Lending conditions are particularly tight in commercial real estate, with the SLOOS details pointing to a sharp tightening for both multifamily and office buildings, the report says.

Banks seem “a notch more relaxed” about consumer and residential mortgage lending, which the authors attribute in part to demand looking to have contracted sharply as households reduce their appetite for borrowing in response to higher interest rates.

Historically, the authors note, SLOOS credit standards and credit spreads have tracked each other closely: As banks pull back on lending, markets demand higher spreads. But in the current episode, credit spreads and the SLOOS have diverged.

The reasons why remain an open issue, though the authors offer one hypothesis: Credit markets may be drawing increasing support from private lenders, which may have more risk appetite and operate under more flexible credit constraints than banks.

Data from the ECB’s Bank Lending Survey look strikingly similar to the U.S. readings. For supply, the tightening isn’t yet comparable to what was seen during the Global Financial Crisis or the peripheral debt crisis, but conditions are challenging nonetheless, with pullback on the demand side looking even more severe and tightening for business loans appearing a touch more vigorous than conditions for households.

The authors note that previous research has studied the relationship between credit conditions and real GDP growth in the U.S. and the euro area. The general finding is that credit tightening has meaningful effects on real GDP, with the impact accumulating over roughly six to eight quarters. For the U.S., research shows that roughly 10 points of net tightening on the SLOOS is associated with an eventual reduction in U.S. real GDP of around 0.5% to 1.0%.

However, the most recent of the relevant papers were published nearly a decade ago, which prompted the authors to take another look and model the relationship in question in two different ways. Both models suggested a significant forthcoming headwind for U.S. GDP, with growth during the coming year being lower by 1 to 2 percentage points and perhaps even more. The authors note that whether such sizable effects materialize will depend on many factors, including the persistence of the credit shock, the Fed’s response, the trajectory of credit markets and the economy’s underlying resilience. An exercise for the euro area echoed those result.

Credit conditions are getting tighter. The question is how much will that impact growth?

While a number of factors are at play, the Citi Research report says, in one scenario deteriorating credit conditions could lower real GDP in the U.S. and euro area economies at least 1% to 2% by the end of next year.

The economists’ starting point is the marked tightening of credit conditions noted by recent central-bank surveys, with evidence of weakness in both credit supply and demand.

Historically, the team notes, tightening of this magnitude has led to meaningful headwinds for the economy, a caution raised by the Fed in the statement that followed its June meeting.

To assess these issues, the economists began by surveying indicators of credit conditions in the U.S. and the euro area.

With the Spring’s banking stresses now apparently largely stabilized, the team’s attention has shifted from acute, near-term risks to chronic, longer-term ones.

Such longer-term risks include rising pressures from higher interest rates on banks’ balance sheets and margins, with potential spillovers into the supply and demand for credit.

The onset of a “credit crunch” is seen by the team as a particular risk. The Fed’s Senior Loan Officer Opinion Survey on Bank Lending (SLOOS) reveals a sharp tightening in bank lending standards. The authors note that since the post-pandemic trough, credit conditions have tightened by roughly 70 points, a contraction similar to that seen during the dot-com downturn and trailing only contractions seen early in the pandemic and through the Global Financial Crisis in terms of size.

Credit Standards

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission

Source: Citi Research, FRB, ECB, Haver Analytics

Summary: Impact of 10pts Credit Tightening on Real GDP*

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

*Note: Bivariate response is fitted with credit tightening implied by the VAR.

Source: Citi Research

Lending conditions are particularly tight in commercial real estate, with the SLOOS details pointing to a sharp tightening for both multifamily and office buildings, the report says.

Banks seem “a notch more relaxed” about consumer and residential mortgage lending, which the authors attribute in part to demand looking to have contracted sharply as households reduce their appetite for borrowing in response to higher interest rates.

Historically, the authors note, SLOOS credit standards and credit spreads have tracked each other closely: As banks pull back on lending, markets demand higher spreads. But in the current episode, credit spreads and the SLOOS have diverged.

The reasons why remain an open issue, though the authors offer one hypothesis: Credit markets may be drawing increasing support from private lenders, which may have more risk appetite and operate under more flexible credit constraints than banks.

Data from the ECB’s Bank Lending Survey look strikingly similar to the U.S. readings. For supply, the tightening isn’t yet comparable to what was seen during the Global Financial Crisis or the peripheral debt crisis, but conditions are challenging nonetheless, with pullback on the demand side looking even more severe and tightening for business loans appearing a touch more vigorous than conditions for households.

The authors note that previous research has studied the relationship between credit conditions and real GDP growth in the U.S. and the euro area. The general finding is that credit tightening has meaningful effects on real GDP, with the impact accumulating over roughly six to eight quarters. For the U.S., research shows that roughly 10 points of net tightening on the SLOOS is associated with an eventual reduction in U.S. real GDP of around 0.5% to 1.0%.

However, the most recent of the relevant papers were published nearly a decade ago, which prompted the authors to take another look and model the relationship in question in two different ways. Both models suggested a significant forthcoming headwind for U.S. GDP, with growth during the coming year being lower by 1 to 2 percentage points and perhaps even more. The authors note that whether such sizable effects materialize will depend on many factors, including the persistence of the credit shock, the Fed’s response, the trajectory of credit markets and the economy’s underlying resilience. An exercise for the euro area echoed those result.

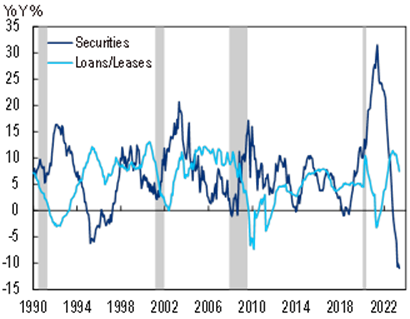

US Bank Securities & Loans Growth

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, FRB, NBER, Haver Analytics

US Bank Securities & Loans

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, FRB, NBER, Haver Analytic

Implications for Growth

The authors note that their baseline forecasts for both regions are notably soft: Both economies are plagued by high inflation and the drag from monetary tightening, and likely to endure recessions.

Second, they note that their forecasts haven’t factored in headwinds from credit conditions of the size and intensity flagged by the new research.

That raises the possibility of a deeper or more prolonged credit tightening, with correspondingly more severe effects on GDP—an important downside risk to consider.

Third, they observe that tightening credit conditions may impede economic activity through multiple channels: firms’ working capital and physical investment, real-estate investment, constrained consumer spending, and reduced funding for markets and financial investment. As such pressures take hold, the effects on growth may be significant.

Finally, they observe that whether these downside risks materialize will depend on the strength of the banking system, the resilience of credit demand, and the underlying economy’s momentum.

The good news, the authors note, is that so far they haven’t seen evidence that tighter credit has restrained growth beyond what their forecasts envisioned. But with effects accumulating gradually over time, the road ahead may yet be challenging.

For more information on this subject, if you are a Velocity subscriber, please see Global Economics - Credit Tightening—Still More Pain to Come? , first published on June 26th.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.