The outlook for global advertising looks robust, even against the backdrop of continuing macro uncertainty. That’s the top line from Citi’s 3rd survey of chief marketing officers which questioned 175 CMOs across 5 countries.

The expectation is for 10.5% growth in advertising over the coming 12 months and 18.5% over the next 2-3 years, implying a very robust CAGR of 6%-9%.

Anticipated Change in Marketing Budgets Over Time

Percentage of Revenues Spent on ALL Forms of Advertising

Breaking it down further, the U.S. is set for 7.0% over the coming 12 months (down from 9.5% in the last survey), the UK +11.8% (stable), India +10.1% (up from 6.1% in January), China +16.1% (up from 10.6% in January) and Brazil +7.7% (down from 15.4%).

The second key finding was that short form digital video not only continues to be the largest single allocation, but is one of only two categories set to continue to take share both on a 12-month and 36-month view, the other being ‘Digital – Other Brand Advertising’. What is striking, the team says, is that other forms of digital, in particular Search and Performance Marketing are set to see diminishing share over the next 2-3 years.

Also, when the team looked at the ‘hot’ categories of Connected TV and Retail Media, they identified a contrast in outlook with the former actually expected to see a diminishing allocation over time (from 8.2% of budgets to 7.2%).

By contrast Retail Media is expected to take share albeit from a lower base (from 5.7% to 5.9%). Indeed in a recent Citi Research report Ygal Arounian takes a deep dive into the how Retail Media has gained significant importance to advertisers in recent years propelled by the growth in eCommerce, shift in the privacy landscape, and better data, targeting, and measurement.

It finds that retail media is now a ~$65B Global Market (ex-China) Growing to $110B by 2027 with Upside: That represents ~12% of total digital advertising dollars today (ex. China) and 14% in 2026.

The report suggests spend will come from newly allocated budgets, but also from offline to online shifts like shopper marketing and trade promotion spend. As more retail spending shifts online, more budgets will continue to follow suit to digital storefronts.

Media Budget Allocation Split By Medium

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

Media Budget Medium Allocation Split By Time Horizon

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

Meanwhile the CMO survey further indicates that overall budget allocations to Social Media platforms are set to increase. For the total respondent base an allocation of 24.4% pre COVID is 31.5% today rising to 37.8% in a year from now.

The report notes that allocations today are much higher in China (38.9%) and the UK (32.1%) than in other markets (interestingly the US is the laggard at 28.2%) but this dispersion is set to even out over the next 12 months with each market (ex-China) converging on c.35%.

What about AI then? In short, the survey suggests that disruption as a result of generative AI might be much less significant than anticipated.

Overall Allocation of Marketing Budgets including AI-Based Tools

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

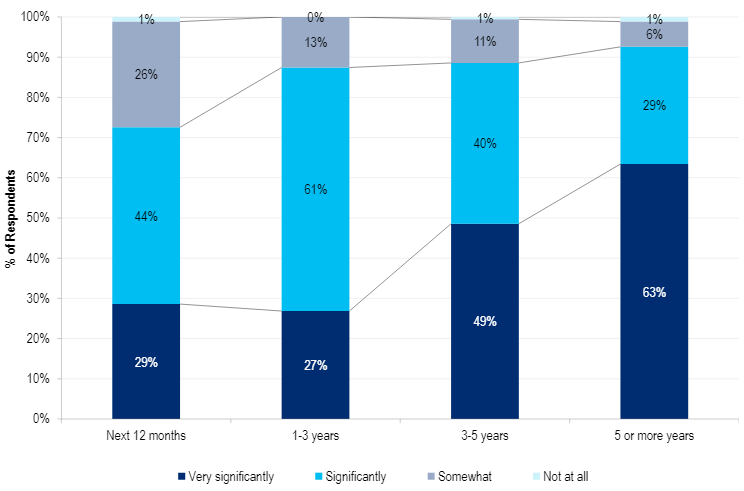

Anticipated Impact of Generative AI on Marketing Services Landscape

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

Areas of Marketing Services Most Impacted by Generative AI

Impact of Generative AI on Overall Working Advertising Spend

It seems clear that AI-based tools are already being used in marketing services. Indeed, a McKinsey & Company study from 2021 said that 20% of all marketing and sales activity had been impacted by AI in some form even back then.

The CMO survey suggests that c. 22% of marketing budgets are in some way impacted by AI-based tools and although this is set to grow over time (from 22.2% today to 22.9% in 12 months’ time and 25.1% in 2-3 years’ time) this is not really a dramatic change in quantitative terms, i.e. anticipated spend/budget allocation.

More qualitatively, however, the implication is that Generative AI (GAI) will have a more profound effect. The proportion of CMOs indicating GAI will have no effect at all is consistently between 0% and 1% across every time frame while on a 5 year+ view 63% of respondents anticipate it to have a ‘very significant’ effect on the landscape which is pretty definitive.

Perhaps most important are the CMOs’ views on the anticipated impact of GAI on absolute spending, the report said. The survey asked specifically about (1) total working advertising spend – i.e., spend on media; (2) money spent on agencies; and (3) money spent on consumer promotion.

On total ad spend, 38% of respondents expect GAI to catalyze ‘significantly more’ spend on advertising and 47% ‘somewhat more’. Meanwhile only 10% of respondents indicated they anticipated ‘no change’ and 4% any form of contraction (interestingly respondents from China are most bearish on this point).

For more information on this subject, and if you are a Citi Velocity subscriber, please see the full reports Global Advertising - Citi CMO Survey: Growth Robust Aided by China/Retail Media first published on July 26th and Global Internet - Retail Media Deep Dive: A Digital Ad Format with 1P Data and Better Measurement Gains Wallet-Share first published on July 21st

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.