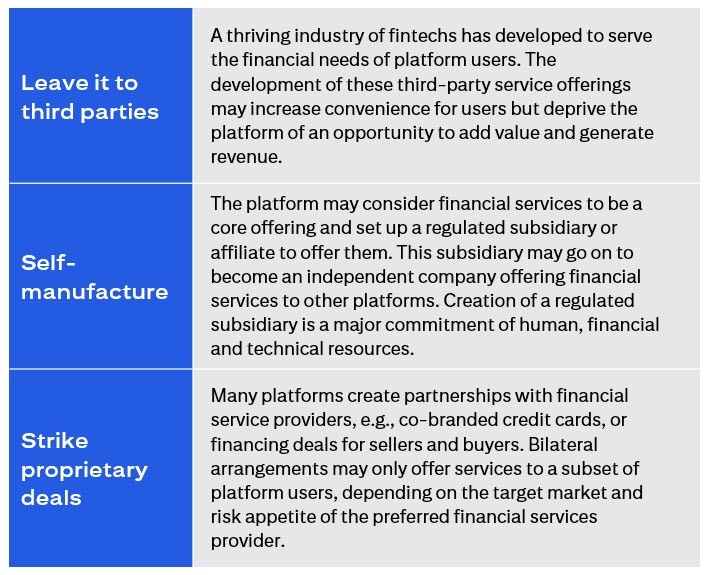

From the outset of E-commerce, it has it has been clear that both buyers and sellers on digital marketplaces require access to financial services such as payments, foreign exchange, and credit. Platforms have pursued the following approaches, singly or in combination:

- partner with established bank and non-bank financial institutions,

- manufacture financial services within a regulated subsidiary or affiliate,

- leave the provision of financial services to external 3rd parties.

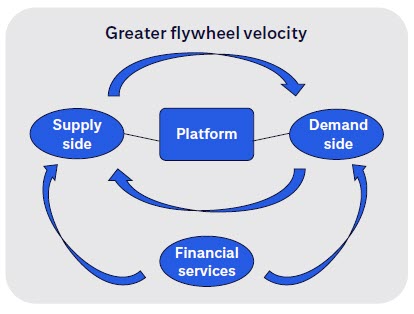

Evidence supports the notion that adding financial services to a platform makes the flywheel run faster. This paper suggests a new strategy for the integration of financial service into marketplaces and platforms through the creation of ‘three-sided markets’. It suggests that platforms might provide standardized contracts and APIs that enable financial services to be onboarded onto platforms as readily as buyers and suppliers. The result is a synthesis of trust-based services provided by the platform itself and the participating financial institutions, leading to new network effects and an acceleration of the economic flywheel.

Introduction

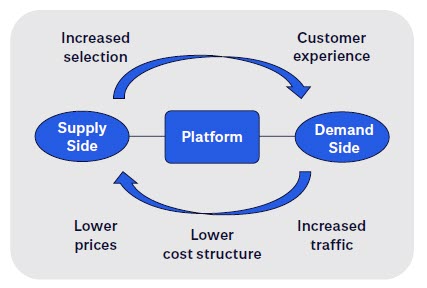

Two-sided digital platforms are among the most successful businesses in the early 21st Century. Winning platforms create a virtuous cycle where growth of the demand and supply sides of the marketplace reinforce each other to create better customer experiences, lower prices, and greater selection.

The emergence of digital platforms with billions of users and trillion-dollar plus market capitalizations may appear as an endpoint in business model history, but further refinements and innovations are not only possible, but likely.

The velocity of the two-sided platform flywheel is impressive, but it might be increased substantially through a further iteration: the development of the three-sided marketplace.

A three-sided platform onboards financial institutions as readily as buyers and sellers. Once enrolled through standard APIs and contracts, those firms can offer their services to enrich platform interactions. Buyers, sellers, financial firms and the platform itself enjoy an expanded set of opportunities for value adding transactions to take place.

Rather than viewing financial services as a ‘bolt on’, three-sided marketplaces will incorporate identity, payments, foreign exchange, lending, hedging, insurance, and the full gamut of trust-based financial services that will further accelerate the platform flywheel.

This article presents a conceptual framework for the three-sided platform model as a new option to embed finance into the digital economy and discusses the strategic implications and opportunities for platform operators and financial service providers, as well as practical steps for implementation.

Integrating financial services into platforms

Platform operators already recognize the need to embed financial services to serve the needs of buyers and suppliers. To date they have followed one or more of the following approaches, singly or in combination:

Some financial services, such as payments, are essential for transactions on the platform to occur. The provision of foreign exchange within a platform facilitates cross border transactions and increased convenience. Others, such as the provision of credit to buyers and suppliers, increase the propensity of transactions, or increase the value of transactions on the platform. The impact can be substantial: a 2019 investigation on the impact of Bigtech on the structure of financial intermediation found strong evidence of the positive effect that credit has on the platform flywheel1.

“Firms that used credit saw the number of products offered rise by 71-73 percentage points more in the following year than borrowers that did not use credit, when considering different control groups. Moreover, these borrowers saw the value of products sold increase by 75-79 percentage points more.”

The current set of options represent the state play today, but an additional approach is conceivable that may unlock further benefits for platform participants: what if it were possible for a financial institution to enroll onto a platform as easily as a buyer or seller?

A platform that onboards buyers, sellers and financial institutions might be known as a three-sided marketplace.

Defining the three-sided market

In their seminal 2016 book ‘Platform Revolution’ the authors Parker, Van Alstyne and Choudary define a two-sided platform as follows:

“A platform is a business based on enabling value-creating interactions between external producers and consumers. The platform provides an open, participative infrastructure for these interactions and sets governance conditions for them. The platform’s overarching purpose: to consummate matches among users and facilitate the exchange of goods, services, or social currency, thereby enabling value creation for all participants.”

A minor modification expands this notion to encompass the expanded idea of embedding financial intermediaries into the platform to enhance interaction between the external producers and consumers.

Two-sided thinking is already firmly embedded in the mindset of platform operators. This expanded definition opens the door to three-sided strategies and opportunities. The essence of the three-sided opportunity is for platforms to offer access to many financial services firms, cumulating network effects with each additional participant.

Three-sided network effects

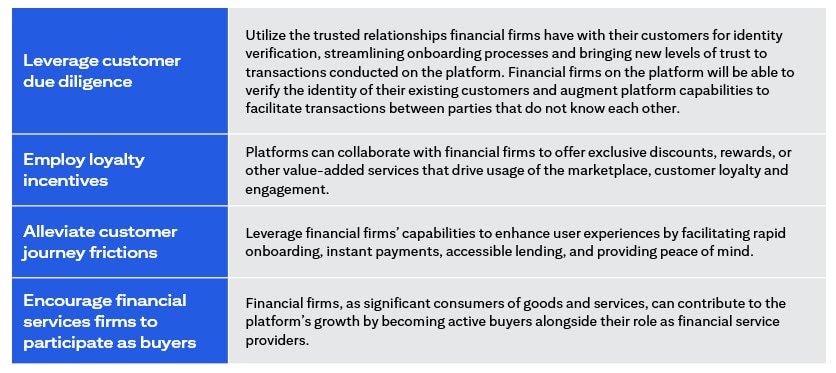

With a multitude of financial services firms forming the third leg of the platform ecosystem, participants will benefit from net new three-sided network effects. The financial service firms connected to the platform will bring large retail and wholesale customer bases including current and prospective buyers and sellers.

The three-sided model fosters net new network effects that can be leveraged to propel growth and deliver greater value to all parties involved. Incremental opportunities include:

To maximize network effects from the inclusion of many financial firms, platforms will need to be mindful of treating firms fairly. Giving privileged access to one firm could reduce the incentives for others to join, thereby reducing positive network effects. The provision of tools that turn every transaction into a bidding contest between financial firms may also inhibit participation from firms that fear commoditization.

Financial firms and platforms will face a similar set of considerations that large brands have contended with when setting strategies for platform engagement. The platform’s goal should be to create an environment where financial firms discern sufficient benefits to maximize the positive network effects that will result from their participation.

Three paths to the three-sided platform

Greater integration of the financial system with the platforms that dominate the digital economy seems inevitable. There are three catalysts that may lead to the emergence of three-sided marketplaces.

Open banking

Banks have been compelled by regulators in several markets to publish APIs for basic services such as the sharing of account information with third parties and the provision of account-based payment services. Might open banking be the path towards the three-sided marketplace?

While open banking is in a formative stage of development, in general the banking community has done the minimum required to meet regulations where they exist. It appears that they consider open banking as more of a risk of disintermediation by fintechs rather than an opportunity to provide services to their customers in the digital economy, although there are notable exceptions to prove the rule.

Open banking could in theory lead to the development of powerful three-sided marketplaces were the banking community to move forward with API standardization across a broad range of identity, retail, and wholesale use-cases. That way, digital platforms would be able to connect simply with thousands of banks through standardized API interfaces.

Embedded finance

Embedded finance is a hot new trend in fintech based on the opportunity to connect financial services into digital platforms through APIs. Money has poured into firms that offer everything from bank accounts to credit cards and lending.

The value proposition from embedded finance provider to platforms is the opportunity to provide financial services from within the platform and reduce leakage to the third parties serving the unmet needs of buyers and sellers.

This proposition is attractive to platforms for at least two reasons:

- engineering resource within platforms is at a premium

- platforms do not necessarily wish to become full service financial services providers themselves

Embedded finance may be an attractive way to increase a platform’s financial services offering but it does not yet go as far as the vision of a three-sided marketplace. The distinction is that embedded finance offerings do not bring to the party the customer bases or balance sheets of existing large financial firms.

There is an opportunity for fintechs to practice a new model of embedded finance by facilitating the connection of existing institutions to digital platforms, and enabling them to upgrade capabilities, like the ability to lend in real time through API based upon data provided by platforms.

Web 3 and decentralized finance (DeFi)

An emerging option to deliver three-sided digital interactions is Web 3 and Decentralized Finance (DeFi), the idea is of a more decentralized internet in which the power of platforms might be reduced.

Internet users may manage their own identities through Self Sovereign Identity (SSI) enabling them to store their own credentials. Distributed Autonomous Organizations (DAOs) may be able to perform the orchestration role currently performed by centralized platforms, bringing the ecosystem players together under rules managed by token holding participants.

Transfer of value could be conducted through cryptocurrencies rather than traditional fiat currency rails. New ways to capture and exchange digital goods such a Non-Fungible Tokens (NFTs) may come to prominence. Lending to buyers and sellers may be conducted through DeFi protocols.

As these innovations develop, they could provide platforms with a route to incorporating financial services into their flywheels. Alternatively, they might come to represent entirely new, trustless paradigm of digital commerce that challenges the role of today’s centralized platforms.

Open banking, embedded finance, and Web 3/ DeFi are in flight initiatives that point towards closer interaction between financial services and digital platforms. Rather than waiting on these to mature, platforms can take matters into their own hands and open the doors to the three-sided marketplace in the following way.

“The platform should embed financial services within each customer journey to optimize potential three-sided network effects.”

Becoming a three-sided platform

Platforms can switch mindset and begin to consider financial firms as a new class of marketplace participant, equal in importance to producers and consumers. Financial services providers must be considered integral components of the ecosystem to stimulate three-sided network effects. Practical steps are outlined below:

Identify financial needs of buyers and suppliers

The first step is to ascertain the financial service requirements of consumers and producers on the platform, identifying the financial touchpoints in transactions, such as payment processing, currency exchange, credit access, insurance, and working capital for both buyers and sellers.

Create digital onboarding pathways for financial firms

Platforms can put as much effort into creating simple onboarding journeys for financial firms as they do for buyers and suppliers. Onboarding as a buyer into a digital platform is simple, regularly achieved through a mobile device. The process for a supplier is more complex as each SKU must be uploaded and presented in an effective way. The onboarding process for a financial services firm is likely to be more complex and require significant integration work on the part of the bank or regulated non-bank participant.

There are two ways that platforms can facilitate onboarding of financial firms:

- Contracts: Provide standardized terms and conditions for financial firms participating in the platform, like agreements with buyers and sellers.

- Reverse APIs: Establish and publish standardized APIs to streamline integration with financial service providers, reducing the need for proprietary connections. This could significantly reduce the engineering resource required within the platform.

Facilitate trust-based platform interactions

The platform should create mechanisms for discovery of financial services and the consummation of transactions within the platform.

At the heart of value creation for the financial firm and the platform will be the exchange of data based upon explicit customer consent.

- Financial data shared with platform: The buyer or seller should be able to share bank data with the platform, e.g., to confirm their identity to the platform based upon the enhanced due diligence performed by the financial firm.

- Platform data shared with financial firm: Equally the buyer or seller should be able to share platform data with their chosen financial firm, e.g., to enable better and more responsible lending decisions.

Buyers and sellers in the platform should be able to form relationships with new financial services firms from within the platform, just as buyers can choose between different sellers. The platform should embed financial services within each customer journey to optimize potential three-sided network effects.

Manage relationships with financial participants

The platform should assign dedicated teams for customer support and relationship management, recognizing financial service firms as full-fledged members of the marketplace. Dashboards can be provided with analytics to help financial firms understand the results of their engagement with the platform.

The efforts of platforms to open their API doors to financial services firms will be moot if the regulated sector does not show up. What is the case for financial firms to participant in three-sided marketplaces?

The business case for financial services firms

Few financial transactions are stand-alone — they happen within a broader economic context. Increasingly this context is provided by digital platforms as the places where producers and consumers come together to transact.

The migration of economic activity to digital platforms presents an engagement problem for financial firms. The customer may never visit the bank branch and the internet banking portal only occasionally. Yet customers transact through digital portals every day and those interactions can be enriched and facilitated by the application of financial services.

What strategic options are open to financial firms? Are they to turn their banking applications into super apps and compete with the platforms? Some firms may enter proprietary deals with platforms for this or that financial service. This might be good for an individual bank, but it might be less than ideal for the platform; they need to do a custom technical implementation and leave a lot of potential network effects off the table by excluding others.

Financial service firms could collaborate to build API standards that would readily facilitate the integration of their services within digital platforms. Proprietary APIs by individual banks are not attractive to platforms as they require custom integrations.

An example of industry collaboration on standards is the SWIFT Pay Later API, published in 20192. This initiative showed that it is possible for API standards to be created that go beyond open banking minimums, although it highlighted that many firms have significant back-office work to do before they would be able to offer instant lending through API.

In an era where digital platforms increasingly dominate customer interactions, financial service providers must evolve to stay relevant. Embracing the three-sided platform model offers these institutions an opportunity to maintain customer engagement, expand their services, and share in the exponential growth enabled by the flywheel power of digital platforms.

“Financial service firms could collaborate to build API standards that would readily facilitate the integration of their services within digital platforms.”

Conclusion

The product-market fit between financial services and digital commerce is a significant area of interest. How best should financial services be integrated into the digital economy?

What does ‘digital native’ finance look like?

The migration of economic activity into digital platforms is a growing reality and the needs of producers and consumers on those platforms is currently served through a patchwork of arrangements, many of which are effective. Two of the strategies — bilateral arrangements between platforms and individual firms and self-manufacture of financial services by platforms — have the potential to leave many financial players out in the cold. By the same token, these arrangements may not maximize the network effects possible through a more expansive three-sided marketplace.

This integration can only take place through APIs provided by either the platforms themselves, or through a collective effort by the financial industry to create standard interfaces for the full gamut of retail and wholesale financial services.

The upside of a three-sided market model is the expanded network effects that could be realized in a platform that incorporates financial services from a broad range of firms. This will require a recognition of the potential benefits from the platforms and financial firms:

- Platform view: Platforms have pursued customer growth and the augmentation of customer journeys through the integration of financial services in creative ways. Limited engineering resource has constrained the ability to connect to many financial partners, but the benefits of connecting more broadly to the financial system could be significant.

- Financial firm view: In earlier times financial institutions constructed branches on the high street because that is where the footfall was. In the digital economy the footfall is replaced by eyeballs on digital platforms, so that is where financial firms need to show up with their services, and the way of establishing presence in the digital economy is through APIs.

A more perfect union between the regulated financial system and the digital economy will be beneficial for all participants. It is time for financial service firms to be considered as equally valuable members of digital platforms.

1. BIS Working Papers. No 779. 8 April 2019. “BigTech and the changing structure of financial intermediation”. Frost, Gambacorta, Huang, Shin, Zbinden. (https://www.bis.org/publ/work779.htm) Accessed June 2023.

2. See: https://www.swift.com/news-events/news/swift-launches-new-pay-later-api-standard-increasing-payment-choice-consumers