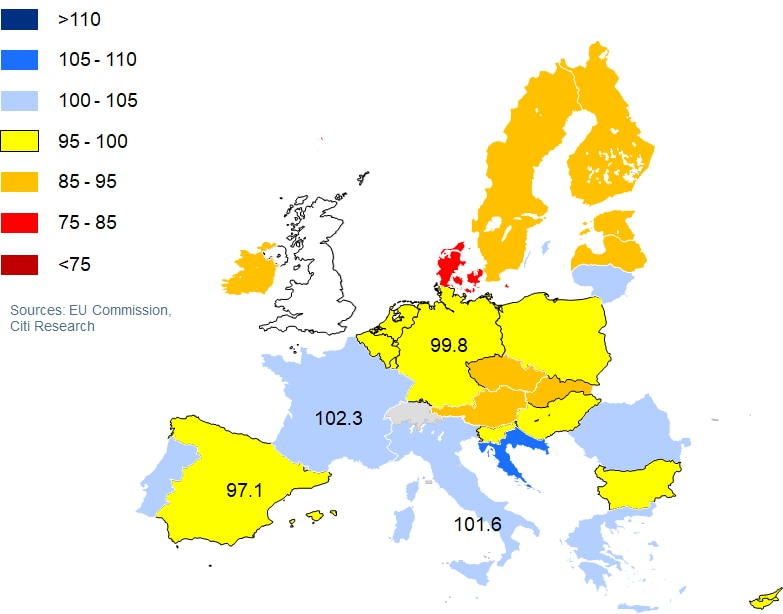

July PMIs confirm that Germany is in recession with the rest of the Euro Area not far behind. The gas crisis continues to be a threat and Italy’s political crisis could make matters worse. By hiking into such a weak macro environment, the ECB makes its focus on inflation abundantly clear.

EU- Economic Sentiment Indicator- July 2022

Gas: a narrow path to avoid rationing

Following the resumption of gas flows to Europe from Russia, volumes appear to have returned to the 40% of capacity which had prevailed since the middle of June. At this pace, it would take another two-and-a half months to reach a storage level of 90%, half a month earlier than legally required.

Germany -- Pipeline Gas Flow from Russia |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, Bloomberg |

That said, gas supply remains severely restricted with the Yamal pipeline shut since late 2021 and the Transgas pipeline carrying no more than 40% of its capacity at the moment.

Despite this, EU gas storage levels have risen from 29% in late February 2022 to 65% now, 12pp higher than at the same time last year.

Clearly all parts of the gas balance have been moved in order to reduce dependence on Russian gas, at least in Germany, suggesting different paths to coping with continued uncertainty about Russian gas supplies.

Italy: What Do Early Elections Mean

After 17 months at the helm of the Italian government, former ECB President Mario Draghi resigned recently, after three of the parties backing his national unity government withdraw their support.

President of the Republic Mattarella has dissolved parliament and called for an election on 25 September. Draghi will remain Prime Minister until a new government is sworn in, likely end-October at the earliest, but he will only be able to deal with ‘current affairs’- no new fiscal measures, for example.

The decision of the centre-right Forza Italia and Lega to walk away, forcing a snap election came as a surprise to most, given Forza Italia’s and the business community’s strong support for Draghi.

Citi Research Economist’s see three potential ‘tension points’ between a centre-right government and the EU over the coming months:

- Compliance with the national recovery plan (PNRR) reforms – In particular, the competition law has been strongly criticized by Lega and it is a key part of the 55 milestones/targets Italy should deliver by 31 December 2022 in order to unlock the next €19bn tranche.

- 2023 Budget – On Draghi’s agenda, the Budget would have had to include payroll tax cuts, pension reform and reductions of tax rebates, which are now unlikely to go through. The pressure for a more expansionary policy, compared to the neutral stance recommended by the EU Commission, will grow with the next government.

- Gas crisis/Italy’s position on Russia – The pro-Ukraine and pro-sanctions against Russia stance has been a source of discontent with the Draghi administration . A departure from these positions could generate tensions with other European countries, especially in case of actual shortages of gas supplies.

The unexpected change in government in itself will likely increase uncertainty and further undermine private sector’s investment decisions.

Italy: Voting Intentions for the Main Parties (%) |

. Italy: Voting Intentions for the Two Blocs (%) |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

Source: Citi Research, various pollsters |

Source: Citi Research, various pollsters |

ECB: Recession and Rake Hikes?

Southern and western parts of the euro area may avoid recession for now because of a strong tourism season and less exposure to the Ukraine conflict and its consequences. However, a further deterioration here is also likely once the tourism season ends, wage growth surges less and the ECB allows tighter financial conditions than in Germany.

The risks to the labour market, a lagging indicator of the economy but potentially either a cushion or an amplifier for the recession, are growing. If it holds up, fiscal stimulus, easing supply and inflation pressures as well as accelerating wage growth should lead to an improving growth picture in 2023.

If the labour market cracks, however, the risks of an extended downturn would increase. For more information on this subject, please see European Economics Weekly: Euro Area: Hiking Into Recession? And for further reading, please see also this separate report European Economics - Euro Area: Recession From the North-East

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.