A recent report from Citi Research’s Nathan Sheets and team examines the path of a more grown-up kind of globalization.

What’s next for globalization? The Citi Research report assesses some of the competing forces at play and sketches out the implications for global trade, capital flows, migration flows, and supply chains. The full report is formed around 12 key questions and answers that take in the most important aspects of the debate. These include the trajectory of goods and services trade, supply-chain management strategies, the evolution of global capital flows, the dollar’s role as a reserve currency role, and the rising use of economic sanctions.

Citi Research analysts say in the full report that although the unrestrained globalization of the late 1990s and 2000s is behind us, and possibly now even looks a touch naïve, they are skeptical that the process will be reversed. Instead, what they term as a more mature globalization is likely to emerge.

While the pace of globalization is likely to be more measured than in previous decades, it will also be more mindful of potential pitfalls and therefore better placed to reap important benefits, they say.

As the chart below shows, global trade sped up during the decade before the global financial crisis, rising from 40% of global GDP in 1955 to 55% of GDP in 2005. This period also saw the deepening integration of European trade and markets via the European Union and the introduction of the single currency in 1999. At the same, protectionist barriers came down and companies diversified their global supply chains. Offshoring increased. And China rose.

Figure 1. Global trade (share of GDP) accelerated in the decade before the financial crisis

© 2024 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research. World Bank, Haver Analytics

Some of the Citi Research report’s key conclusions are as follows:

-Various measures of global integration largely stalled during the decade after the global financial crisis. Global trade as a share of GDP flattened out, and some capital flow measure also levelled out. The gathering headwinds were further evidenced in the 2016 Brexit vote and the election of Donald Trump as US president.

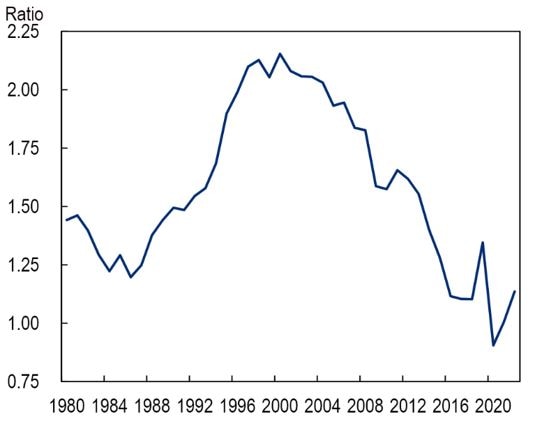

Figure 2. The ratio of global trade growth to global GDP growth hovered near one in the decade before the pandemic

© 2024 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research. World Bank, Haver Analytics

- Recently, the headwinds appear to be gathering strength. The pandemic highlighted many countries’ dependence on global trade for key goods. Policymakers are considering the benefits of moving toward increased economic self-sufficiency and reduced reliance on trade.

- Global trading relationships have also been pressured by geopolitical developments, including the Russia-Ukraine war, recent shipping challenges in the Suez Canal, and US-China tensions, which have led to tariffs and sanctions.

- Global supply-chain strategies are also being reconfigured. Firms are in some cases moving to more diversified sourcing strategies, bringing supply chains closer to home, and holding larger inventories. Whether this ultimately means less globalization—or a shift in its contours—it’s too early to tell.

- The pandemic also brought a sharp drop in global migration flows. But once the pandemic eased, migration flows surged again. This meant expanded labor supply in many DM countries, which has helped satisfy the demand for workers. In tandem, however, social and political concerns about the size of these flows have prompted debate and, in some countries, policies to slow the pace of migration.

-The dollar’s reserve currency status has proven to be robust, perhaps surprisingly so. Despite China’s increased economic prominence, as well as legitimate concerns about the quality of US economic policies - particularly the soaring public debt - key measures of the dollar’s international usage have barely moved. The analysts put this down to the world’s familiarity with the dollar, the depth of US financial markets, and the willingness of the Fed to act as an international lender of last resort during crises.

The motivation for globalization, the report notes, has arisen from advancing technologies, rising consumer incomes, an effort by firms and investors to increase efficiency and profits, and the desire of human beings to explore, learn, and improve their lives. None of these impulses is likely to be easily blunted, the report says.

As these various headwinds and tailwinds collide, Citi Research analysts say they expect that a more mature and compelling globalization will emerge. Globalization does offer real economic benefits, they note, but to reap the full range of those benefits-and to maintain political support for the underlying policies-policymakers must be mindful of the distributional and social consequences.

In sum, the Citi Research report says that the next chapter of globalization will incorporate the tough lessons learned over recent decades, with the result likely be more measured and circumspect than previously, more likely to avoid the potential pitfalls, while harvesting many of the important benefits.

For more information on this subject, and if you are a Velocity subscriber, please see the full report (originally published on 22 February 2024) here: Global Economics - Globalization vs. Deglobalization: What’s Next?

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.