The U.S. water system faces mounting problems. While provisions in the U.S. Inflation Reduction Act are moving in the right direction, more is needed, according to the new Citi Research report.

The issues, the analysts note, aren’t limited to crumbling infrastructure, though that’s a huge job. They also include water-treatment processes that protect people from antibiotic resistant genes and bacteria.

While terms such as ESG, green and climate change have become politicized, the report observes that clean drinking water for all should be a unifying objective.

Funding Water Infrastructure

The Bipartisan Infrastructure Law, part of the Inflation Reduction Act, delivers more than $50 billion to the Environmental Protection Agency to improve drinking water, waste-water and stormwater infrastructure, and is the federal government’s largest-ever investment in water.

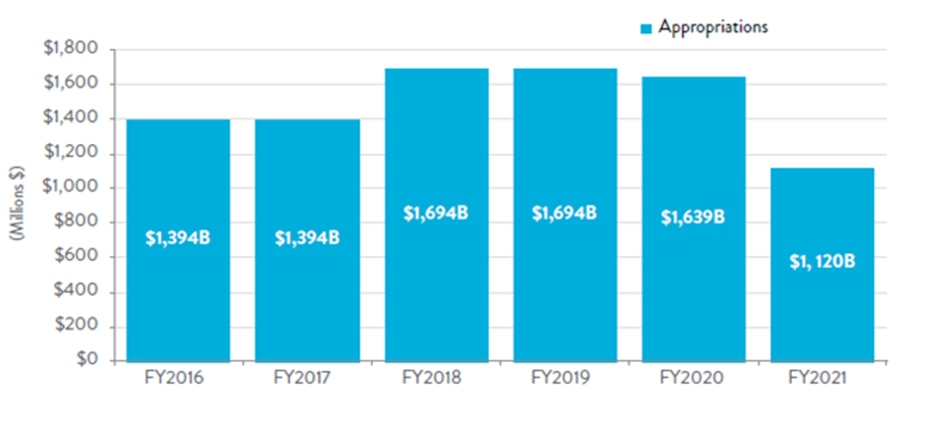

US EPA clean water state revolving fund appropriations

Source: American Society of Civil Engineers (ASCE), www.infrastructurereportcard.org

It provides $5 billion through SRFs to reduce exposure to various contaminants in drinking water and to help address discharges. These funds are distributed to communities entirely as forgivable loans or grants, with states not required to provide matching funds.

The analysts note that the primary impediment to solving the U.S. water crisis is funding, which hasn’t kept up with the growing need to address aging infrastructure.

Generally speaking, state and local governments have invested more than their federal counterparts: Federal money has fallen over time from 63% of capital spending in the water sector to just 9% in 2017. With federal and state assistance limited, the burden of maintaining wastewater infrastructure has fallen to local governments—and in most cases the cost of upgrades have become prohibitive, leaving communities relying on “Band-Aid” fixes.

The report describes the public investment needs for the nation’s drinking-water systems as “staggering,” citing a 2020 economic study from the American Society of Civil Engineers that estimated the annual drinking-water and wastewater investment gap will grow to $434 billion by 2029.

A number of investments are needed, it says. Aging systems of leaky pipes are prone to breaking. Regulation to guard against pollutant discharges is patchy. Municipal wastewater treatment plants have limited capabilities for detecting and treating antibiotic resistant genes and bacteria. And utilities must keep pace with emerging contaminants and regulatory requirements, with utilities in more rural communities hampered by a smaller rate-payer base that produces less revenue.

The authors note that at the federal level, progress has been impeded by disagreements around environmental and societal issues, as well as by shifting priorities. That leaves state and local governments in key roles, but those governments face obstacles.

For one, they don’t have the fiscal muscle necessary to take on such an undertaking; and municipalities often find it hard to convince residents of the importance of managing water infrastructure proactively, with the attendant rates needed to cover such costs.

Is the Municipal Market a Solution?

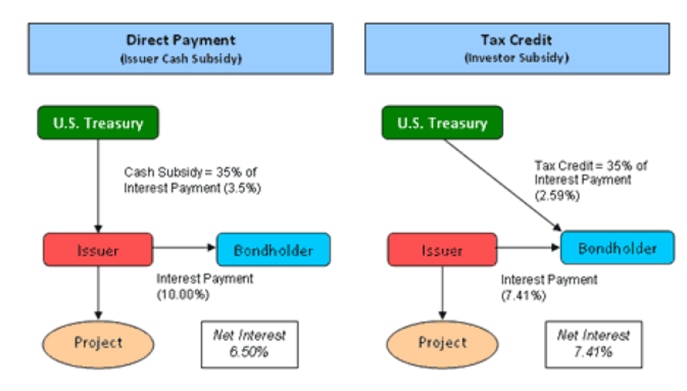

Help could come from the municipal market, the authors suggest. The authors identify Direct Pay bonds as instruments that could prove highly effective in jumpstarting water infrastructure investments.

Illustration of Build America Bonds: Direct Payment vs. Tax Credit structure with 10% return

Source: U.S. DOT

Direct Pay bonds were last used as part of the Build America Bonds program, created in 2009. Direct Pay BABs are taxable bonds for which the U.S. Treasury pays a direct subsidy to the issuer to offset borrowing costs, with the subsidy originally set at 35% and later reduced. (In addressing water-infrastructure needs, the authors suggest a reincarnated Direct Pay BAB program with a subsidy reduced to the 30% to 32% range.).

Simply put, the current size of the municipal market is ~$4 trillion and the water infrastructure financing need is ~$2 trillion, implying the municipal buyer base would need to expand by 50%.

Given that foreign investors expressed an unwavering interest in investing in US infrastructure, they are likely to be keenly interested in a Direct Pay bond structure. This is because, from their perspective, the Direct Pay bond is indistinguishable from a conventional taxable bond, as the annual return is paid entirely in cash.

That said the authors note that Direct Pay bonds do not solve all the problems that are associated with the ambitious US infrastructure upgrade program. This is because, they implicitly assume that there are $2.0 trillion worth of shovel-ready infrastructure projects that can be greenlit if the federal government is only willing to subsidize the interest costs of these projects. That is an oversimplification, they say, and could end up conflating financing with funding

For more information on this subject if you are a Velocity subscriber, please see Global ESG & SRI - Why 2023 can be a pivotal year for US water infrastructure first published on May 5th.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.