In 2023, the proliferation of ChatGPT and other Generative AI tools tailored for retail users have democratized the adoption of AI. This is putting pressure on the investment management industry to leverage this technology for innovation.

This year’s report starts by assessing how investment managers could use AI tools to improve their approach to idea generation. It then discusses how AI capabilities provided by FinTechs can be used by investment managers in their ESG investment approaches. As such it highlights specific use cases throughout the investment value chain along with the benefits and risks associated with AI.

Continuing the theme of ESG, the authors examine how proxy voting is being deployed by investment managers as a part of their ESG toolbox.

Next, the authors shift to the realm of technological advancements, exploring the trend of tokenizing real-world assets and how both traditional and decentralized finance are using tokenization. Tokenization may provide benefits such as enhanced portfolio diversification and reduced operational hurdles. The report also looks at the intersection of private markets and wealth management and considers the technology deepening that relationship-- namely digital platforms and tokenization.

Extending this argument, the focus shifts next to the tools used by alternative and wealth managers today to enable investors to access private market investments, even as the investments remain relatively illiquid.

Wealth Platforms Bridging the Gap Between Wealth and Private Markets

Source: Citi Business Advisory Services

In the wealth ecosystem, digital platforms are providing greater access to private funds through digitization and the enablement of lower investment minimums. These platforms allow wealth investors to access and invest in several different funds in one place. The platforms then aggregate commitments from multiple investors to each fund into feeder funds that are invested into their respective master funds.

Continuing the theme for wealth management, the report considers how wealth managers are using technology to reinvent their business models, delivering broader capabilities to their clients. This mindset could enable wealth managers to build offerings that are more holistic in nature across an investor’s total wallet.

And lastly, the authors take a step back and assess how the various demands from investors could change the investment management industry. They split this analysis into four parts:

-Potential outcomes for pension plans in a decumulating world.

-How the industry could shift from generic approaches to create customized solutions and then eventually fully personalized portfolios.

-How the industry might adapt to a bespoke product creation framework, and how each type of firm could take advantage of the emerging landscape.

-Reflections on how sovereign wealth funds and public pension funds could lower their cost per dollar managed by expanding their pool of investors and potentially fund strategic priorities.

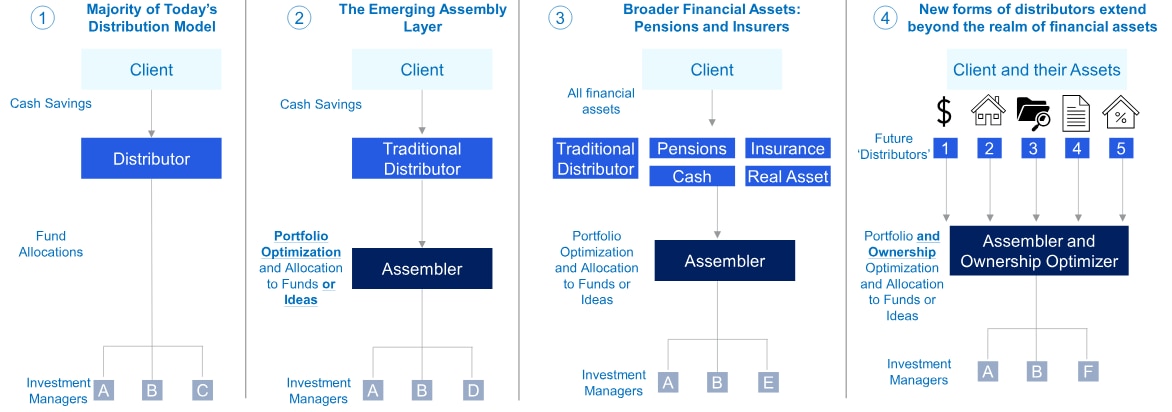

Extending Beyond the Financial Realm to Ownership Optimization

Source: Citi Business Advisory Services

Within this discussion, the authors delve into how the investment management industry’s role could expand beyond financial assets and what this could look like in terms of today’s ecosystem of managers.

In this framework, the selection of managers, shown at the base of the diagram above, could change depending on the range of assets and the degree of control and responsibility awarded to the various market participants, especially the assembler and ownership optimizers.

For more information please find the full report, first published on November 2nd here TrendWatch: 2023 Edition

Citi Global Insights (CGI), Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.