A recent report from Citi Research takes a look at the $3trillion banking question: Do banks – large and small- provide a sturdy safety net for the ailing commercial real estate sector?

How solid is commercial real estate? It’s a timely question given recent news headlines about problems in the sector.

A recent Citi Research report analyzed potential banking system losses due to commercial real estate exposure and found that even if delinquencies rose to 6%, reserves would be sufficient.

This reassuring message comes with the caveat that markets can become destabilized even if fundamental damage stays contained.

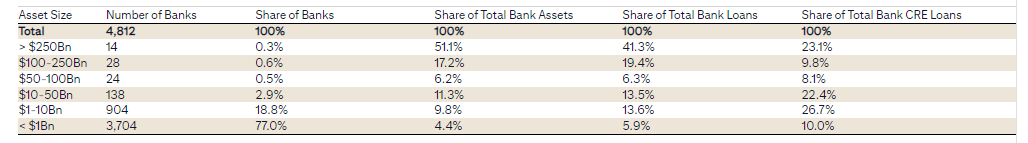

Citi’s Global Chief Economist Nathan Sheets notes that large money-centers and regional banks have generally charged off CRE-related debt or set aside allowances on loans expected to sour. Small and mid-tier banks are more exposed to CRE, and many haven’t been as aggressive in reserving against such exposures. But Nathan notes that their loans tend to have lower risk attributes.

While office buildings in large urban environments are feeling stress, the prospect is less severe for other types of CRE exposures and in other environments.

Nathan’s bottom line: CRE delinquency rates are likely to rise over the next several years, with losses gradually accruing, but the likely level of losses is broadly in line with a normal cyclical downturn, and well below losses seen during the Global Financial Crisis. This differs markedly from media headlines that offer up a more dire characterization of the situation and potential damage to the banking system.

Meanwhile Citi’s mortgage-backed security strategist Jeffrey Berenbaum notes that banks in the aggregate have reserved $39 billion, or 1.4% of total CRE loan balances, against potential CRE-related losses. Delinquency rates on office and multifamily bank loans are sitting at 1.5% and 0.4%, respectively. That suggests $5.5 billion of losses if a 50% recovery rate is assumed.

U.S. Bank Assets by Bank sizes as of Q4 2023

© 2024 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: SNL, Citi Research

That said, the report says that a disproportionate amount of the allowances for credit loss resides in the larger banks. Smaller banks that tend to have higher CRE concentrations as a percentage of total assets look to be well behind larger peers in recognizing accruals and write-offs. That suggests more headlines are on the way as such institutions deal with problematic loan maturities.

The report suggests defaults will rise as borrowers struggle to refinance maturing loans. Mortgage coupons have jumped to 6.75% or higher, compared with 4.5% on existing loans, and borrowers must fully pay off commercial mortgages in five to 10 years at maturity since they don’t fully amortize like residential ones. Office owners, Jeffrey notes, face declining property income in addition to higher mortgage costs as vacancies rise and rents fall, which makes getting a new mortgage that much more difficult.

But that’s not the whole picture, he notes: Lower financing costs will mitigate the magnitude of defaults and losses. Expectations for a Fed cut have helped pull down long-term rates, supporting the lending environment, and rallying capital-market spreads are also lowering borrowing costs.

The report also says that non-bank lenders may play a larger role refinancing maturing loans this year, as banks are generally still tightening standards for CRE loans. Nearly 40% of banks reported tighter lending standards in the latest Senior Loan Officer Opinion Survey, though that’s down from a recent peak north of 70%. Meanwhile, demand for CRE loans remains soft, with 50% of banks reporting weaker demand. But this metric is also easing, having bottomed at nearly 70% in mid-2023. Loan demand, Berenbaum predicts, will pick up as more borrowers reach out to refinance their maturing loans.

A caution in this multifaceted analysis comes from Citi’s global macro strategist Dirk Willer, who notes that markets can become destabilizing even if fundamental damage remains relatively contained. Citi Research’s view is that the CRE problem is manageable, a headwind for the banking sector but not a crisis. But bank runs can become self-fulfilling, with a lot of damage done by the time authorities step in—as the events of March 2023 demonstrate. Willer cautions investors that falling stock prices can lead to deposit outflows, which can send stock prices still lower.

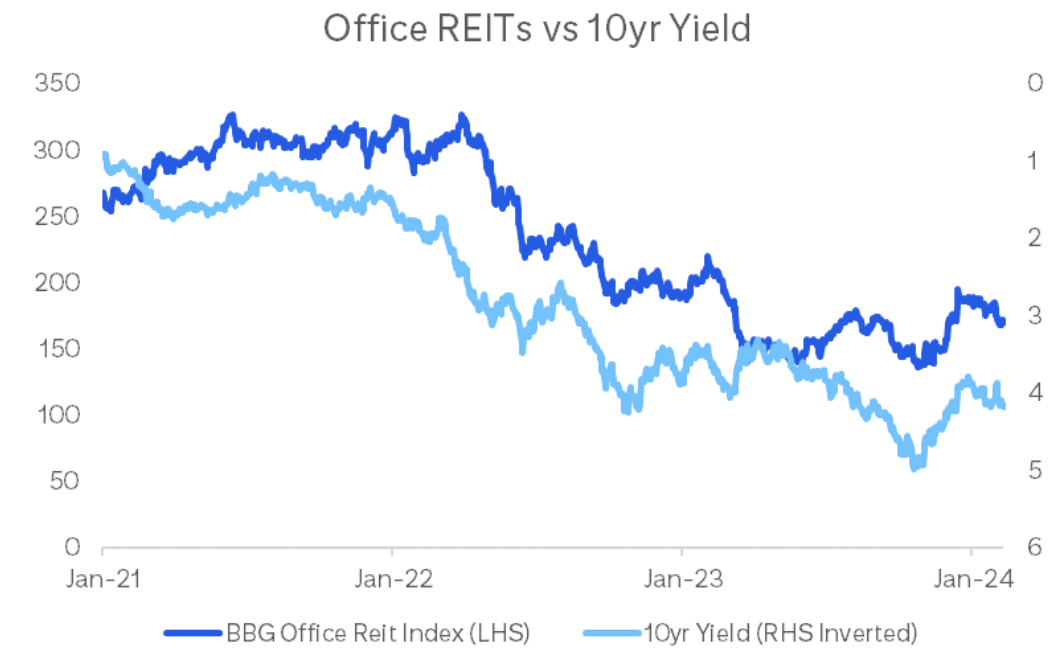

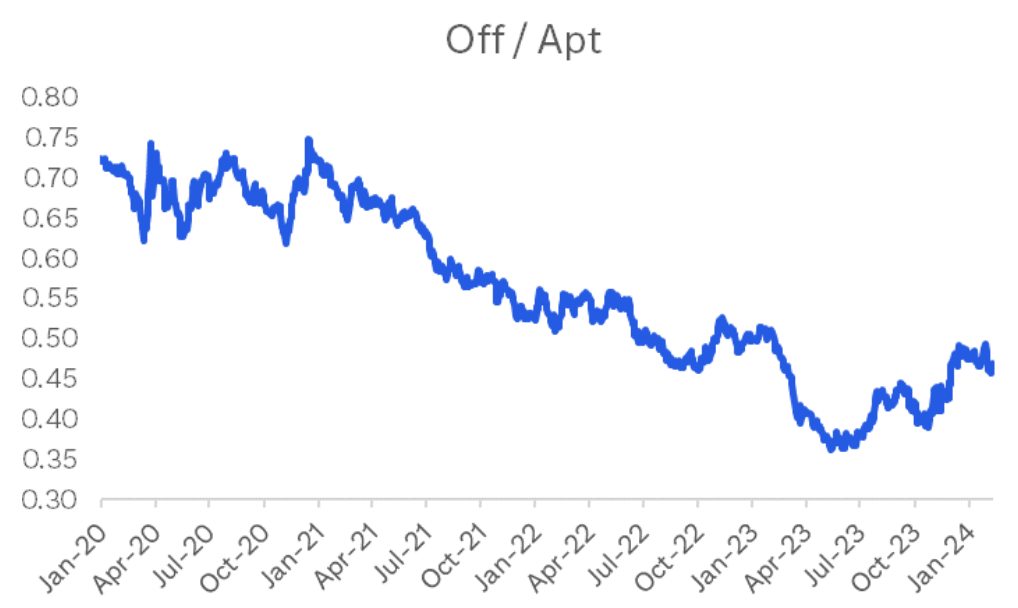

But Dirk also sees mitigating factors at work. First off, the issue of office CRE is well understood: Office REITs peaked in February 2020, recovered substantially after the COVID selloff and then collapsed when interest rates started to rise; currently, we’re more than 50% below the 2020 peak. While office REITs have underperformed since early 2021, they’ve actually outperformed apartment REITs since mid-2023, with the NYCB shock only leading to underperformance of 5%. He notes that while cheap assets can always get cheaper, it’s at least clear that this isn’t a new problem but something the market has already priced to a significant extent.

| Office REITs have been falling for a long time | Office recently outperformed apartment REITs |

|

|

|

© 2024 Citigroup Inc. No redistribution without Citigroup’s written permission. Source: Citi Research |

© 2024 Citigroup Inc. No redistribution without Citigroup’s written permission. Source: Citi Research |

The other reassuring point, he observes, is that equity markets have behaved very differently than they did during March 2023’s bank stresses. And fixed-income markets have also seen the NYCB situation as much more benign. The direction of rates suggests the impact hasn’t been seen as sufficient to increase the risk of an earlier policy turn from the Fed, and no stress has been observed in money markets. On the credit side, spreads between the largest U.S. banks and the regional banks jumped in March 2023 and have remained elevated, but they didn’t jump further with NYCB. This implies the market consensus is that larger banks’ credit quality hasn’t been significantly impacted so far—and that’s another reassuring sign.

For more information on this subject, if you are a Velocity subscriber, please see the full report here Global Multi-Asset Strategy - CRE: The Three Trillion Dollar Banking Question (22 Feb)

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.