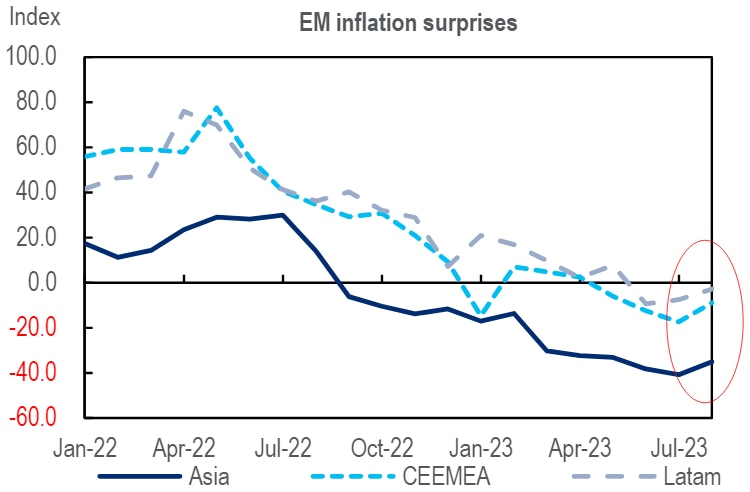

Emerging Markets have been experiencing a ‘Goldilocks’ moment recently – with upside surprises to growth, and downside surprises to Consumer Price Inflation. Now that’s coming under threat.

Though China’s muted recovery helps keep EM inflation basically low, some threats to the disinflation narrative are appearing due to a combination of rising energy prices, atypical increases in food prices and the strength of demand in some countries.

And, the report says, other risks are beginning to emerge as possible threats to continued disinflation.

1. The possible further appreciation of the dollar, given the contrast between the Eurozone’s economic weakness and the US’s resilience.

2. El Niño. Which is starting to have an impact across parts of Latin America.

The analysts say that these threats are more likely to put EM on a shallower path towards targeted inflation rates rather than put the disinflation process into reverse.

That’s especially true, the report says, because the surprising strength of domestic demand in ex-China EM is likely to weaken over time and because the authors continue to doubt that China will deliver a big stimulus.

As long as that’s true, EM’s effort to keep inflation falling will face limited risks, but a weak China will ultimately undermine EM growth too, they say.

China’s fiscal space has been eroded by a decade-long decline in tax revenues…

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, Haver Analytics

…and the scale of the US-China interest differential leaves PBOC constrained in what it can do with monetary policy.

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, Haver Analytics

Chinese authorities looking to be forgoing major stimulus, helping to control inflation in EM.

The authorities may be unwilling to introduce stimulus because of their deep commitment to weaning the Chinese economy off its dependence on real estate investment. And indeed they may simply be unable against a backdrop of weak fiscal revenues and heightened debt levels, both of which limit the government’s ability to introduce fiscal measures at all. And the authors note the disparity between US and China interest rates which further limits the PBOC’s ability to use interest or exchange rates to boost the economy.

The PBOC’s reluctance to use a significantly weaker exchange rate stems from several factors:

- concerns that it would create capital outflows, introducing the possibility of a ‘one-way bet’ for the CNY

- a weaker CNY might undermine its potential use as a settlement currency

- US policymakers might retaliate if the CNY is seen to be be putting US firms at a disadvantage

Inflation surprises have tilted upwards recently, as oil prices have risen…

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, Bloomberg

One reason the Fed is not a constraint is because it is well into its tightening cycle. That said, the dollar’s appreciation in recent weeks is a new development –from 1.12 against the EUR in mid-July to 1.07 in mid-September. This has introduced some volatility into EMFX

In addition, EM CPI expectations in some countries might be impacted by the El Niño weather phenomenon, as illustrated in the two charts below.

An El Niño event of some magnitude is already underway…

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, National Centers for Environmental Information

…and there is almost a 75% chance of a strong El Niño

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, National Centers for Environmental Information

The authors say fundamental to their view is a fundamental pessimism about China’s growth prospects, not only in the next quarters, but for years to come.

It has by now become consensus that growth in China will be lower in the coming decade than in the recent past. By how much is open to debate.

China has seen exceptional growth in GDP per worker…

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, The Conference Board

…largely as the consequence of capital accumulation. The question is thus whether this is sustainable.

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, The Conference Board

China’s working age population peaked in 2015 and has been falling since. Average annual employment growth over the last ten years is at -0.4%. But GDP grew on average by 6.2% between 2012 and 2022, suggesting stronger GDP per worker growth (see the first chart above)

For more information on this subject, please see Emerging Markets Economic Outlook & Strategy: Is EM’s ‘Goldilocks’ moment over? (22 September 2023)

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.