The past year or so has been defined by challenges and uncertainty for global trade due in part to supply chain disruption brought about by the pandemic and a boom in demand. In this report, we discuss the current state of play in supply chain disruption and present why it can be imperative for corporates to engage with a bank that could help navigate through the storm.

State of Play – Supply Chain Disruption

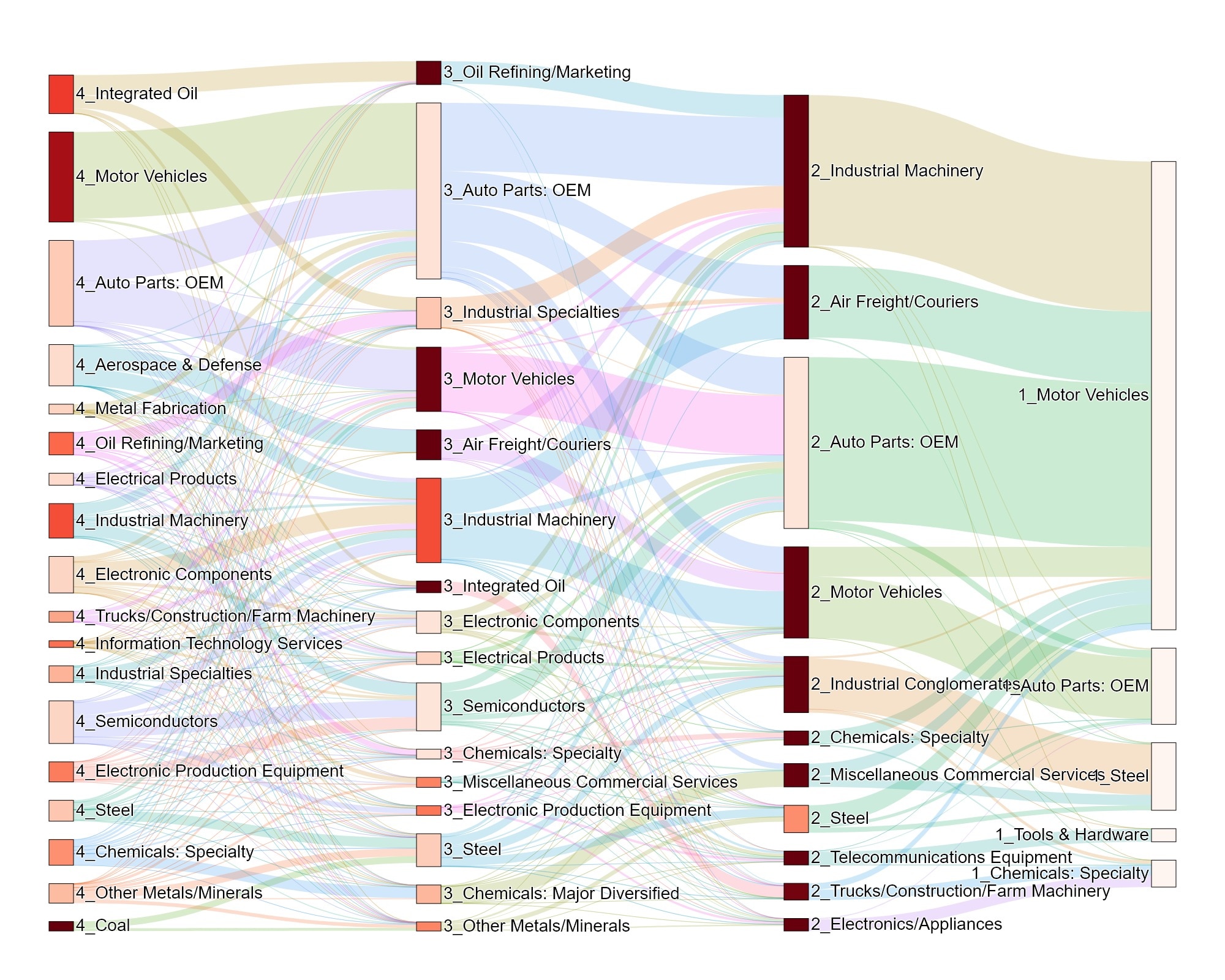

The supply chain of large multi-national corporates can be extremely complex due to the global nature of operations and the diversity of products produced. By taking a sample of 12 large industrials companies globally, we demonstrate the inter-sector dependency of supply chains of these companies, tracing three layers upstream of their suppliers.

Figure 1. Supply Chain Dependency – Industrials

Source: Citi Global Data Insights, Bloomberg

In Figure 11, the colour intensity of the sector corresponds to how ‘concentrated’ that sector is. This can be a useful proxy to help identify sectors in the supply chain that are heavily reliant on a few companies, which may make them more susceptible to supply chain shocks. It is evident from the diagram that Auto Parts and Semiconductor supplies are critical to this sector, but attention should also be paid to the presence of multiple other sectors in this interlinked supply network.

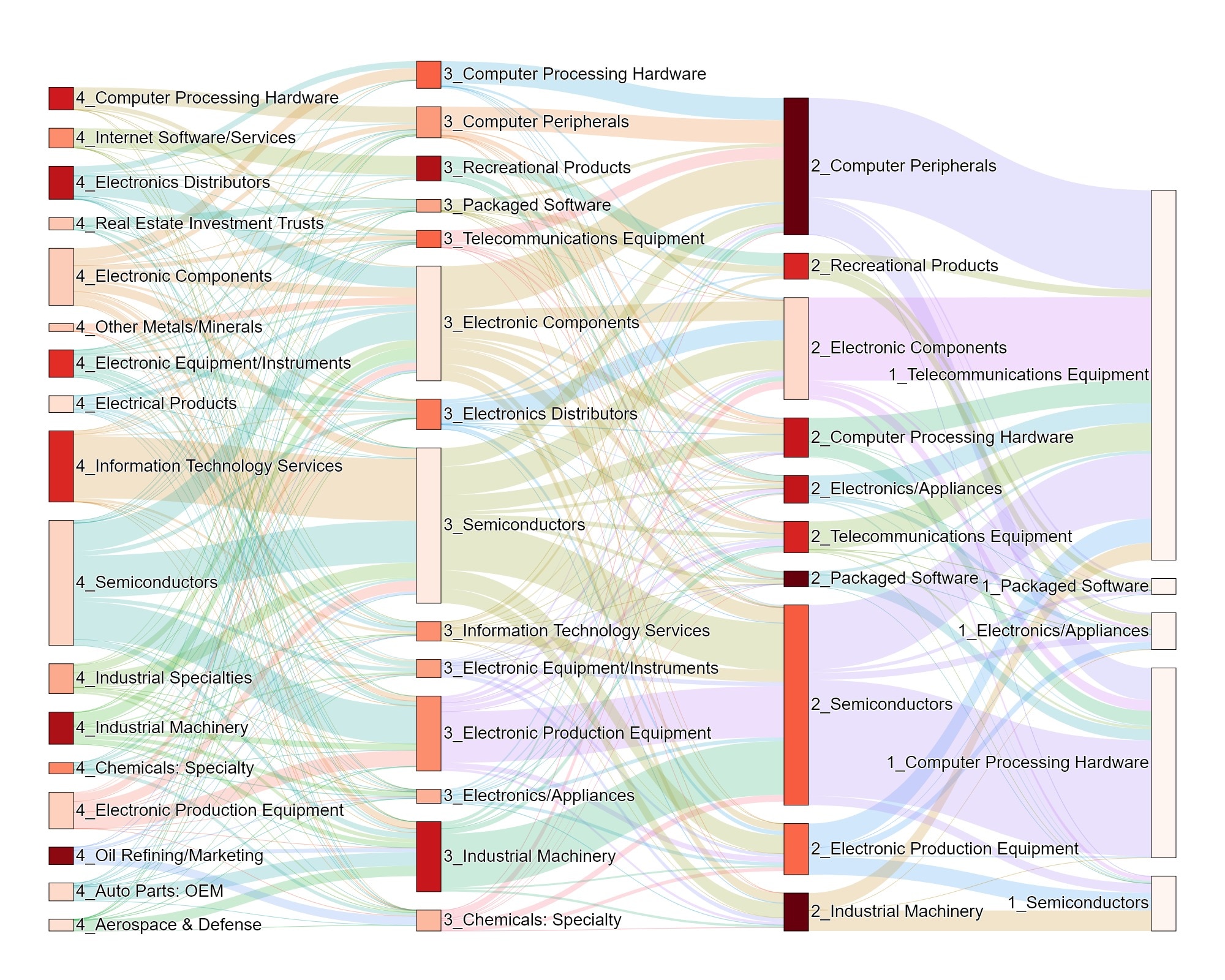

Focusing on tech2, the shortage of semiconductor equipment unsurprisingly appears to be an even bigger issue for the sector. Other tech supplies such as Electronic Components and Computer Processing Hardware are also prevalent in this sector. Similar to what we have observed of the Industrials sector, the supply chain of tech broadens out rapidly to other sectors with merely tracing upstream by two layers. These observations may demonstrate the expansive nature of the global trade and the scale of the problem if their supply chains are disrupted, as the ripple effect could easily expand beyond the immediate supply layer.

Figure 2. Supply Chain Dependency – Technology

Source: Citi Global Data Insights, Bloomberg

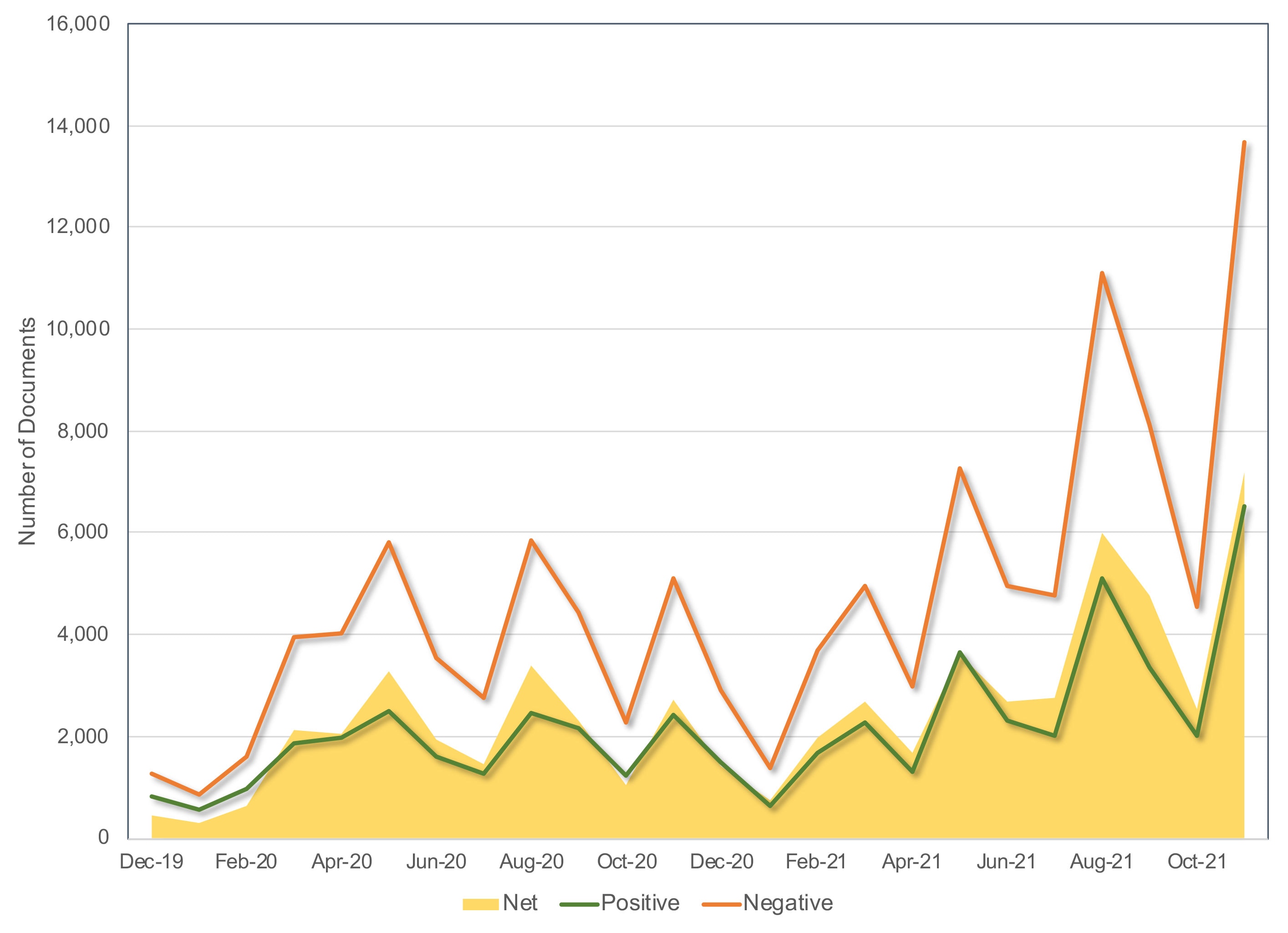

Figure 3. Supply Chain Disruption – mentions in corporate documents

Through natural language processing (NLP) on corporate filing and other public documents, we analyse corporate sentiment surrounding supply chain issues globally. It appears that the negative sentiment expressed in corporate documents has been increasing since the beginning of 2021 with a large spike seen in the second half of 2021.

Source: Citi Global Data Insights, AlphaSense

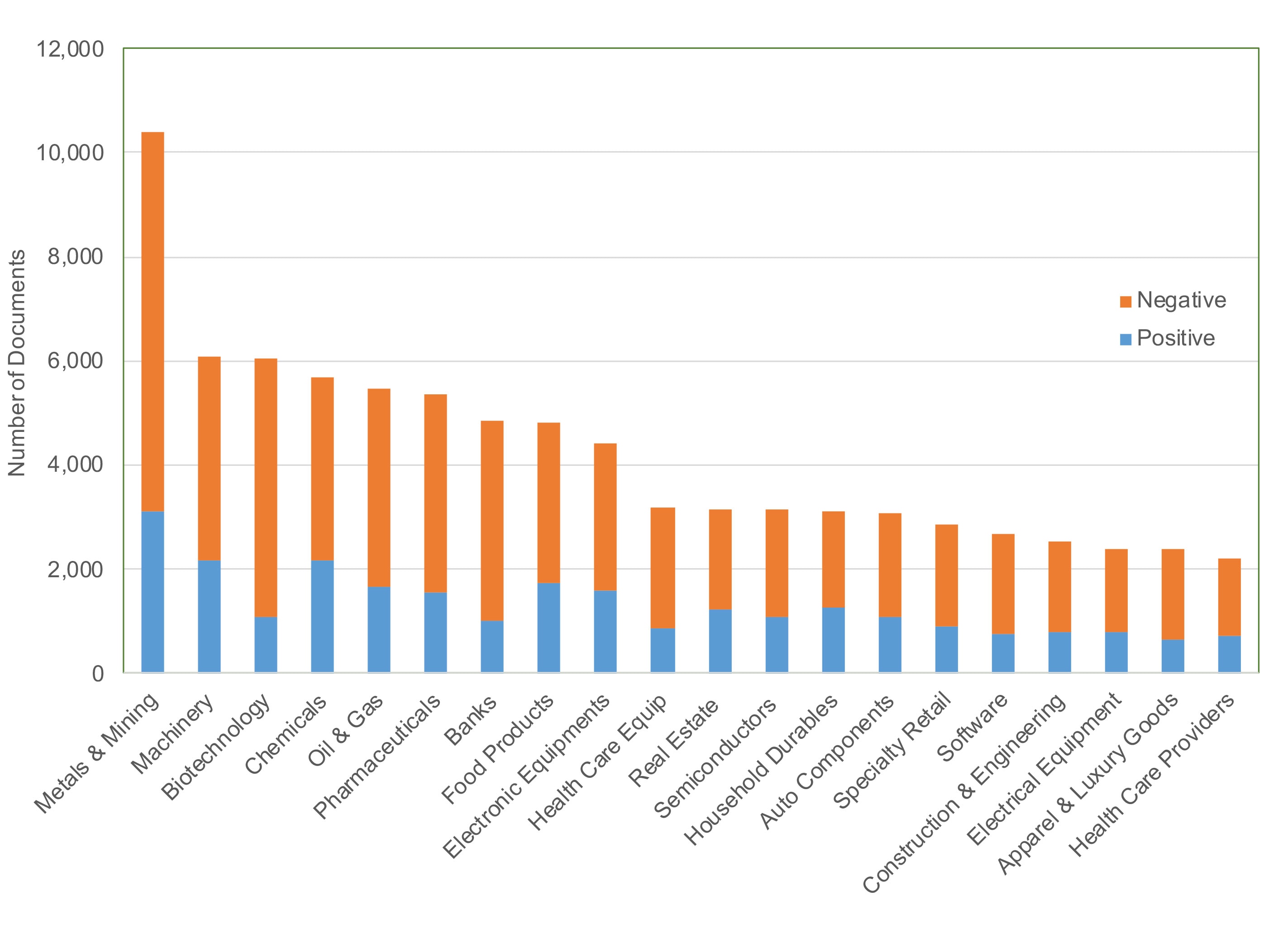

Figure 4. Supply Chain Disruption by Industry – mentions and sentiment in corporate documents

The industry breakdown as shown in Figure 4 highlights the top 20 industries where supply chain issues were mentioned with the highest frequency and where the most pain appears to be felt as the negative sentiment dominates.

Source: Citi Global Data Insights, AlphaSense

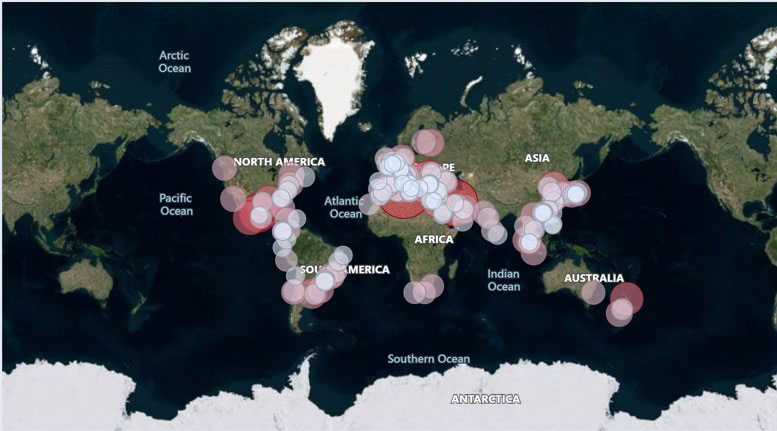

Figure 5. Ports Experience Increases4 in Average Stop Duration by Shipment

To understand the scale of the problem on the ground, leveraging shipping data from Contguard3, Figure 5 supports that the bottlenecks indeed spread across the globe with the most significant escalations in average wait time seen in the US, Asia, South America and Middle East. Most of these ports have reported double-digit increases in terms of average stop duration by shipment when comparing 2021 to 2020.

Source: Contguard

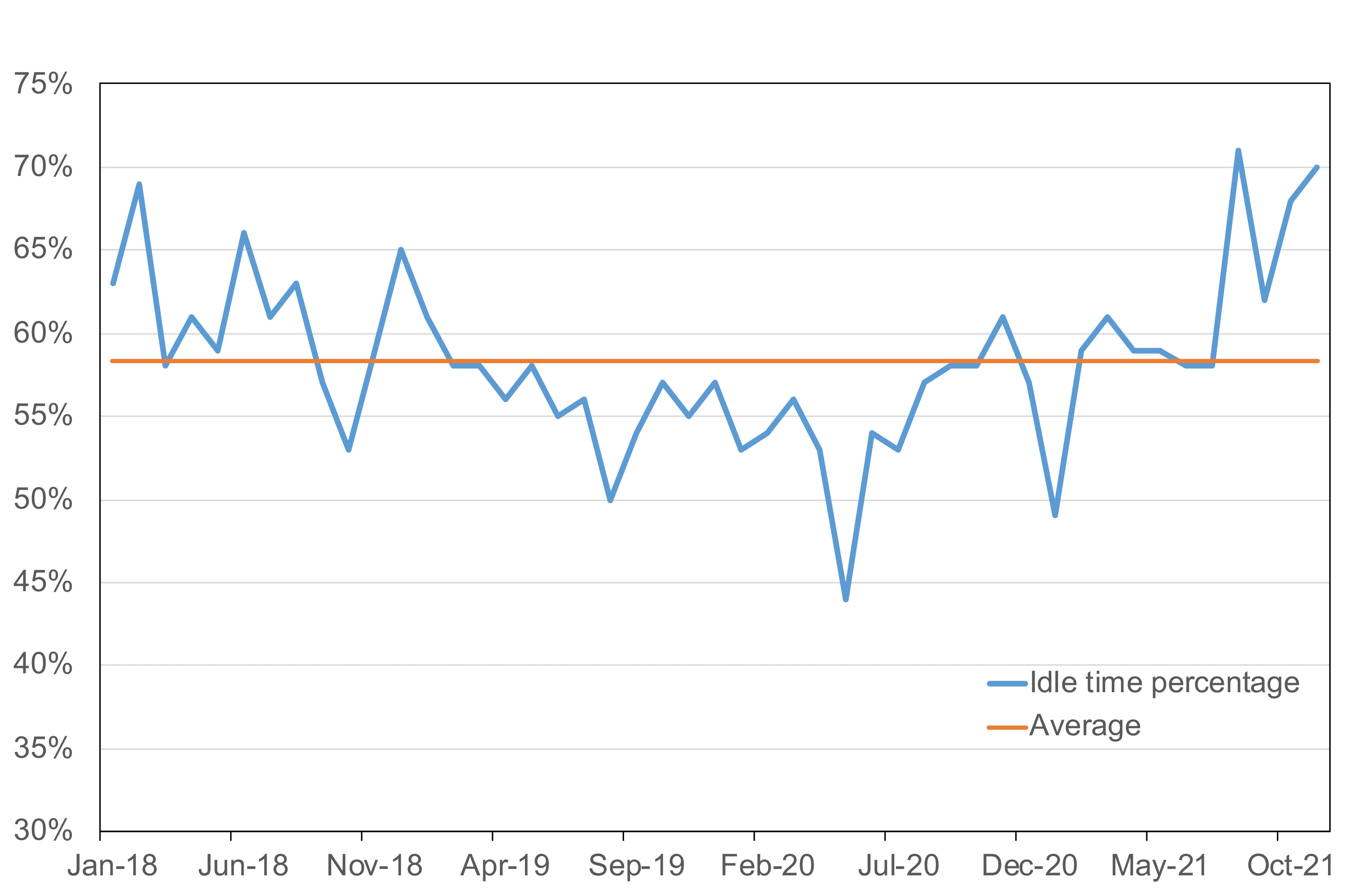

Figure 6. Average % Idle Time per Shipment

The average percentage of idle time per shipment, which can be a useful data point for corporates to optimize inventory levels, has also increased to over 70%, well above the 3-year average of 58% across the shipments that Contguard tracks.

Source: Citi Global Data Insights, Contguard

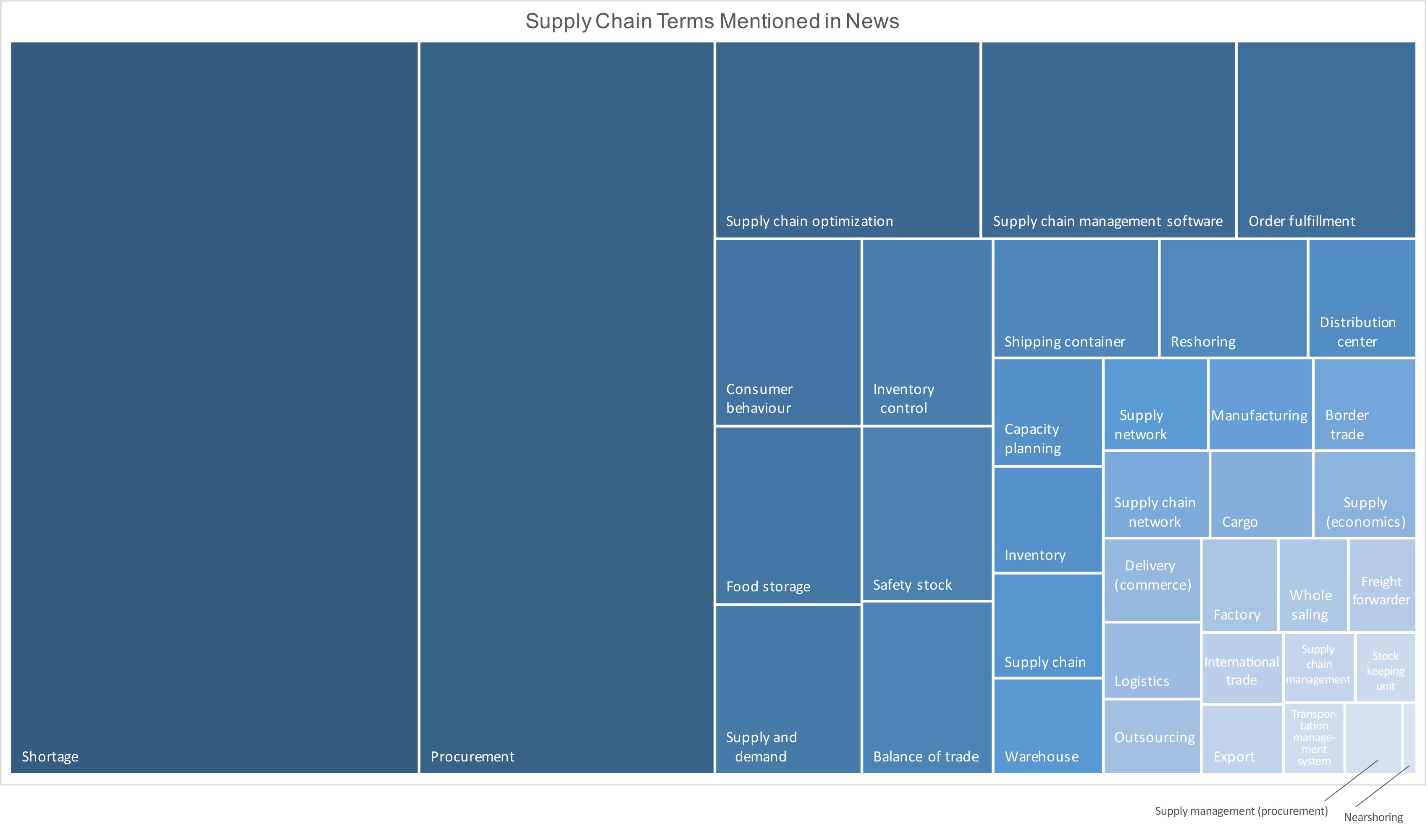

Figure 7. Supply Chain Topics Mentioned in News

Source: Citi Global Data Insights, Yewno

Supply chain issues have also been widely reported in the news media, especially over the past 12 months. By using NLP to extract topics mentioned, Figure 7 illustrates the terms that are most often associated with supply chain news articles.

Unsurprisingly “Shortage” and “Procurement” are the two most mentioned terms highlighted in the news but importantly supply chain optimisation, inventory control management and order fulfilment have also been the key topics discussed.

The supply chain challenges observed currently can highlight the importance of engaging with a bank that has a global footprint and a culture of fostering innovations to help corporates navigate potential roadblocks at this critical time.

Helping clients work through supply chain disruption

Recent events have underscored the importance of a steadfast, experienced and innovative financial collaborator and advisor when it comes to helping to mitigate exposure to market risk. The value of such partnerships can be particularly evident when businesses are required to act swiftly in response to rapid, widespread or unexpected developments.

Throughout the pandemic, leading banks have been a stalwart for businesses – working closely with clients to help support their daily operations and working capital needs and working to ensure the wheels of global trade continue turning effectively.

Examples

- The collapse of Greensill Capital put many supply chains at risk. As a result, many affected companies turned to financial institutions (FIs), like Citi, to help absorb their trade flows and financing needs. Citi provided support to several major corporates including a telco company, which faced the challenge of onboarding a high spend, strategically large client along with several hundred suppliers across multiple markets. Through regular correspondence, transparency and the company’s close management of its key stakeholders – including its suppliers – the telco’s needs were met within a restricted timeframe, helping to mitigate the risks presented by the fallout.

- As the COVID-19 pandemic reached Brazil, Citi helped Kimberly-Clark (K-C) ensure that its hygiene products were available to protect families and communities with a distributor finance solution. K-C quickly mobilised resources across its global business services (GBS) division and approached Citi to develop a solution to mutually sustain and grow our business during this difficult period. Our combined team quickly stepped up, often at very antisocial hours, to create and deliver a bespoke solution at pace. The outcome was a strategy helping to drive sales growth and support K-C’s wider distribution ecosystem, whilst helping to address working capital needs in an efficient way.

At the height of the pandemic, many supply chains came under severe strain and shifted course, buying behaviour patterns dramatically changed and some businesses experienced credit rating downgrades. U.S. credit downgrades, in dollar terms, during the 2020 pandemic shock were among the largest seen, according to Citi Research. Companies looked for banks close to their clients around the world and which were positioned to help connect clients with multilateral agencies (MLAs), export credit agencies (ECAs) and development agency financing to support them quickly and efficiently. For instance, Citi was recently involved in notable UK Export Finance (UKEF) supported transactions in which a high-end automobile maker accessed a high value loan facility as part of the Export Development Guarantee scheme and a leading engineering client was the beneficiary of a loan that gave it the financial resources to take advantage of green trade opportunities.

A global ally with local insights

But what makes such institutions so resilient and reliable during a crisis? Scale, for one, can be central. Having global coverage can enable clients to receive consistent support and access to new products – wherever they may be based or do business.

Scale can also open up access to vast networks of payables finance investors. The benefits here can be two-fold: first, businesses may be able to leverage a larger, more diverse investment pool; and second, sharing the credit support means those banks may be more diversified to credit risk and therefore may be better positioned to provide additional working capital support to clients.

Examples

- Citi implemented a global supply chain finance (SCF) solution for Halliburton in the pandemic that has helped to unlock an estimated US$150m+ in working capital globally and closed the gap on supply chain neutrality, working to align vendor and supplier terms, while supporting suppliers with competitive financing. The programme has more than 500 suppliers. Citi delivered for Halliburton in countries such as Oman and Iraq, demonstrating our global capabilities, and a truly global platform. Halliburton can see all their in-country financial supply chain activities on a single dashboard.

- Citi helped Tetra Pak International, the food packaging and processing company, implement a global SCF solution. Tetra Pak wanted to ensure consistency and efficiency and align its SCF programme with the global approach taken by its finance function. Moreover, Tetra Pak’s business model means that suppliers have relationships with multiple global buying entities; to make the SCF programme as straightforward as possible for suppliers, a truly global implementation was required. Tetra Pak developed an IT solution that covers 95% of designated countries and achieves automation via full integration with our ERP and our bank’s platform.

Citi’s global digital banking platform coupled with our local knowledge in many markets can be a great help to clients as they navigate complex markets. Helping them with changing buying patterns to minimise supply chain disruptions and helping to ensure timely payment to existing suppliers, coupled with onboarding new sets of suppliers quickly and digitally, is also in our toolkit. Given Citi’s global presence and global platforms, shifting operations from one market to another can help support a seamless experience for our clients.

Additionally, larger banks can be more self-sufficient in many of the areas that smaller providers may need to outsource. For instance, having the funding capabilities and experience to develop solutions in-house can be a differentiator. This can enable banks like ours to choose the most effective route for implementing a particular solution, whether creating it internally or through collaboration with technology providers, helping to avoid the risk of disruption driven by business setbacks.

Open for innovation

Citi’s global network of people, data and relationships fosters a mindset for effectively helping to find opportunities, manage risks and make connections for clients.

Being open to various forms of innovation and collaborations is a key requirement. Whatever the path, the destination should be delivering client-centric innovation. Citi is collaborating with multiple leading, carefully selected third parties to help bring enhancements to clients.

Leading banks have a responsibility to be an agent for change. Global banks also help shape the global trade landscape in line with client needs. Working closely with multinational industry bodies, such as the International Chamber of Commerce (ICC), is an important way to help promote positive developments. Banks are also working to help drive important developments in the industry.

Example: Trade Information Network

Some ventures, particularly those involving a significant change in industry practice, in many instances are best executed in collaboration with industry partners. An excellent example is the Trade Information Network, a consortium that Citi helped found in 2018, together with five other banks5. As an inclusive global multi-bank, multi-corporate network in trade finance, it seeks to transform open account trading by digitizing it – creating an inclusive and open industry-standard network that is open to both banks and corporates.

It allows corporates to communicate trade information to banks more easily and securely (for instance by digitally submitting and verifying purchase orders and invoices), and to request trade financing directly. Once they join, Buyers and suppliers are in control of their data, designating who can access it. Having reliable information assists banks and can help reduce errors and fraud, while at the same time having information earlier in the supply chain can help unlock earlier financing.

By deploying open architecture, standardised connectivity and governance principles modelled on SWIFT, the Network aims for maximum adoption that eases access to trade finance for a wider range of companies, including small-medium size enterprises (SMEs). The fundamental purpose is to address the persistent industry issue of the global trade finance gap, estimated at US$1.5 trillion6, which affects SMEs, thereby helping such businesses and global trade, to reach their full potential. Citi will use the network to offer additional financial support to suppliers earlier in the supply chain cycle.

Collaborating for a greener future

Moving forward, environmental, social and governance (ESG) sustainability in supply chains is a big hurdle that corporates need to adjust to, with multiple shifts in sourcing policy. The industry appears to be seeing a big push from many clients to use their supply chains as a tool to help improve the ESG sustainability of their businesses – and partnerships are can often be invaluable in this space.

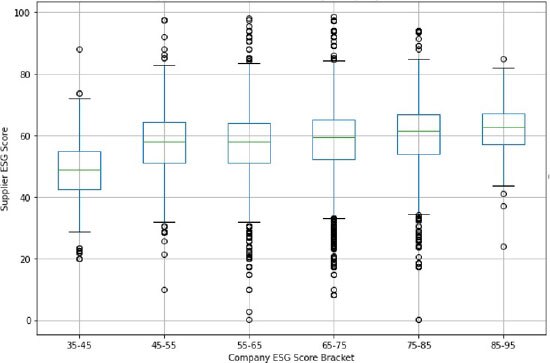

Figure 8. Supplier ESG Score vs Company ESG Score Distribution

Indeed, as depicted in Figure 8, corporates that have higher ESG scores appear to have suppliers that are deemed to be better ESG performers7. The trend may accelerate further in this space as more corporates strive to coalesce around suppliers that are regarded as more sustainable.

Source: Citi Global Data Insights, Truvalue Labs, MSCI, Bloomberg

Citi is expanding its global supply chain finance capabilities for clients to include new sustainable finance solutions that are designed to help them meet their sustainability goals, including diversity and inclusion initiatives.

Citi’s engagement with a third-party provider of business sustainability ratings is designed to help support Citi’s clients and their suppliers’ efforts to achieve sustainability performance targets and uphold best practice standards. The programme incorporates an incentivized pricing model for suppliers as a motivational tool to align with a company’s procurement sustainability goals, including ESG issues based on data and insights provided by the third-party verifier.

Examples

- Citi recently launched its first Sustainability-linked Supply Chain Finance programme in Asia Pacific for Henkel, aimed at supporting Henkel as it advances its ESG priorities, improves the resilience of its supply chain and manages working capital needs. The programme was first launched with suppliers in Australia and will be expanded to include suppliers in additional markets. The programme is also a first for Henkel in Asia Pacific and it is targeted at existing and new suppliers who demonstrate strong or improving sustainability performance. Qualifying suppliers can access Citi’s supply chain financing at preferential rates on a tiered basis, with rates improving as a supplier’s sustainability score improves.

- Citi partnered with the International Finance Corporation (IFC) and McCormick & Company, a global leader in flavour, to provide suppliers of McCormick’s herbs and spices with financial incentives linked to improvements in measures of social and environmental sustainability. The programme has started with suppliers in Indonesia and Vietnam and will soon be launched in other countries.

By collaborating with experts in ESG solutions, such as ratings platforms (used to assess business sustainability), banks can deliver tools to help support clients’ journeys to green and help meet their ESG sustainability targets.

Working with government agencies can further support clients’ sustainability and climate resilience aims. Through working arrangements with organisations such as the IFC and UKEF, for instance, clients may benefit from partial guarantee supply chain finance programmes targeted specifically towards green financing. By providing banks with risk mitigation support, such programmes help to increase the amount of sustainability funding support that may be available to clients.

Citi’s aim to support ESG initiatives is not only with our clients and government agencies. This also includes internal practices. For example, the Trade back-office team recently digitised several internal processes to reduce printing paper.

In summary

Market developments, challenges and – in particular – crises, are often hard to predict, but having a strong financial collaborator and advisor can make a material difference to a corporate’s ability to help address business disruption. As the industry continues to evolve, Citi is committed to building upon our existing capabilities and network – including with clients, fintechs, industry bodies, multilateral agencies and internally – in order to maintain the exceptional level of support we aim to provide to our clients around the world.

Helen Krause,

Head of Data Science Insights, Citi Global Data Insights

Brian Yeung,

Data Scientist, Citi Global Data Insights

Parvaiz Dalal,

Global Head of Payables Finance, Treasury and Trade Solutions, Citi

Valeria Sica,

Global Head of Trade Product Development, Treasury and Trade Solutions, Citi

Adoniro Cestari,

Global Head of Trade Product Management, Treasury and Trade Solutions, Citi

1 The width of each pipe represents the total relationship amount between each supplier and customer sector pair. This helps identify the biggest sectors by dollar amount in the supply chain that are crucial to the final product / service the end companies provide. A darker-colour bar indicates a higher concentration means that majority of the transaction flow for a sector is attributed to a small number of companies

2 Using supply chain data of large 40 tech companies globally

3 Contguard is a global monitoring company that offers an end-to-end service for managing goods in transit and helps monitor and track billions of dollars’ worth of shipments across a multitude of global routes.

4 Larger circles in darker colour indicate longer average stop duration at ports.

5 ANZ, BNP Paribas, Deutsche Bank, HSBC and Standard Chartered

6 https://www.adb.org/publications/2019-trade-finance-gaps-jobs-survey

7 Analysis done on MSCI World universe by using Truvalue ESG scores (ranges from 0 to 100) combined with supply chain data from Bloomberg. The green horizontal line in the box plot denotes the median of the score distribution for each ESG score bracket.