Global landscape of risks facing multinational corporations

Treasury leaders today face a myriad of risks such as political risk, financial risk, and digitalization risk. Finding the right balance and determining the key areas to focus on can be daunting. Nevertheless, treasurers have to examine these risks to best prepare for unexpected events as part of a prudent risk management framework.

Given the prevalence of geopolitical uncertainty and increasingly frequent unpredictable global events, treasury is exposed to significant political risk that influence the way they operate globally. As if that were not enough, treasury is also facing an environment of currency volatility, inflation, interest rate rises, and bank closures; as it consequently becomes harder for them to accurately forecast foreign exchange, interest rate, liquidity, and counterparty risk.

Global crisis preparedness: So, what can treasury do?

In order to mitigate potential risks, there are three steps treasury can take to help reduce risk and ensure their organization is well-positioned to react to adverse situations. The following is a roadmap of best practice observations based on what some of the leading companies have done.

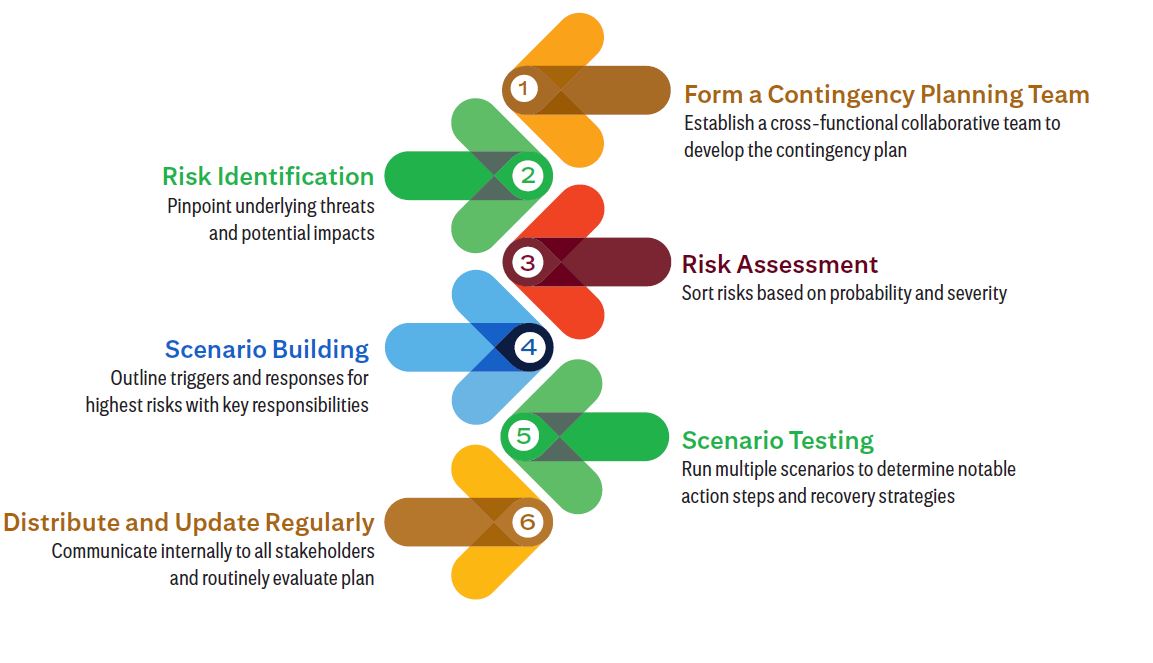

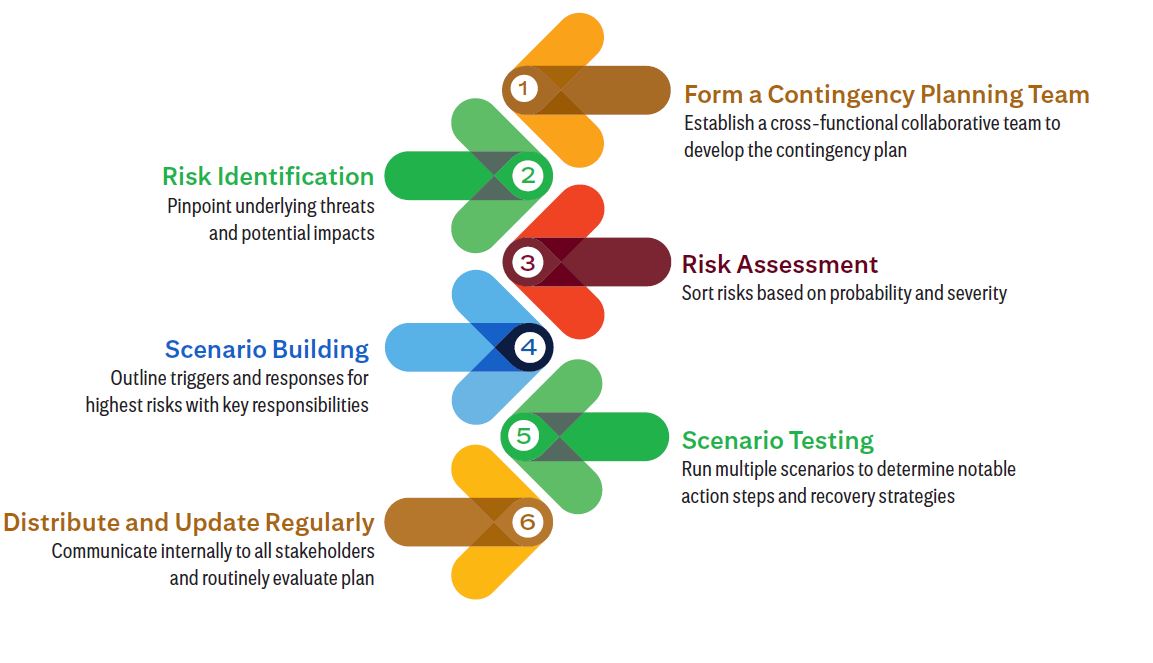

1. Contingency planning

The contingency planning process can be utilized to simulate multiple scenarios and different potential outcomes depending on the idiosyncratic risks that the treasury’s organization faces based on its industry, countries, and currencies. Scenario planning and stress testing of treasury flows and financial risk exposures, including customer and bank exposure, is now more important than ever to help treasurers plan for potential shocks and prepare on how to best manage.

An important example is the stress testing of supply chain resilience. What if certain suppliers temporarily halt or suspend their operations due to a crisis? Would the organization have backup options to meet the ongoing demands of their customers? How might this impact funding and working capital management? It is essential for treasury to consider such scenarios in their contingency planning process to be better prepared in facing the fluctuating and ever-evolving risks that an organization faces.

Treasury needs to have a clear contingency plan in order to help avoid organizational chaos in times of crisis. Together with their internal partners including the executive committee, tax, legal, and other key internal and external stakeholders, treasury can formulate a comprehensive contingency plan that can help minimize disruptions in the event of a crisis.

2. Functional Centralization

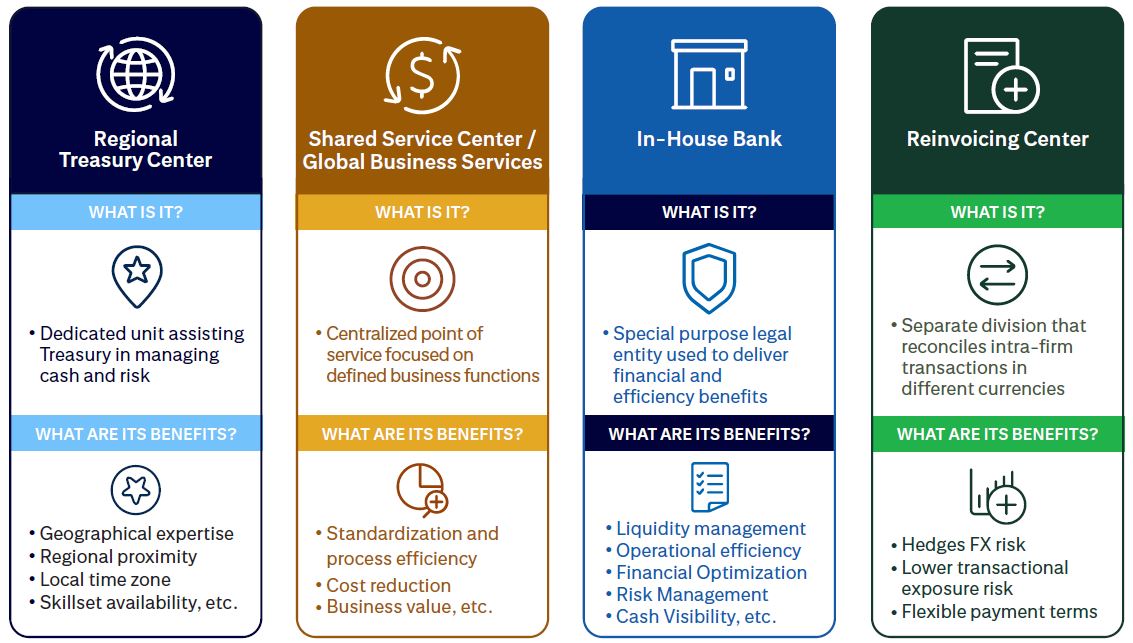

Treasury has to functionally centralize to be able to act swiftly and nimbly in the event of a disruption. This doesn’t mean that treasury’s operations should be all in one place – instead, treasury should look to disperse across functions of people, process, and technology, while also considering the finance organization. The prevalence of hybrid and remote working models also means that treasury can be unencumbered in distributing their organization, rather than having its people congregate in concentrated places.

Treasury can review the various treasury constructs such as In-House Bank (IHB), Regional Treasury Center (RTC), Shared Service Center (SSC) and Reinvoicing Center, to see which one or a mix can complement its organization based on their unique needs and circumstances. With functionally centralized treasury centers, an organization can be better prepared to face uncertainty versus having a single global treasury model. In the event that one center encounters a crisis, there would be other centers that could support global treasury operations preventing further disruption to the organization.

Once treasury has decided the most suitable treasury constructs, they can then assess physical locations, taking into consideration:

- Legal, regulatory and governance framework

- Trading environment

- Taxation considerations

- Financial markets

- Innovation ecosystems

- Availability of talent

- Quality of infrastructure

3. Geographical Diversification

Treasury should always assess locations for treasury centers considering a range of factors including political and economic stability. Geographic diversification of a centralized treasury function can help to ensure business continuity in the event of a crisis.

As an example, treasury can consider having a RTC located in a different country than the headquarters treasury center. In the event of a crisis in the headquarters country, treasury can still have access to their liquidity and help prevent disruptions to their operations, including the processing of payments and invoicing. If payments and receivables are part of a separate finance organization, while it might not be fully under treasury’s control, they can still advise their colleagues and keep in mind what other parts of the organization have to deal with.

When a treasury assesses countries to diversify its geographic location, it is important to consider:

- Proximity of important markets to the business

- Country’s technological readiness

- Financial market development

- Infrastructure

- Macroeconomic environment

- Currency convertibility

- Tax implications

- Financial market depth

- Access to people

- Access to foreign exchange markets

- Time zones

- Regions treasury may need to support

- Holding minimum liquidity in different countries to minimize trapped cash

Conclusion

While the “Plan, Centralize, Diversify” construct outlined above will not be able to fully ensure zero disruptions to an organization in the event of a crisis, treasury can be better prepared and positioned to face uncertainties – and know how to swiftly react – when unexpected events occur.

These materials are provided for informational purposes only and are intended for institutional clients and not as a solicitation by Citi for any products or services. The materials may include market commentary, views and/or opinions of the Citi Treasury and Trade Solutions Client Advisory, based on reasonable analysis of information available to the group. Although the content herein is believed to be reliable, these materials and the information herein do not constitute legal, accounting, tax, or investment advice and Citi makes no representation or warranty whatsoever as to the accuracy or completeness of any information contained herein or otherwise provided.