A series of severe supply shocks continues to rip through the global economy. As the year began, Citi Research economists were hopeful this narrative could be shifting. But the headwinds instead seem to have become more intense and debilitating.

Firstly, the pandemic, which for over two years has shaped global economic performance, remains persistently in play. China looks to be coming out of its recent lockdowns, and economic activity there appears to be bouncing back, but the damage to performance has been done.

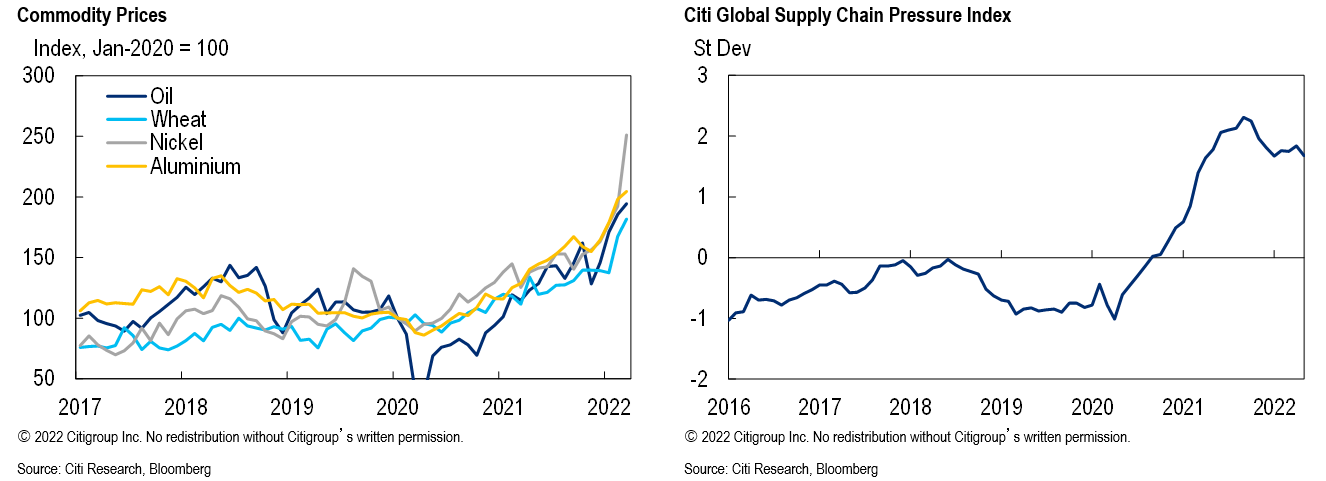

Second, the war in Ukraine is casting a long shadow across the global economy. The resulting stresses are particularly intense in Europe, given its dependence on Russian energy and other commodities. What’s especially unsettling is the lack of any clear pathway to resolving the conflict, as well as the uncertainty as to how the tensions will evolve. Largely for this reason, commodity prices have remained high and volatile, which has been another source of global stress.

Third, supply chain tensions remain in play. After peaking last fall, these pressures moderated a notch late last year but have since moved sideways. Citi Research economists remain on high alert for further pressures in coming months, as the effects of the lockdowns in China and the constraints on commodities and materials supply from Russia-Ukraine work their way through the system. In addition, firms typically move in the late summer and early fall to fill their shelves and warehouses in the run up to the fourth-quarter holidays, so seasonal shipping pressures may also soon be in play.

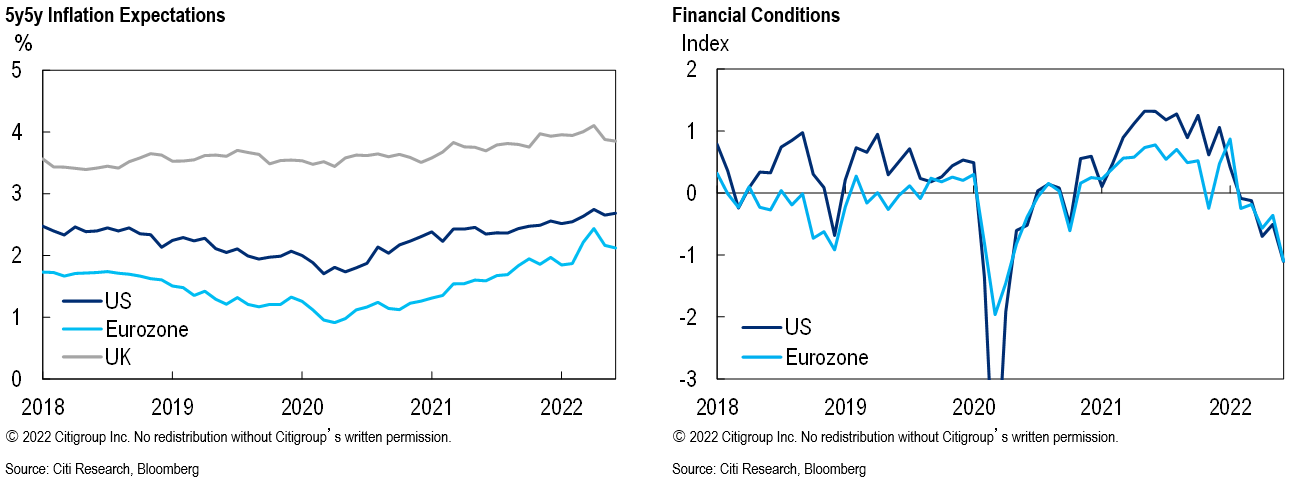

For some time now, these supply shocks have torn their way through the global economy, pushing inflation to high levels and increasingly constraining real incomes and growth. The key question shaping the global macro outlook—and which is at the center of the recent financial market volatility—regards the balance of these forces. What is the trajectory of inflation versus growth over the next 18 months?

How Does the Story End?

Given the various cross-currents influencing the global economy, the question on the minds of market participants is what comes next? How do these competing cross currents play through? Clearly, the global economy could yet evolve in any number of directions. But simply saying, “it’s complicated”—while perhaps scoring points for intellectual candor—provides little guidance for investors seeking to navigate this episode.

With this in mind, we draw on the observation in the first paragraph of this essay that the global economy is in the jaws of some severe supply shocks. We see this as suggesting three distinct scenarios for the global economy going forward. We consider each of these in turn:

- First, the supply shocks could ebb, which would create tailwinds for central bank efforts to restore macro stability and support a soft landing.

- Second, the shocks’ inflationary features could dominate, with the global economy seeing a longer period of high inflation than central banks are currently forecasting.

- Third, the growth headwinds from the shocks and central banks’ related tightening could drive the global economy into recession.

To be concrete, the FOMC’s projections envision headline PCE, their formal target, running at 2.7% at the end of 2023 and 2.2% at the end of 2024. But what if the path over the next three years is instead 3.3%, 2.7%, and 2.2%? Or even, over the next four years, is 3.6%, 3.1%, 2.6%, and 2.1%? Would such paths justify inducing a painful recession? After all, there is no chapter in the handbook of central banking that dictates the necessary timing along which inflation must come back to target. And over the years, economic research has struggled to find meaningful costs of allowing inflation to run with a 3-handle versus outcomes close to 2%.

But if inflation remains stubbornly high or longer-term inflation expectations begin to bleed upward, central banks will likely conclude that their options are limited. In this case, they could feel obliged to hike aggressively to defend their credibility, and recession probabilities will correspondingly rise.

For more information on this subject, please see Global recession risks rise further

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.