First Quarter 2019 Results and Key Metrics

HIGHLIGHTS

- Net Income of $4.7 Billion ($1.87 per Share)

- Revenues of $18.6 Billion

- Returned $5.1 Billion of Capital to Common Shareholders

- Repurchased 66 Million Common Shares

- Book Value per Share of $77.09

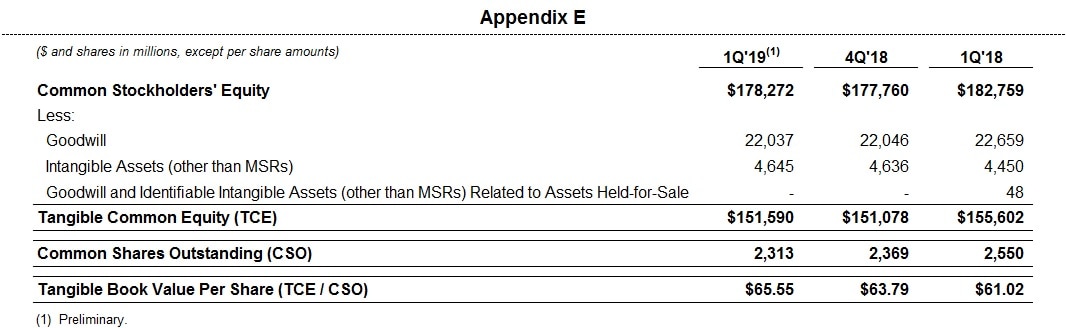

- Tangible Book Value per Share of $65.555

Read the full press release with tables and CEO commentary.

View the Financial Supplement (PDF)

View Financial Supplement (Excel)

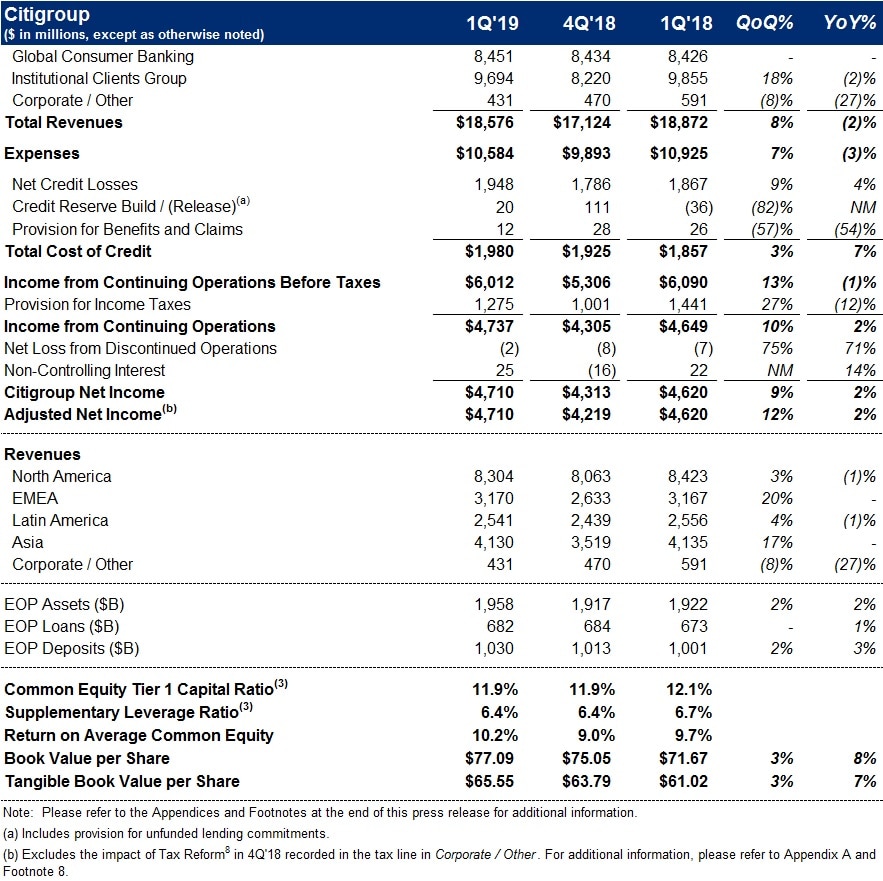

New York – Citigroup Inc. today reported net income for the first quarter 2019 of $4.7 billion, or $1.87 per diluted share, on revenues of $18.6 billion. This compared to net income of $4.6 billion, or $1.68 per diluted share, on revenues of $18.9 billion for the first quarter 2018.

Revenues decreased 2% from the prior-year period, including the impact of a $150 million gain on the sale of the Hilton portfolio in North America Global Consumer Banking (GCB) in the prior-year period. Excluding this gain6, revenues decreased 1% from the prior-year period largely driven by lower revenues in Equity Markets as well as mark-to-market losses on loan hedges7, both in the Institutional Clients Group (ICG), and the continued wind-down of legacy assets in Corporate / Other. Net income increased 2% from the prior-year period, driven by a reduction in expenses and a lower effective tax rate, partially offset by the lower revenues and higher cost of credit. Earnings per share increased 11%, primarily driven by a 9% reduction in average diluted shares outstanding as well as the growth in net income.

Citi CEO Michael Corbat said, "Our earnings reflect the progress we are making to improve our return on and return of capital. Both our consumer and institutional businesses performed well and we saw good momentum in those areas where we have been investing, such as U.S. Branded Cards, Treasury and Trade Solutions, and Investment Banking. Importantly, our strategy in North America consumer banking is showing good early results as we introduce new products and engage with a broader range of customers, through digital channels.

"We increased our Return on Tangible Common Equity to 11.9%, had positive operating leverage for the tenth consecutive quarter and had strong growth in both loans and deposits in our core businesses. We returned over $5 billion to our shareholders during the quarter, contributing to the 11% increase in our earnings per share from a year ago. We further reduced our common shares outstanding, down 9% from a year ago, while maintaining our Common Equity Tier 1 Capital Ratio at 11.9%. We remain committed to executing our strategy and continuing to make steady progress towards our financial targets," Mr. Corbat concluded.

Percentage comparisons throughout this press release are calculated for the first quarter 2019 versus the first quarter 2018, unless otherwise specified.

Citigroup

Citigroup revenues of $18.6 billion in the first quarter 2019 decreased 2%, reflecting the lower revenues in Equity Markets as well as mark-to-market losses on loan hedges in ICG and the continued wind-down of legacy assets in Corporate / Other.

Citigroup operating expenses of $10.6 billion in the first quarter 2019 decreased 3%, driven by efficiency savings and the wind-down of legacy assets, partially offset by investments.

Citigroup cost of credit in the first quarter 2019 was $2.0 billion, a 7% increase, driven by a lower loan loss reserve release in ICG as well as growth and seasoning in Citi-Branded Cards and Citi Retail Services in North America GCB.

Citigroup net income of $4.7 billion in the first quarter 2019 increased 2%, driven by the lower expenses as well as the lower effective tax rate, partially offset by the decrease in revenues and the higher cost of credit. Citigroup's effective tax rate was 21% in the current quarter compared to 24% in the first quarter 2018.

Citigroup's allowance for loan losses was $12.3 billion at quarter end, or 1.82% of total loans, compared to $12.4 billion, or 1.85% of total loans, at the end of the prior-year period. Total non-accrual assets declined 13% from the prior-year period to $3.8 billion. Consumer non-accrual loans declined 14% to $2.2 billion and corporate non-accrual loans declined 11% to $1.5 billion.

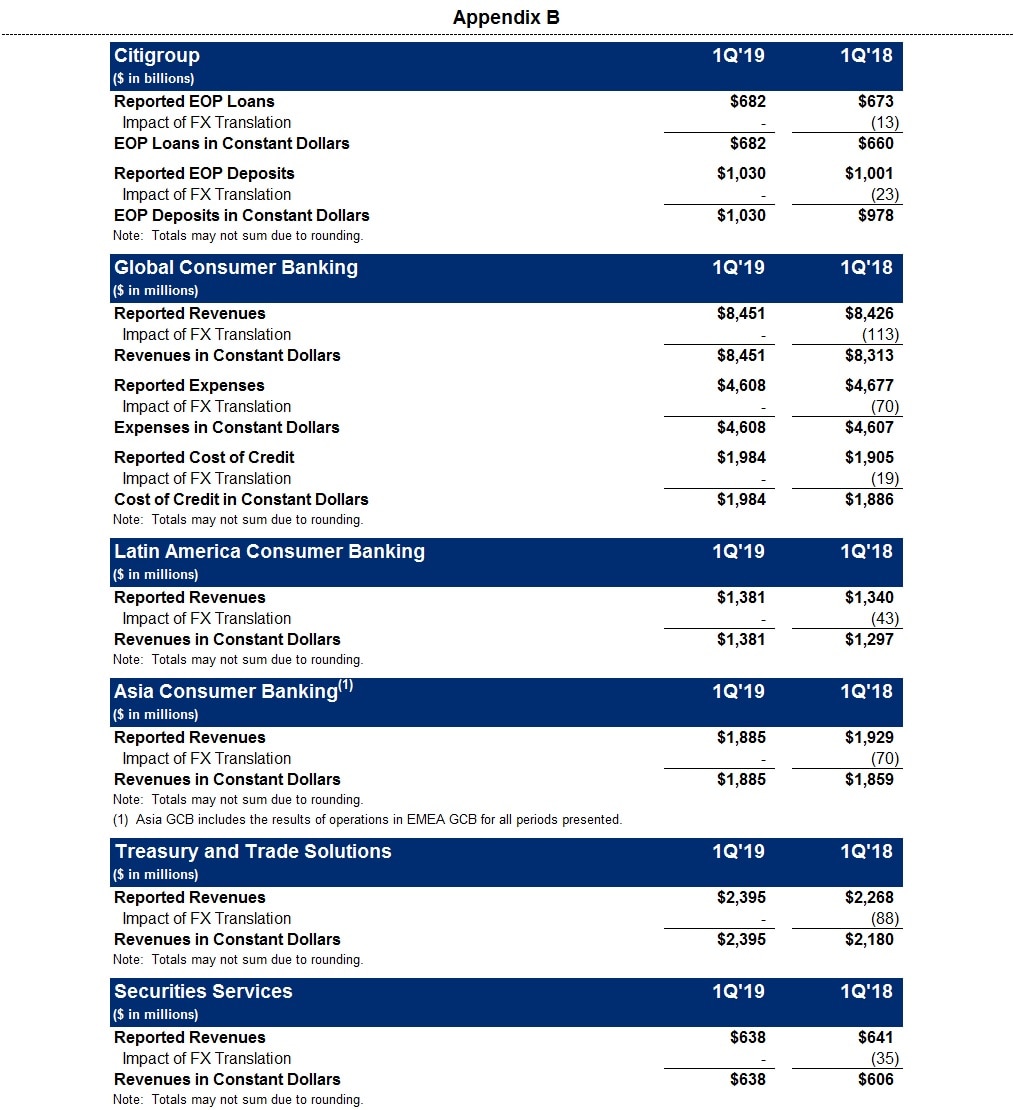

Citigroup's end-of-period loans were $682 billion as of quarter end, up 1% from the prior-year period. Excluding the impact of foreign exchange translation9, Citigroup's end-of-period loans grew 3%, as 5% aggregate growth in ICG and GCB was partially offset by the continued wind-down of legacy assets in Corporate / Other.

Citigroup's end-of-period deposits were $1.0 trillion as of quarter end, an increase of 3% from the prior-year period. In constant dollars, Citigroup's end-of-period deposits grew 5%, driven by 8% growth in ICG as well as 2% growth in GCB.

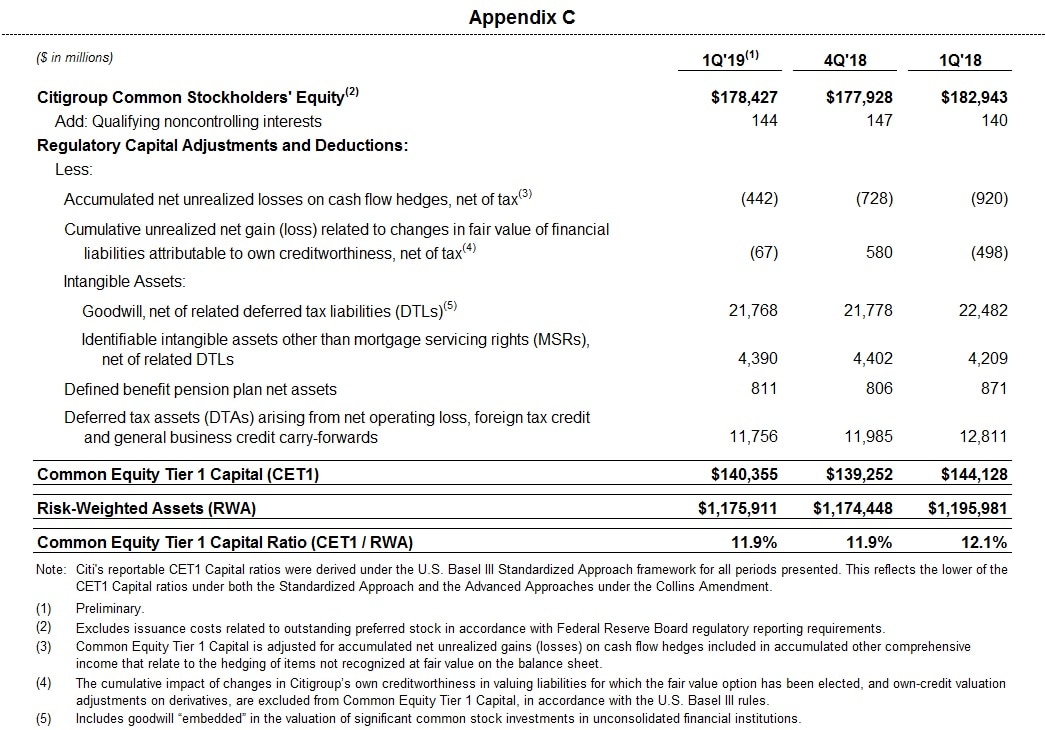

Citigroup's book value per share of $77.09 and tangible book value per share of $65.55, both as of quarter end, increased 8% and 7%, respectively, from the prior year driven by the benefit of a lower share count. At quarter end, Citigroup's CET1 Capital ratio was 11.9%, unchanged from the prior quarter as net income was offset by common share repurchases and dividends. Citigroup's SLR for the first quarter 2019 was 6.4%, unchanged from the prior quarter. During the first quarter 2019, Citigroup repurchased 66 million common shares and returned a total of $5.1 billion to common shareholders in the form of common share repurchases and dividends.

Global Consumer Banking

GCB revenues of $8.5 billion remained largely unchanged on a reported basis. In constant dollars, revenues increased 4%, excluding the gain on the sale of the Hilton portfolio in the prior-year period, driven by growth in all three regions.

North America GCB revenues of $5.2 billion increased 1% on a reported basis and 4% excluding the gain on the sale of the Hilton portfolio, with growth in all three businesses. Retail Banking revenues of $1.3 billion increased 1%. Excluding mortgage, Retail Banking revenues increased 2%, driven by continued growth in deposit spreads as well as modest growth in deposit volumes. Citi-Branded Cards revenues of $2.2 billion increased 5%, excluding the gain on the sale of the Hilton portfolio, driven by continued growth in interest-earning balances. Citi Retail Services revenues of $1.7 billion increased 3%, primarily reflecting organic loan growth and the benefit of the L.L.Bean portfolio acquisition.

Latin America GCB revenues of $1.4 billion increased 3% on a reported basis and 6% in constant dollars, including the impact of the sale of an asset management business in Mexico in 2018. This impact was a net benefit in the current quarter as Citi recorded a small residual gain on the sale, partially offset by the absence of related revenues. Excluding this impact, revenues increased 5%, largely driven by continued deposit growth as well as improved deposit spreads.

Asia GCB revenues decreased 2% to $1.9 billion. In constant dollars, revenues increased 1%, as continued growth in deposit, lending and insurance revenues was largely offset by lower investment revenues.

GCB operating expenses of $4.6 billion decreased 1%. In constant dollars, expenses were largely unchanged, as investments and volume-driven expenses were offset by efficiency savings.

GCB cost of credit of $2.0 billion increased 4%. In constant dollars, cost of credit increased 5%, driven by a 10% increase in net credit losses, primarily reflecting volume growth and seasoning in Citi-Branded Cards and Citi Retail Services in North America GCB, partially offset by a lower net loan loss reserve build.

GCB net income of $1.4 billion increased 4% on a reported basis and 14% in constant dollars, excluding the gain on the sale of the Hilton portfolio (approximately $115 million after tax), primarily driven by the higher revenues, partially offset by the higher cost of credit, as expenses were largely unchanged.

Institutional Clients Group

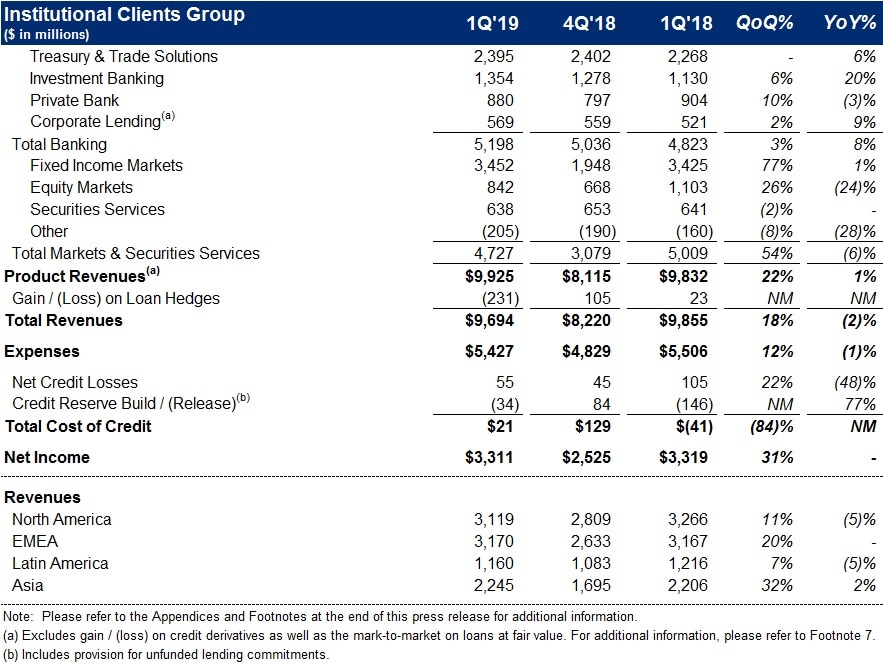

ICG revenues of $9.7 billion decreased 2%, as growth in Banking (including gain / (loss) on loan hedges) was more than offset by a decline in Markets and Securities Services.

Banking revenues of $5.0 billion increased 2% (including gain / (loss) on loan hedges). Treasury and Trade Solutions revenues of $2.4 billion increased 6% on a reported basis and 10% in constant dollars, reflecting continued growth in deposits as well as improved spreads. Investment Banking revenues of $1.4 billion increased 20%, as strong growth in advisory and investment grade debt underwriting more than offset a decline in equity underwriting driven by a lower market wallet. Advisory revenues increased 76% to $378 million, equity underwriting revenues decreased 20% to $172 million and debt underwriting revenues increased 15% to $804 million. Private Bank revenues of $880 million decreased 3% compared to a strong prior-year period, reflecting lower managed investment revenues and higher funding costs. Corporate Lending revenues of $569 million increased 9% (excluding gain / (loss) on loan hedges), reflecting loan growth and spread expansion.

Markets and Securities Services revenues of $4.7 billion decreased 6%. Fixed Income Markets revenues of $3.5 billion increased 1%, as strength in rates and spread products was partially offset by weakness in foreign exchange, as a result of low currency volatility in the current quarter, while corporate client activity remained stable. Equity Markets revenues of $842 million decreased 24%, compared to a strong prior-year period, reflecting lower market volumes and client financing balances. Securities Services revenues of $638 million were flat on a reported basis and increased 5% in constant dollars, driven by growth in deposits as well as improved spreads.

ICG net income of $3.3 billion remained largely unchanged, as a decrease in expenses and the lower effective tax rate offset the decline in revenues and an increase in cost of credit. ICG operating expenses decreased 1% to $5.4 billion, as efficiency savings more than offset investments and volume-driven growth. ICG cost of credit included net credit losses of $55 million ($105 million in the prior-year period) and a net loan loss release of $34 million (net loan loss release of $146 million in the prior-year period).

Corporate / Other

Corporate / Other revenues of $431 million decreased 27%, primarily driven by the wind-down of legacy assets.

Corporate / Other expenses of $549 million decreased 26%, primarily driven by the wind-down of legacy assets.

Corporate / Other loss from continuing operations before taxes of $93 million decreased from a loss of $144 million in the prior-year period, as the lower expenses and cost of credit more than offset the lower revenues.

Citigroup will host a conference call today at 10 a.m. (ET). A live webcast of the presentation, as well as financial results and presentation materials, will be available at https://www.citigroup.com/global/investors. Dial-in numbers for the conference call are as follows: (866) 516-9582 in the U.S. and Canada; (973) 409-9210 outside of the U.S. and Canada. The conference code for both numbers is 8995846.

Additional financial, statistical, and business-related information, as well as business and segment trends, is included in a Quarterly Financial Data Supplement. Both this earnings release and Citigroup's First Quarter 2019 Quarterly Financial Data Supplement are available on Citigroup's website at www.citigroup.com.

Citi

Citi, the leading global bank, has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. Citi provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management.

Additional information may be found at www.citigroup.com | Twitter: @Citi | YouTube: www.youtube.com/citi | Blog: http://blog.citigroup.com | Facebook: www.facebook.com/citi | LinkedIn: www.linkedin.com/company/citi

Certain statements in this release are "forward-looking statements" within the meaning of the rules and regulations of the U.S. Securities and Exchange Commission (SEC). These statements are based on management's current expectations and are subject to uncertainty and changes in circumstances. These statements are not guarantees of future results or occurrences. Actual results and capital and other financial condition may differ materially from those included in these statements due to a variety of factors, including, among others, the efficacy of Citi's business strategies and execution of those strategies, such as those relating to its key investment, efficiency and capital optimization initiatives, governmental and regulatory actions or approvals, various geopolitical and macroeconomic uncertainties, challenges and conditions, for example, changes in monetary policies and trade policies, and the precautionary statements included in this release and those contained in Citigroup's filings with the SEC, including without limitation the "Risk Factors" section of Citigroup's 2018 Form 10-K. Any forward-looking statements made by or on behalf of Citigroup speak only as to the date they are made, and Citi does not undertake to update forward-looking statements to reflect the impact of circumstances or events that arise after the date the forward-looking statements were made.

Contacts:

Press: Mark Costiglio (212) 559-4114

Investors: Susan Kendall (212) 559-2718

Fixed Income Investors: Thomas Rogers (212) 559-5091

Click here for the complete press release and summary financial information.

1 Citigroup's total expenses divided by total revenues.

2 Preliminary. Citigroup's return on average tangible common equity (RoTCE) is a non-GAAP financial measure. RoTCE represents annualized net income available to common shareholders as a percentage of average tangible common equity (TCE). For the components of the calculation, see Appendix A.

3 Ratios as of March 31, 2019 are preliminary. For the composition of Citigroup's CET1 Capital and ratio, see Appendix C. For the composition of Citigroup's SLR, see Appendix D.

4 Citigroup's payout ratio is the sum of common dividends and common share repurchases divided by net income available to common shareholders. For the components of the calculation, see Appendix A.

5 Citigroup's tangible book value per share is a non-GAAP financial measure. For a reconciliation of this measure to reported results, see Appendix E.

6 Citigroup's results of operations excluding the impact of gains-on-sale are non-GAAP financial measures.

7 Credit derivatives are used to economically hedge a portion of the corporate loan portfolio that includes both accrual loans and loans at fair value. Gains / (losses) on loan hedges includes the mark-to-market on the credit derivatives and the mark-to-market on the loans in the portfolio that are at fair value. The fixed premium costs of these hedges are netted against the corporate lending revenues to reflect the cost of credit protection. Citigroup's results of operations excluding the impact of gains / (losses) on loan hedges are non-GAAP financial measures.

8 Represents the fourth quarter 2018 one-time impact of the finalization of the provisional component of the impact related to the enactment of the Tax Cuts and Jobs Act (Tax Reform), which was signed into law on December 22, 2017, based on Citi's analysis as well as additional guidance received from the U.S. Treasury Department. Citigroup's results of operations excluding the impact of Tax Reform are non-GAAP financial measures. For the components of the calculation, see Appendix A.

9 Results of operations excluding the impact of foreign exchange translation (constant dollar basis) are non-GAAP financial measures. For a reconciliation of these measures to reported results, see Appendix B.