A recent report from Citi Research’s Filippo Falorni, looks at some of the early impacts of the increased adoption of GLP 1 drugs to combat obesity.

Glucagon-Like Peptide -1 or GLP-1 drugs, originally developed for treatment of diabetes, have recently grabbed the headlines as users have reported immediate and often effortless weight loss results.

A survey conducted in concert with the Citi innovation lab analyzed 1,000 U.S. adults, 499 of whom were GLP-1 users, and the other 501 users of other weight-loss methods. The survey asked about factors including weight loss satisfaction, financial impact of the drug, and changes in behavior & consumption patterns. The survey showed similar patterns of weight-loss across the groups.

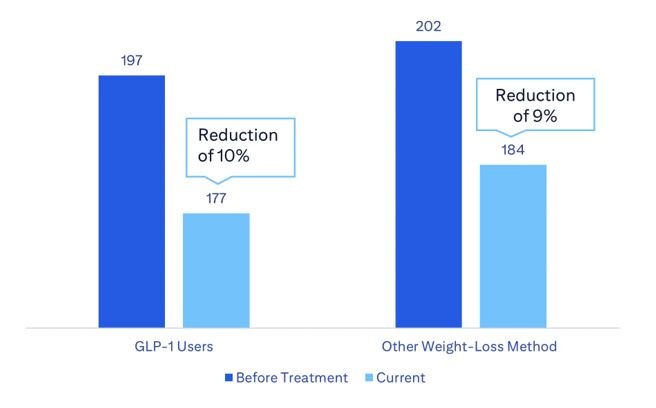

It found that despite rapid weight-loss seen within the GLP-1 exposure group, as shown in the chart below, calorie cuts and average weight-loss results remained in line with other participants using alternative treatments. Furthermore, respondents using GLP-1 treatments did not indicate significant lifestyle improvement vs. other participants. Based on the survey results and adoption forecasts from Citi Research’s pharma team, the Citi Research analysts forecast a potential ~1%/1.75% annual reduction in U.S. meal/snacking consumption by 2035, and a ~1.2% reduction in U.S. calorie intake.

Self-Reported Weight Loss in Pounds Shows GLP User Weight Loss is In Line with Other Weight Loss Methods

Source: Citi Research

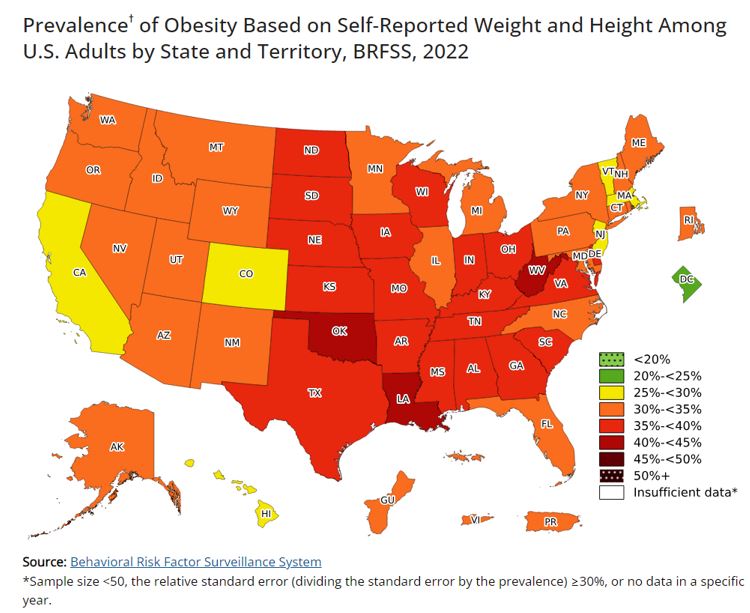

The backdrop to the survey is that global obesity rates have steadily climbed in recent years. It is now affecting developing countries as well as developed.

That said, limited supply of GLP-1s amid soaring demand, as well as the accompanying steep price tag, are constraints. The survey found that users of alternative weight-loss methods cited long-term health-oriented lifestyle goals, while GLP-1 users on average have not demonstrated significant changes in their behaviour patterns oriented towards maintaining their weight results.

Based on these results, the analysts say they anticipate an acceleration in consumer adoption of GLP-1s in the coming years. Current adoption in the U.S. is at ~6.5 mm users but expected to increase as the treatment becomes more accessible and costs drop.

There are several risk factors regarding further adoption of the treatment. However, these mostly depend on a stabilized supply-chain of GLP-1 production, further development of the medication into a potential pill format, expanded health insurance coverage (including Medicare), FDA approval for obesity treatment specifically, and decreasing costs of GLP-1s.

Side effects, including higher risk of gastrointestinal issues and other serious health concerns, are also one of the risk factors we consider as the drug becomes more accessible.

What Does the Survey Imply for Changes in Consumer Behaviours?

The Citi Research’s Innovation Lab survey shows that users of GLP-1 for weight-loss saw a weight reduction of ~10%, compared to an average ~9% weight-loss for consumers under other weight-loss regimens.

In terms of calorie reduction, the survey shows an average ~500 calorie reduction (or ~18.5%) for respondents using GLP-1 drugs, compared to a ~600 calorie reduction (or ~23.1%) for respondents using other weight loss methods.

While the reduction in calorie intake is significant, a key conclusion of the survey is that GLP-1 user behaviours are not that dissimilar from people using other weight-loss methods. However, an acceleration in GLP-1 adoption could drive material reductions in aggregate calorie intake.

GLP-1 is a relatively new entrant to a weight loss market in the U.S. that is well established. According to the Centers for Disease Control and Prevention (CDC), 49.1% of Americans try to lose weight annually (CDC Data). Women (56.4%) drive most of the weight loss attempts vs men (41.7%). Commonly reported weight loss methods were exercising and consuming less food, followed by increased fruit, vegetable, and salad consumption. Roughly 43 million or 17% of U.S. Adults try to follow a special diet each year. The diet segment dominated global weight loss & management market in 2022 with a worldwide share of 76.3%.

Diet changes are also gaining popularity in developing countries because the method requires no additional equipment and is easily manageable compared to other weight-loss tools like fitness & exercising. The market is expected to grow further with more people trying to lose weight as their income and body weight increase.

For more information on this subject, please see the full report here if you are a Velocity subscriber Global Consumer - Market Not Yet Losing Appetite for GLP-1 Impacts, Should It? (1 Feb 2024)

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.