Future of Payments Survey

Insights from Citi’s “Enable Banks” Growth Mission Co-Heads

KD: Dawid, Will, thank you for taking the time to talk today.To set the scene, we have recently engaged over 100 of our financial institution clients to partner with us on a “Future of Payments” survey, and I would love to get your commentary on its results as we are making them available to the industry. But first, why do we feel it was the right time to take a pulse-check?

DJ: Thanks, Katie. Honestly, we are going through unprecedented levels of change in payments driven by a shift in client expectations, accelerated adoption of new technologies and increased focus from regulators on customer protection, resilience and fostering innovation. We see the evolutions of message standards, open banking and digital assets often acting as innovation catalysts. It is by far the most dynamic time in payments that I have experienced in my banking career.

WA: To put it simply, the very attractive and growing cross- border payments revenue pie is going to be split between various players very differently 3-5 years from now. Our survey offers an indication of what may be needed to be on the winning side of this reshuffle.

When you then add the dynamic competitive landscape into the mix, with disruption from fintechs and challenger banks, “traditional” banks must respond to this evolving environment. This is a call to action for any institution, who wants to win on the back of this transformation: the time is now!

KD: The time certainly is now, but what have our clients told us about the impact this is having?

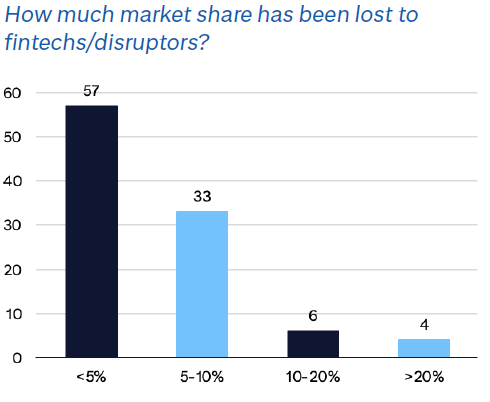

WA: The findings on this were not overly surprising, yet, still troubling. Of our bank clients who were surveyed, 2 out of 5 indicated that they lost at least 5% market share to fintechs. A staggering 89% of respondents said they expect to lose at least 5-10% market share over the next 5-10 years. In some follow-up conversations our clients have even said that they believe the 5-10% disruption they have seen is significantly higher in the cross-border space – this absolutely has to focus our collective response.

DJ: What makes it more concerning is that over half of our bank clients (58%) believe they will lose greater than 10% market share — that could be a game-changer! When we ask who is eating the biggest piece of the pie, the results point toward institutions investing heavily in the client experience.

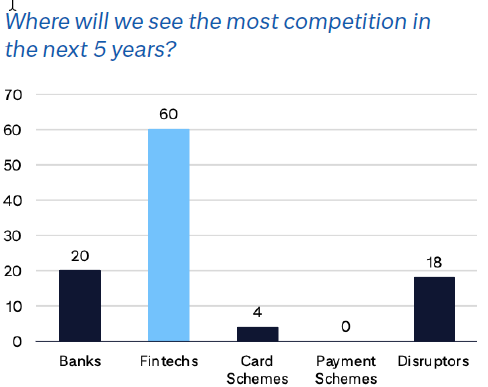

WA: That’s not surprising. The level of change in this space will favor those embracing the elevation of and concentration on client experience, and the reality is fintechs are usually better at this, particularly with frontend technology. It helps explain why 59% of our bank clients indicate they view fintechs as the greatest threat to their market shares.

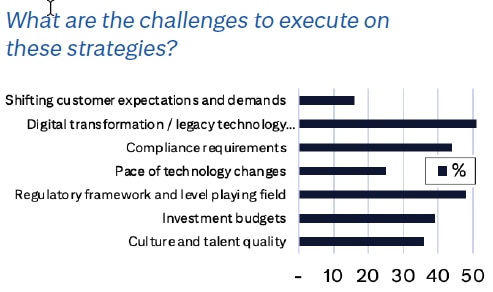

KD: Wow, these numbers can’t really be ignored. So, what would stop banks doing something about this immediately?

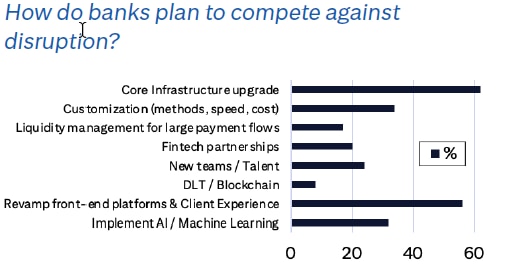

DJ: Honestly, when you peel back the layers, it comes down to competing investment priorities. While over 50% see the need to revamp frontends to improve client experience, over 60% of respondents point to the need to upgrade their core infrastructure. Tackling both transformative projects at the same time is no small task.

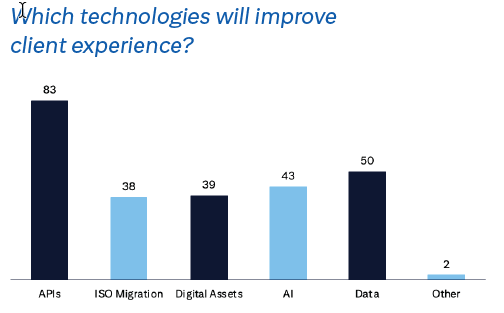

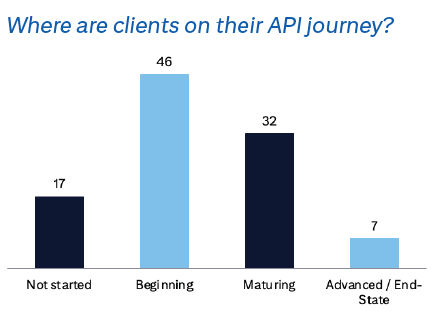

WA: Our bank clients seem to realize the potential of APIs, pointing to it as the technology with the greatest potential to elevate client experience. The competing investment priorities keep the level of API adoption below where it needs to be, but this is changing. Over 80% of our clients have started their API journey, and we are excited about that! The flipside of that is that their corporate clients are typically much further ahead in terms of their readiness to use APIs.

KD: So, what else can banks do to get started on responding to disruption?

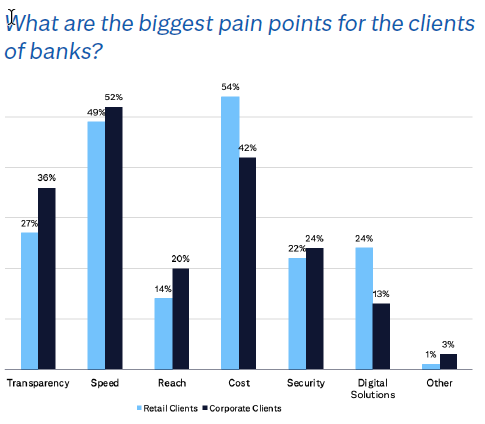

DJ: I’d say, firstly, banks should take a look at the key pain points their clients are facing. Based on our survey results - cost, seed and transparency lead the pack as significant client pain points.Second, banks must make an honest assessment about whether to build, buy or partner to evolve their offering to help differentiate themselves as the best bank for their clients in addressing their pain points.Third – they should consider evolving different solutions for retail, corporate and treasury clients as their expectations vary meaningfully as the underlying flows are different in nature. We have also found that “doing it alone” is overwhelming — and unnecessarily costly — given all other priorities. That’s why we consider collaborating to help deliver better solutions to underlying clients as the sweet spot.

WA: Agreed, Dawid! I think it would be worthwhile here to talk through a real-life example to make this more meaningful. We had a large retail bank in North America who wanted to double down on retail and commercial flows by leading with a cross-border payout solution to rival the innovative fintech’s. They wanted to regain wallet share and respond to competition who have launched online, app-based cross- border payment offerings.

We were able to extend their currency footprint to 120 currencies —increasing their FX revenue and attracting new clients — with our WorldLink cross-border payment platform. The solution also provided them with the scalability needed to support higher volumes through their expanded cross- currency payment capabilities.

DJ: We know, however, that one size does not fit all. While API based solutions are the Northern Star, there is probably a lot which can be achieved even without APIs in the interim in a very cost-efficient way without the need for substantial

investment – for example ensuring very consistent experience when it comes to deducted fees to increase transparency, offering client friendly options for beneficiaries to track incoming payments, or increasing ability to deliver payments on holidays in increasingly 24/7/365 fashion. Citi works with many bank clients to deliver these without any investment from their end, and even without any implementation requirements on their side.

KD: What else should banks consider when developing a solution with a partner?

WA: Anything that clients are considering should always come back to how pain points are being addressed. In the survey, over half of our clients indicated cost, particularly in the retail space, is their biggest consideration. When you engage in a relationship with a provider that already can offer a vast amount of choice — including cross- border ACH, IP, wallets, etc. — you can work toward the goal of reducing cost.

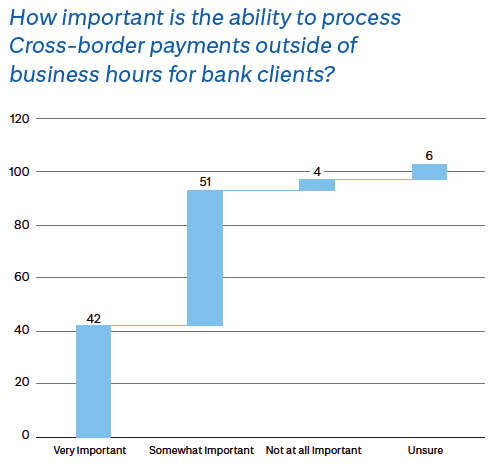

For many clients speed – which often ties to 24/7/365 service availability - is the key. To address the cross-border payments needs of such clients, banks need a partner that can deliver on the 24/7/365 evolution and be able to support the various instant payments methods that are continuously being expanded.

KD: Gentleman, thank you for taking the time to share your thoughts and observations from the survey.

| Survey Results | |

|

|

|

|

|

|

|

|

|

|

|

|