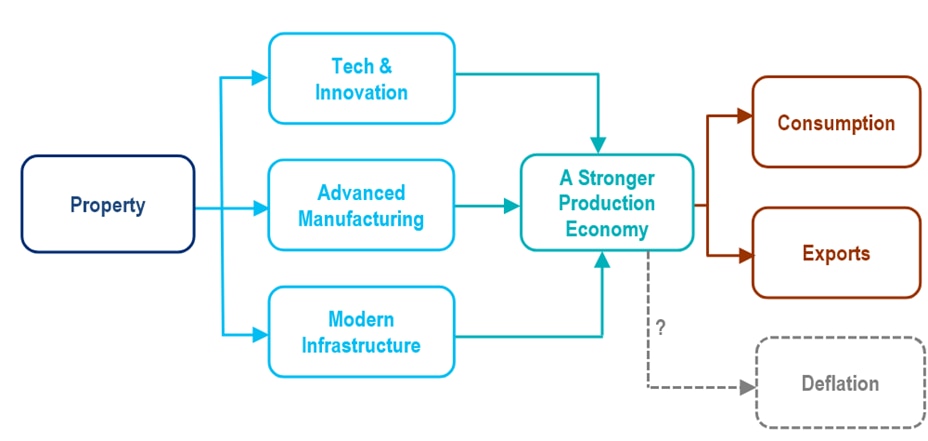

Beyond property: China looks to Tech, Manufacturing, and Infrastructure

China’s “de-property” process is proceeding as part of the country’s still-fragile post-COVID recovery. The government seems to be pinning its hopes on three areas to take up the slack following the well-publicized malaise in the Chinese property market.

- Tech and Innovation

- Advanced manufacturing

- Modern infrastructure

These emerging sectors could match the size of property and would consolidate China’s status as “the world factory”.

A Road Map for China’s Transition Away from Property

© 2024 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

The backdrop, of course, is turmoil in the property sector, historically a hugely important driver of the Chinese economy. The sector, which once accounted for at least 20% of China’s GDP both directly and indirectly, has contracted deeply. Home sales in the 12 months ending November 2023 were already down 35.4% from the 2021 peak.

So, what’s happening in the government’s alternatives?

Tech and Innovation

National security concerns given tensions with the US have placed tech and innovation in sharp focus. China’s aging society makes promoting labor productivity and automation more urgent still.

Innovation has now been elevated to the “core status” in China’s modernization with pledges to develop a whole nation system to achieve breakthroughs in artificial intelligence (AI), quantum information, integrated circuit (IC), life & health, brain science, biological breeding, aerospace, and other strategic technologies.

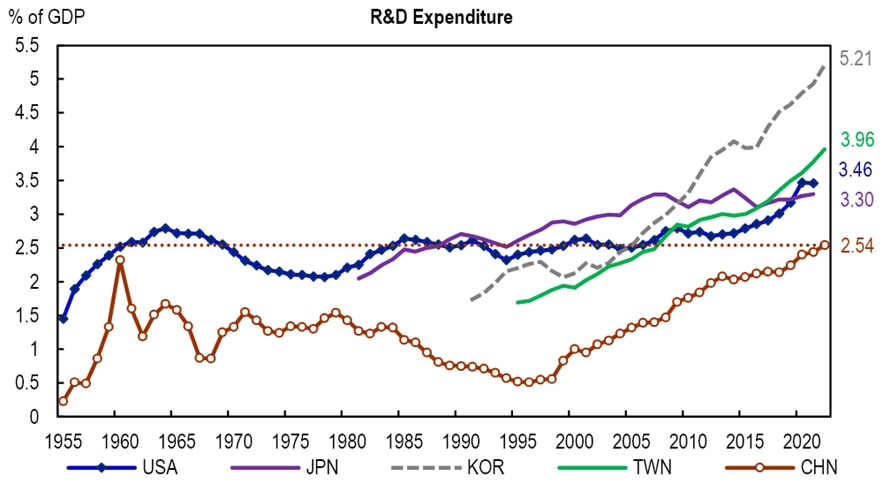

While the economy was struggling with COVID, China’s R&D spending exceeded RMB3trn for the first time in 2022, up 10.1%YoY and equivalent to 2.54% of GDP. Relative to its GDP size, China’s current stage in R&D spending roughly corresponds to Taiwan’s in the mid-2000s, Korea’s in the early 2000s, and Japan’s in the early 1990s.

While foreign partnerships are still crucial, China will have to rely more on domestic companies and talents to drive innovation in the new geopolitical setting. Semiconductors are in the spotlight of the US-China tech rivalry.

China’s R&D Expenditure

© 2024 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: NBS, OECD, Citi Research

Advanced Manufacturing

Beijing’s policy thinking seems to have refocused on the real economy, especially “new industrialization”. The government has been determined to transform and upgrade traditional industries, develop and expand strategic emerging sectors, and promote modern services.

Quality will be the key element of China’s next wave of industrial prosperity. It is a reality that China is losing cost advantages in low-value-added sectors amid aging population and slowing urbanization.

It’s important to note that China’s labor productivity, in real terms, has also improved 5.2x since joining the WTO with its nominal wage expanding 10x. Long “the world factory”, China has accumulated production experience and improved its workmanship.

Modern Infrastructure

Long term, China is trying to build a modern infrastructure system. On the one hand, China remains underdeveloped. The country’s vast hinterland, for example, is still in need of massive infrastructure investment. A stark example of this is that the length of paved roads per capita in Henan is only one-fourth of that in the coastal province of Jiangsu.

On the other hand, industrial upgrade can only be achieved with compatible new infrastructure, including efforts to:

- support new technologies like 5G, AI, big data, blockchain, cloud computing, and robotics;

- link traditional infrastructure to software, for creating smart cities and intelligent energy networks; and

- drive innovation and technological development.

The new growth model is not necessarily easier than the old one. Supply-side adjustment could take a while, but it should happen eventually. Challenges for a stronger production economy could be largely from the demand side, according to Citi Research analysts.

Housing has been the most important powerhouse for demand across sectors in the past few decades, they note. That picture, they point out, will be dramatically different with tech and manufacturing leading the way.

The success of the new growth model will ultimately hinge on the making of China’s consumer economy. And that hope for the consumer model remains just that as the country struggles to recover from the pandemic and endures the property downturn.

For more information on this subject and if you are a Velocity subscriber, please see the full report, originally published on 20 December 2023, here: China Economics - What To Drive Growth After Property?

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.