Russia is not only the top supplier of enriched uranium, it is also the largest builder of new nuclear plants around the world. As such, it is both difficult and costly to wean off Russian supplies in the short- to mid-term.

Because it is used in nuclear energy generation, uranium is an important commodity in this era of energy transition, energy independence, and energy security. Nuclear energy generates around 10% of electricity produced today globally; almost 20% in advanced economies; France is the leader with 70% of electricity generated from nuclear energy.

The Russia/Ukraine conflict heightens and exacerbates the risks to the reliability of nuclear energy, with Russia being a critical player in the uranium market and nuclear energy, generally. Russia’s future role in global nuclear infrastructure is in question in light of recent geopolitical developments. While Russia is not a significant supplier of uranium (about 6% of global trade), it is a substantial exporter of enriched uranium (26% to the world of uranium fuel). France, Netherlands, Germany and the UK are among the other largest exporters of enriched uranium.

Also, Russia has installed and is currently constructing a number of reactors across the world, exporting its leading expertise and sphere of influence in nuclear markets. A Russian state-owned corporation is securing its market share in various regions by first building water-water energetic reactors (VVER) and then providing required maintenance and servicing for those reactors over their lifetime.

Electricity baseload based on type of energy |

Efficiency of the nuclear fuel |

|

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. Source: Citi Research, EIA |

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. Source: Citi Research, American Nuclear Association |

Uranium and uranium fuel from Russia

Russia is not the largest uranium producer in the world, with only 6.9mln lbs of U3O8 being produced in 2021- proportions are shown in the graph below. The majority of that production is needed to fulfill domestic needs, as Russia currently has 38 operating reactors and required over 12mln lbs of U3O8 for domestic needs in 2021.

U3O8 production, by country share in 2021 |

Major exporters of uranium, % of world trade, 2020 |

|

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, UxC |

Source: Citi Research, OEC |

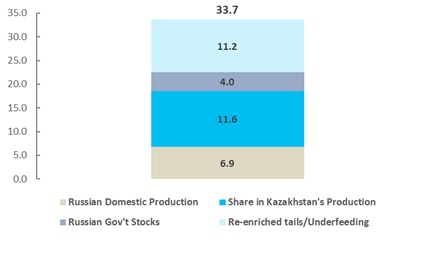

In addition to domestic uranium production, Russia holds a significant share in Kazakhstan’s uranium production. It is estimated that of the total of Kazakh production of 56.7mln lbs of U3O8 in 2021, 11.6mln lbs of U3O8 belonged to Russia – 20% of Kazakhstan’s production.

Russian supply to the uranium market in 2021 (mln lbs U3O8) |

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. Source: Citi Research, UxC |

US dependence on Russian enriched uranium

The US dependence on Russian uranium began after the collapse of the Soviet Union, when large stockpiles of uranium were not needed anymore. The “Megatons to Megawatts” program was introduced back in 1993 and ran up to 2013, where highly enriched uranium was dismantled from Russian nuclear weapons and transferred for civil needs and ultimately sold to the US utilities.

The Russian Suspension Agreement (RSA) was also put in place, to control levels of uranium being sold from Russia. This agreement was amended several times and recently was extended to 2040. The recently amended RSA (2020) aimed at protecting the domestic US uranium producers and conversion industries by introducing a quota for imported EUP. The EUP quota for Russian-originated products drops from 24% of US enrichment demand in 2021, to 15% annually from 2028 through 2040.

However, the agreement also grants an exemption for the import cores and allows for exemptions if there is insufficient supply to meet the US demand. Such an agreement was put in place long before the Russia/Ukraine conflict and suggests that the US Department of Energy (DOE) has identified this as a potential vulnerability and has been trying to limit Russian dominance in the domestic market.

The full report goes into greater depth on the uranium fuel cycle and the its importance and historical background and includes an in depth section on Russian reactors around the world.

For more information on this subject, please see Global Commodities: Uranium fuel and Russian dominance in nuclear energy could be challenged, but can anything replace them? A primer

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.