A recent report from Citi Research’s Nathan Sheets and team looks at the outlook for the global economy as elections loom around the world and geopolitical volatility remains elevated.

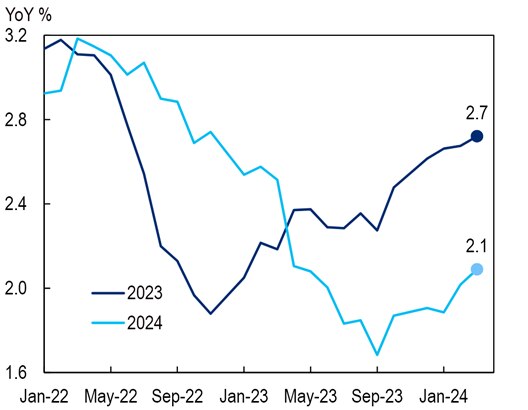

Tougher times lie ahead. While the global economy looks to have registered growth of around 2.7% in 2023, not far from its historical trend of around 3%, Citi Research economists call for a step down to just 2.1% global growth in 2024.

Figure 1. The Evolution of Citi’s Growth Forecast

© 2024 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

For context, the economy has shown significant resilience in recent years and repeatedly surprised with its ability to absorb shocks while maintaining solid growth amidst substantial headwinds. But looking ahead, most major economies are expected to slow relative to last year, with weakness concentrated in developed markets.

Here’s a breakdown of the global outlook:

- Economies that turned in the weakest performance last year — Germany, Sweden, and the UK — are expected to remain weak.

- The largest outperformers last year — the US, Spain, Mexico, and Brazil — all look poised to slow.

- China and India are expected to show solid growth though cool a little compared to last year.

- A few emerging markets look set to accelerate, including Korea which should benefit from a bounce back in semiconductor demand as well as Poland and Chile.

Citi Research economists have already marked up 2024 global growth 0.2 pct pts since December of last year as recent data have been a notch better than expected.

Here’s a little more detail:

- US growth is tracking near 1.5% QoQ SAAR in the first quarter by Citi Research’s accounting.

- Euro-area growth, meanwhile, still looks set for a weak year, but Citi Research’s 2024 forecast increased slightly and has risen for two months in a row.

- The UK, meanwhile, was in a technical recession in the second half of last year but posted an upside surprise with monthly GDP for January.

- Citi Research maintains its forecast for China at 4.6% for this year, but the government has set a more ambitious target of 5%.

- In India, growth surprised strongly late last year and Citi Research’s forecast for this calendar year has increased from 5.7% to 6.5% in recent months.

Citi Research economists remain concerned over several lingering challenges, such as the ongoing effects of tight monetary policy and the continued fading in consumers’ post-pandemic appetite for services.

Central Banks

Global central banks are now contemplating the start of their easing campaigns. The risks to central banks look increasingly two-sided. On the one hand, inflation may prove more entrenched than expected, particularly given the lack of recent progress on services inflation.

On the other hand, the longer rates stay elevated, the more central banks run the risk of holding policy too tight for too long, which could lead to sharper falls in growth and an undershooting of inflation targets.

With these considerations in mind, we expect central banks to approach policy easing cautiously and with a greater weight placed on the upside risk of sticky inflation.

Geopolitics

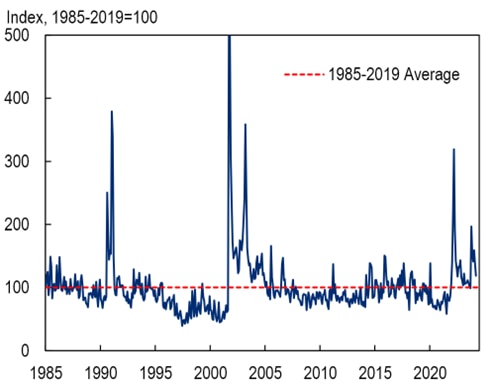

The global outlook to start the year has not been short of risks. For one, geopolitical tensions remain elevated as the war in Ukraine and conflict in the Middle East are still ongoing. By some measures, as highlighted in the figure below, the level of geopolitical stress has subsided significantly since its October spike. This pattern is also consistent with the response of financial markets—oil prices spiked only temporarily last October as did market volatility. Still, we continue to monitor geopolitical developments closely.

Figure 2. Geopolitical Risks Remain Elevated

© 2024 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, Caldara and Iacoviello

The headwinds from fiscal consolidation could also ultimately end up being less than feared given this year is a historic one for global elections.

Governments may delay some of their intended tightening for this year or pass some stimulus measures to win the hearts and minds of voters. The UK, for example, recently announced modest tax cuts.

These elections also pose policy risks that may not move the dial for 2024 growth but will underpin the prospects for the global economy for years to come. For example, the Citi Research analysts expect that these elections will have a pivotal influence on the path of globalization.

For more information on this subject, and if you are a Velocity subscriber, please see the report, originally published on 20 March 2024, here: Global Economic Outlook & Strategy: Resilience Today, Slowdown Tomorrow?

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.